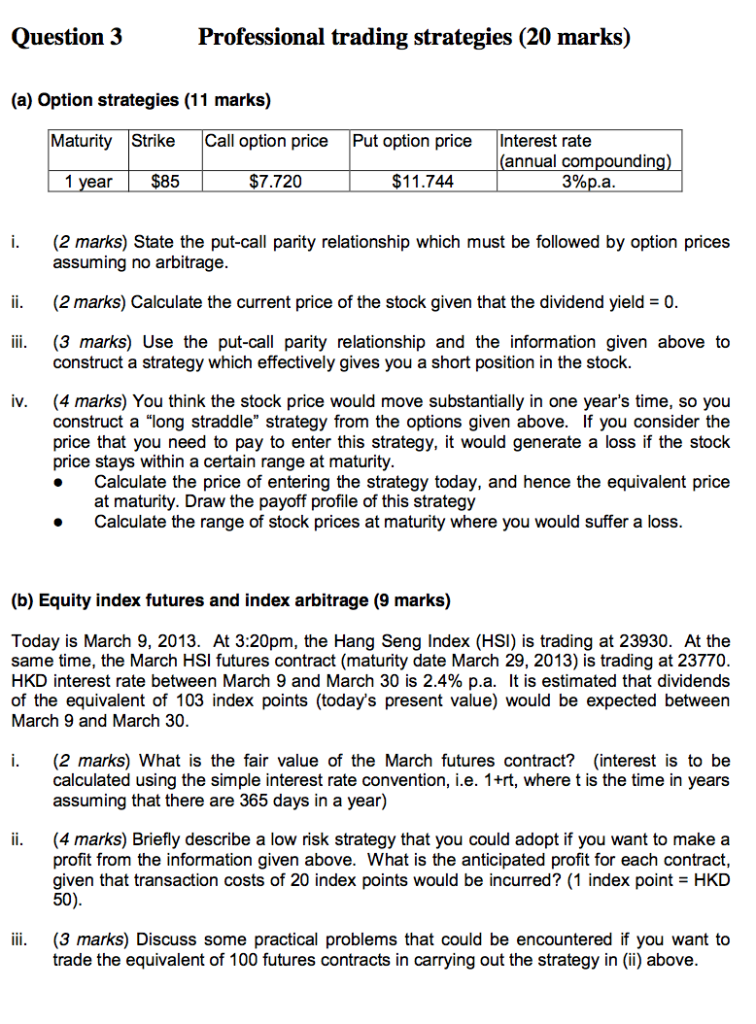

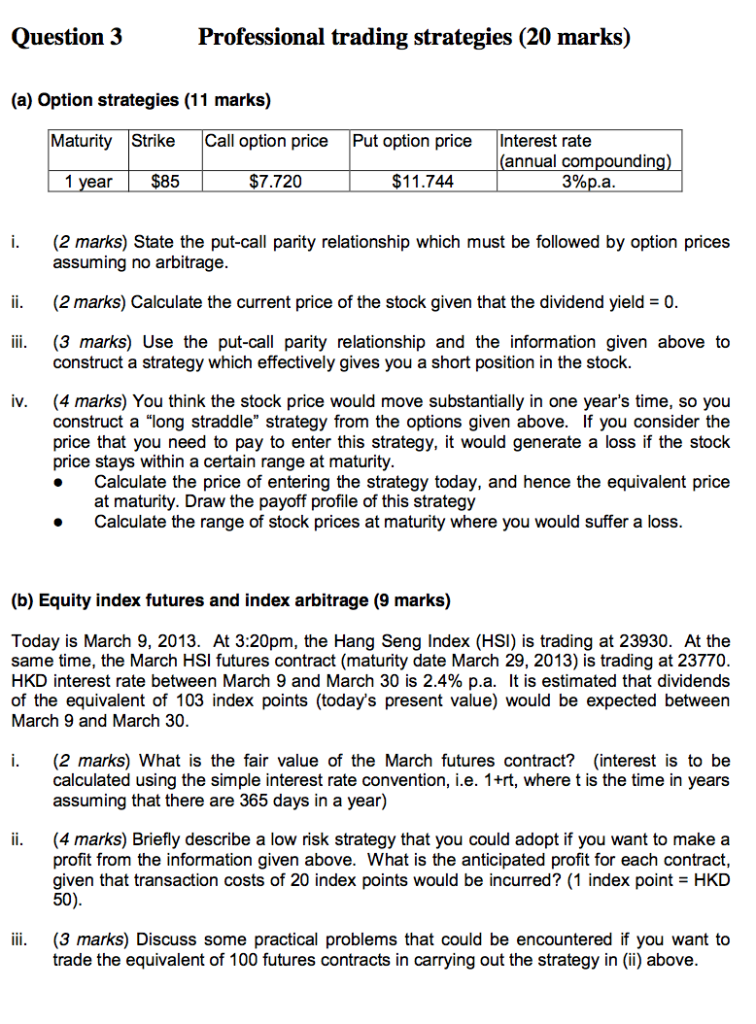

Question 3 Professional trading strategies (20 marks) (a) Option strategies (11 marks) Maturity Strike Call option price Put option price Interest rate (annual compounding 3%pa 1 year $85 $7.720 $11.744 i. (2 marks) State the put-call parity relationship which must be followed by option prices assuming no arbitrage. ii. (2 marks) Calculate the current price of the stock given that the dividend yield0 ii. (3 marks) Use the put-call parity relationship and the information given above to construct a strategy which effectively gives you a short position in the stock. iv (4 marks) You think the stock price would move substantially in one year's time, so you construct a "long straddle" strategy from the options given above. If you consider the price that you need to pay to enter this strategy, it would generate a loss if the stock price stays within a certain range at maturity Calculate the price of entering the strategy today, and hence the equivalent price at maturity. Draw the payoff profile of this strategy Calculate the range of stock prices at maturity where you would suffer a loss (b) Equity index futures and index arbitrage (9 marks) Today is March 9, 2013. At 3:20pm, the Hang Seng Index (HSI) is trading at 23930. At the same time, the March HSI futures contract (maturity date March 29, 2013) is trading at 23770 HKD interest rate between March 9 and March 30 is 2.4% pa. It is estimated that dividends of the equivalent of 103 index points (today's present value) would be expected between March 9 and March 30 i. (2 marks) What is the fair value of the March futures contract? (interest is to be calculated using the simple interest rate convention, i.e. 1+rt, where t is the time in years assuming that there are 365 days in a year) ii. (4 marks) Briefly describe a low risk strategy that you could adopt if you want to make a profit from the information given above. What is the anticipated profit for each contract given that transaction costs of 20 index points would be incurred? (1 index point HKD ii. (3 marks) Discuss some practical problems that could be encountered if you want to trade the equivalent of 100 futures contracts in carrying out the strategy in (i) above Question 3 Professional trading strategies (20 marks) (a) Option strategies (11 marks) Maturity Strike Call option price Put option price Interest rate (annual compounding 3%pa 1 year $85 $7.720 $11.744 i. (2 marks) State the put-call parity relationship which must be followed by option prices assuming no arbitrage. ii. (2 marks) Calculate the current price of the stock given that the dividend yield0 ii. (3 marks) Use the put-call parity relationship and the information given above to construct a strategy which effectively gives you a short position in the stock. iv (4 marks) You think the stock price would move substantially in one year's time, so you construct a "long straddle" strategy from the options given above. If you consider the price that you need to pay to enter this strategy, it would generate a loss if the stock price stays within a certain range at maturity Calculate the price of entering the strategy today, and hence the equivalent price at maturity. Draw the payoff profile of this strategy Calculate the range of stock prices at maturity where you would suffer a loss (b) Equity index futures and index arbitrage (9 marks) Today is March 9, 2013. At 3:20pm, the Hang Seng Index (HSI) is trading at 23930. At the same time, the March HSI futures contract (maturity date March 29, 2013) is trading at 23770 HKD interest rate between March 9 and March 30 is 2.4% pa. It is estimated that dividends of the equivalent of 103 index points (today's present value) would be expected between March 9 and March 30 i. (2 marks) What is the fair value of the March futures contract? (interest is to be calculated using the simple interest rate convention, i.e. 1+rt, where t is the time in years assuming that there are 365 days in a year) ii. (4 marks) Briefly describe a low risk strategy that you could adopt if you want to make a profit from the information given above. What is the anticipated profit for each contract given that transaction costs of 20 index points would be incurred? (1 index point HKD ii. (3 marks) Discuss some practical problems that could be encountered if you want to trade the equivalent of 100 futures contracts in carrying out the strategy in (i) above