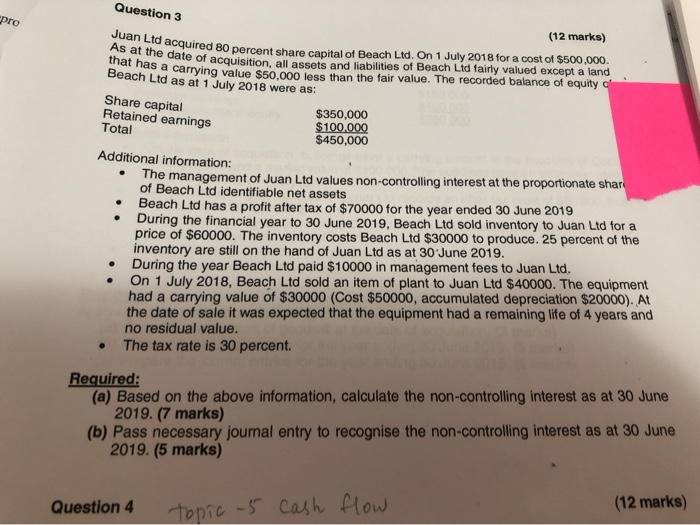

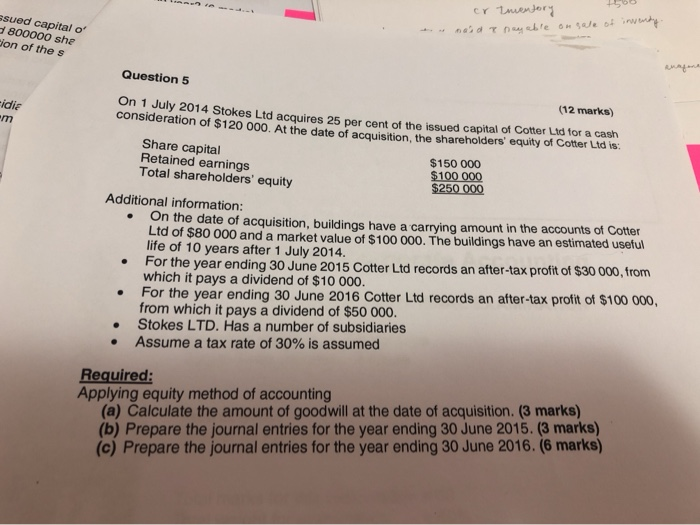

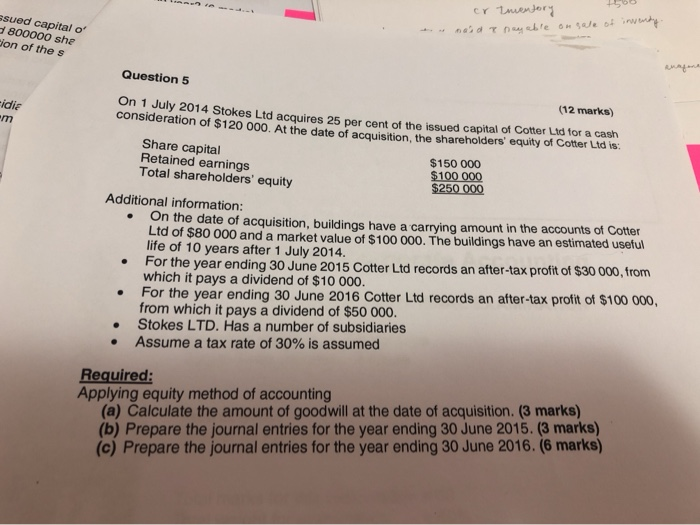

Question 3 pro (12 marks) quired 80 percent share capital of Beach Ltd. On 1 July 2018 for a cost of $500.000 ate of acquisition, all assets and liabilities of Beach Ltd fairly valued except a land a carrying value $50.000 less than the fair value. The recorded balance of equity Beach Ltd as at 1 July 2018 were as: Juan Ltd acquired 80 percent As at the date of acquisition, a that has a carrying value $50. Share capital Retained earnings $350,000 Total $100.000 $450,000 Additional information: The management of Juan Ltd values non-controlling interest at the proportionate shari of Beach Ltd identifiable net assets Beach Ltd has a profit after tax of $70000 for the year ended 30 June 2019 During the financial year to 30 June 2019, Beach Ltd sold inventory to Juan Lid for a price of $60000. The inventory costs Beach Ltd $30000 to produce. 25 percent of the inventory are still on the hand of Juan Ltd as at 30 June 2019. During the year Beach Ltd paid $10000 in management fees to Juan Ltd, On 1 July 2018, Beach Ltd sold an item of plant to Juan Ltd $40000. The equipment had a carrying value of $30000 (Cost $50000, accumulated depreciation $20000). At the date of sale it was expected that the equipment had a remaining life of 4 years and no residual value. The tax rate is 30 percent. Required: (a) Based on the above information, calculate the non-controlling interest as at 30 June 2019. (7 marks) (b) Pass necessary journal entry to recognise the non-controlling interest as at 30 June 2019. (5 marks) (12 marks) Question 4 topic -5 cash flow ssued capital o 800000 she djon of the s ILIB cr Inentory d able Hse of in idia Question 5 (12 marks) On 1 July 2014 Stoke On 1 July 2014 Stokes Ltd acquires 25 per cent of the issued capital of Cotter Lid for a cash consideration of $120 000. At the date of acquisition, the shareholders' equity of Cotter LIV Share capital Retained earnings Total shareholders' equity $150 000 $ 100 000 $250 000 Additional information: on the date of acquisition, buildings have a carrying amount in the accounts of Cotter Ltd of $80 000 and a market value of $100 000. The buildings have an estimated useful life of 10 years after 1 July 2014. For the year ending 30 June 2015 Cotter Ltd records an after-tax profit of $30 000, from which it pays a dividend of $10 000. For the year ending 30 June 2016 Cotter Ltd records an after-tax profit of $100 000, from which it pays a dividend of $50 000. Stokes LTD. Has a number of subsidiaries Assume a tax rate of 30% is assumed Required: Applying equity method of accounting (a) Calculate the amount of goodwill at the date of acquisition. (3 marks) (b) Prepare the journal entries for the year ending 30 June 2015. (3 marks) (c) Prepare the journal entries for the year ending 30 June 2016. (6 marks) Question 3 pro (12 marks) quired 80 percent share capital of Beach Ltd. On 1 July 2018 for a cost of $500.000 ate of acquisition, all assets and liabilities of Beach Ltd fairly valued except a land a carrying value $50.000 less than the fair value. The recorded balance of equity Beach Ltd as at 1 July 2018 were as: Juan Ltd acquired 80 percent As at the date of acquisition, a that has a carrying value $50. Share capital Retained earnings $350,000 Total $100.000 $450,000 Additional information: The management of Juan Ltd values non-controlling interest at the proportionate shari of Beach Ltd identifiable net assets Beach Ltd has a profit after tax of $70000 for the year ended 30 June 2019 During the financial year to 30 June 2019, Beach Ltd sold inventory to Juan Lid for a price of $60000. The inventory costs Beach Ltd $30000 to produce. 25 percent of the inventory are still on the hand of Juan Ltd as at 30 June 2019. During the year Beach Ltd paid $10000 in management fees to Juan Ltd, On 1 July 2018, Beach Ltd sold an item of plant to Juan Ltd $40000. The equipment had a carrying value of $30000 (Cost $50000, accumulated depreciation $20000). At the date of sale it was expected that the equipment had a remaining life of 4 years and no residual value. The tax rate is 30 percent. Required: (a) Based on the above information, calculate the non-controlling interest as at 30 June 2019. (7 marks) (b) Pass necessary journal entry to recognise the non-controlling interest as at 30 June 2019. (5 marks) (12 marks) Question 4 topic -5 cash flow ssued capital o 800000 she djon of the s ILIB cr Inentory d able Hse of in idia Question 5 (12 marks) On 1 July 2014 Stoke On 1 July 2014 Stokes Ltd acquires 25 per cent of the issued capital of Cotter Lid for a cash consideration of $120 000. At the date of acquisition, the shareholders' equity of Cotter LIV Share capital Retained earnings Total shareholders' equity $150 000 $ 100 000 $250 000 Additional information: on the date of acquisition, buildings have a carrying amount in the accounts of Cotter Ltd of $80 000 and a market value of $100 000. The buildings have an estimated useful life of 10 years after 1 July 2014. For the year ending 30 June 2015 Cotter Ltd records an after-tax profit of $30 000, from which it pays a dividend of $10 000. For the year ending 30 June 2016 Cotter Ltd records an after-tax profit of $100 000, from which it pays a dividend of $50 000. Stokes LTD. Has a number of subsidiaries Assume a tax rate of 30% is assumed Required: Applying equity method of accounting (a) Calculate the amount of goodwill at the date of acquisition. (3 marks) (b) Prepare the journal entries for the year ending 30 June 2015. (3 marks) (c) Prepare the journal entries for the year ending 30 June 2016. (6 marks)