Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 please Question 1 (10 points) Saved An investor would like to purchase a new apartment property for $2 million. However, she faces the

Question 3 please

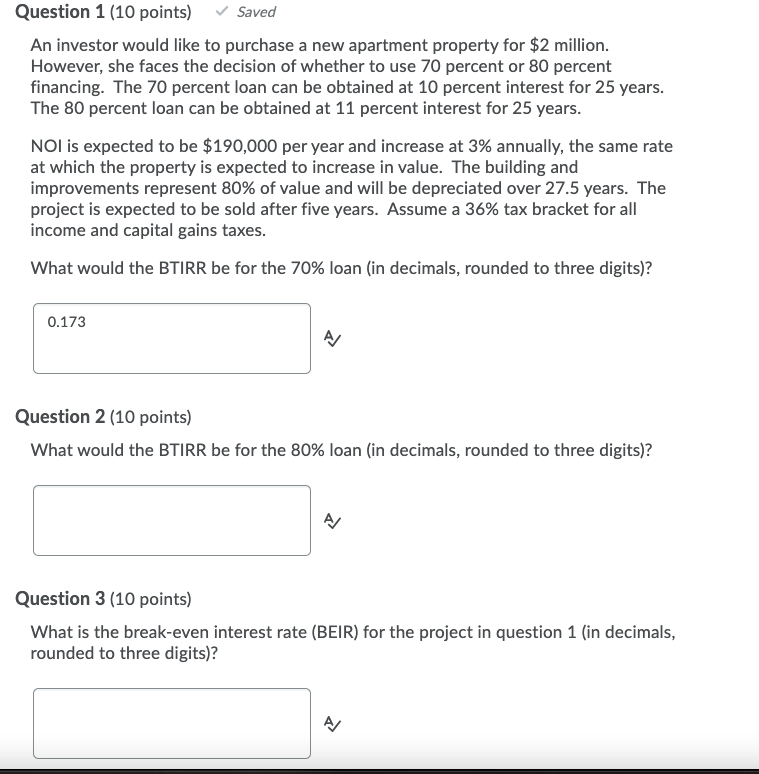

Question 1 (10 points) Saved An investor would like to purchase a new apartment property for $2 million. However, she faces the decision of whether to use 70 percent or 80 percent financing. The 70 percent loan can be obtained at 10 percent interest for 25 years. The 80 percent loan can be obtained at 11 percent interest for 25 years. NOI is expected to be $190,000 per year and increase at 3% annually, the same rate at which the property is expected to increase in value. The building and improvements represent 80% of value and will be depreciated over 27.5 years. The project is expected to be sold after five years. Assume a 36% tax bracket for all income and capital gains taxes. What would the BTIRR be for the 70% loan (in decimals, rounded to three digits)? 0.173 Question 2 (10 points) What would the BTIRR be for the 80% loan (in decimals, rounded to three digits)? A Question 3 (10 points) What is the break-even interest rate (BEIR) for the project in question 1 (in decimals, rounded to three digits)? AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started