Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Priyanka and Adrita own jewellery shops, having branches in different cities and towns. They deal in gold and diamond ormaments. During the financial

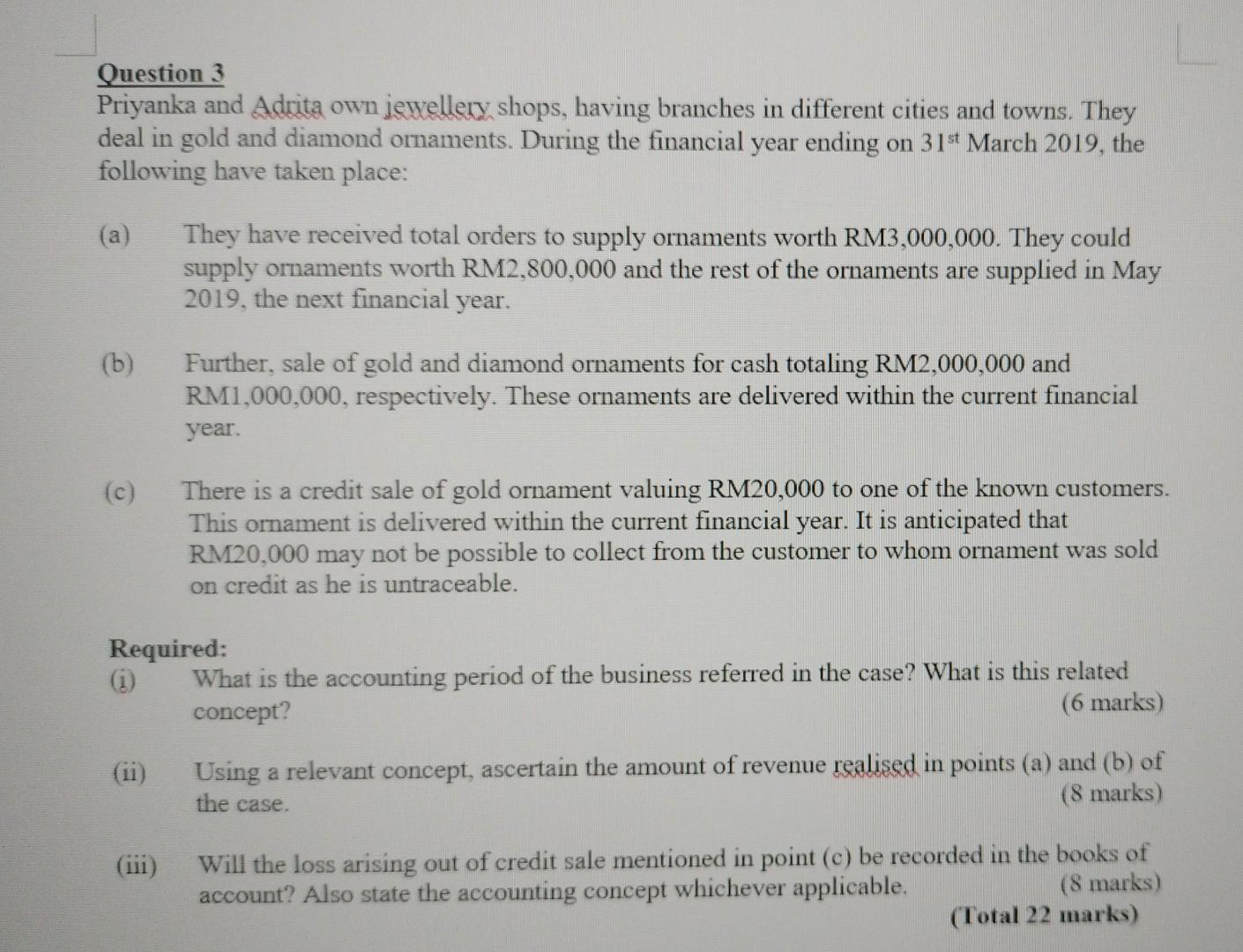

Question 3 Priyanka and Adrita own jewellery shops, having branches in different cities and towns. They deal in gold and diamond ormaments. During the financial year ending on 31st March 2019, the following have taken place: (a) They have received total orders to supply ornaments worth RM3,000,000. They could supply ornaments worth RM2,800,000 and the rest of the ornaments are supplied in May 2019 , the next financial year. (b) Further, sale of gold and diamond ornaments for cash totaling RM2,000,000 and RM1,000,000, respectively. These ornaments are delivered within the current financial year. (c) There is a credit sale of gold ornament valuing RM20,000 to one of the known customers. This ornament is delivered within the current financial year. It is anticipated that RM20,000 may not be possible to collect from the customer to whom ornament was sold on credit as he is untraceable. Required: (i) What is the accounting period of the business referred in the case? What is this related concept? (6 marks) (ii) Using a relevant concept, ascertain the amount of revenue realised in points (a) and (b) of the case. ( 8 marks ) (iii) Will the loss arising out of credit sale mentioned in point (c) be recorded in the books of account? Also state the accounting concept whichever applicable. ( 8 marks ) (Total 22 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started