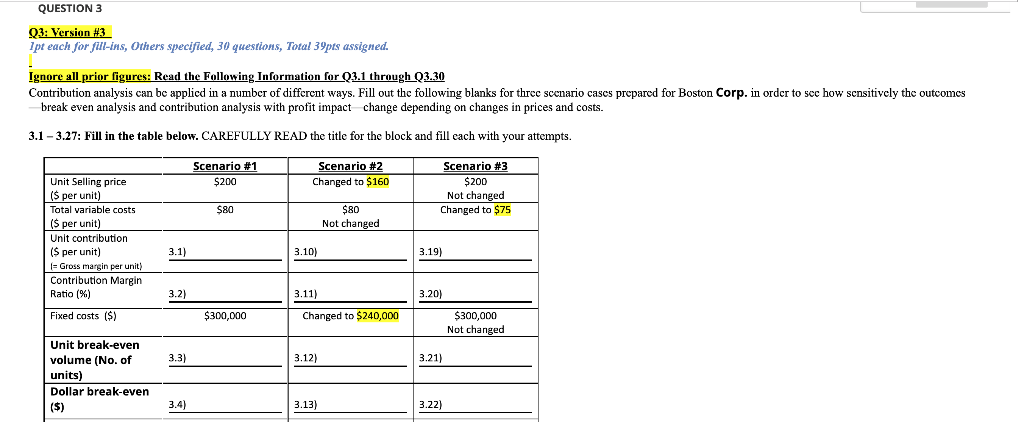

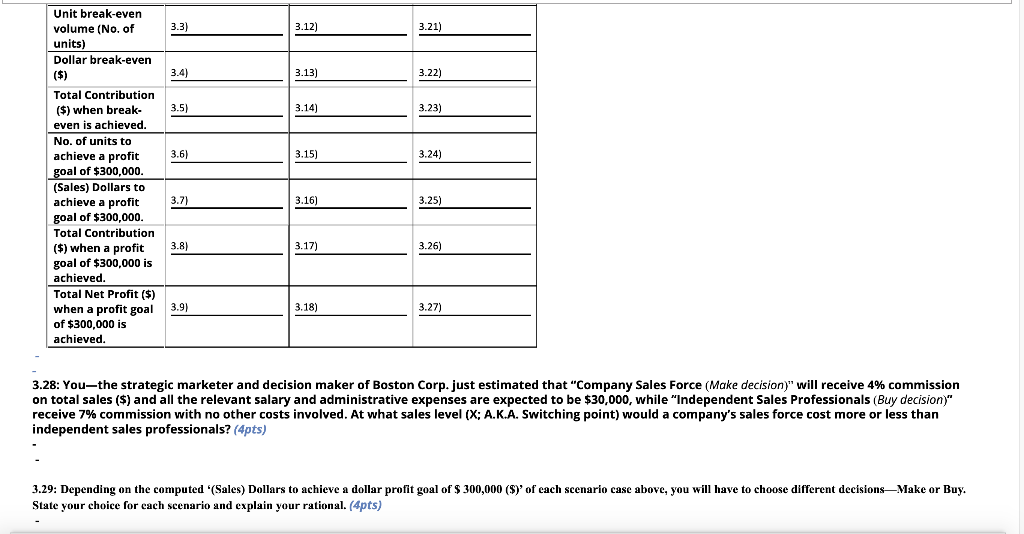

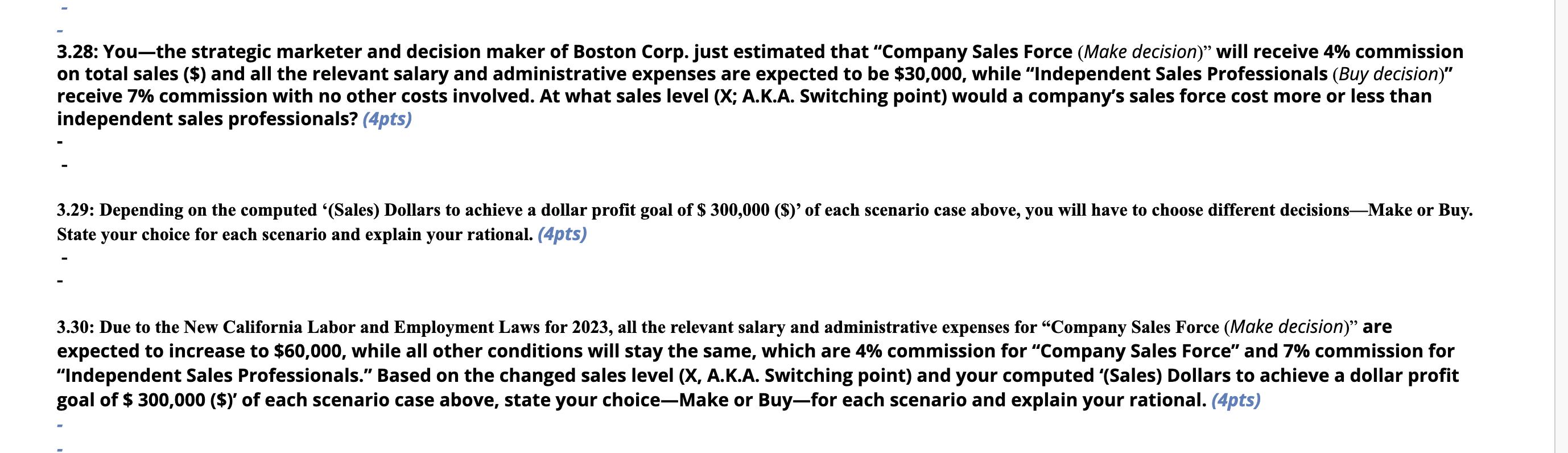

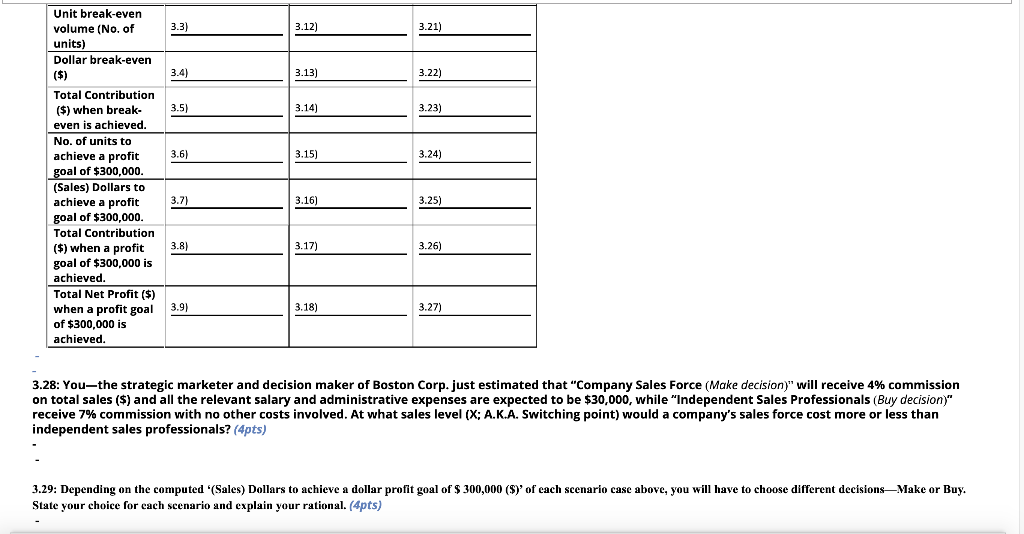

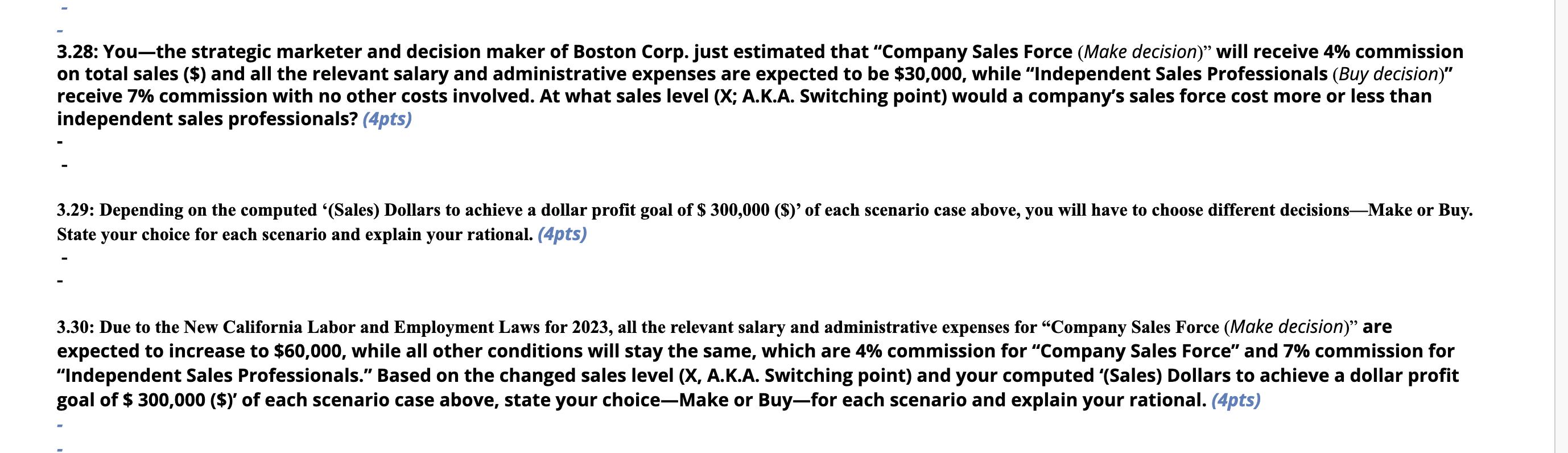

QUESTION 3 Q3: Version #3 ipt each for ful-ins, Others specified, 30 questions, Total 39pts assigned. Ignore all prior figures: Read the following Information for Q3.1 through 23.30 Contribution analysis can be applied in a number of different ways. Fill out the following blanks for three scenario cases prepared for Boston Corp. in order to see how sensitively the outcomes break even analysis and contribution analysis with profit impact change depending on changes in prices and costs. 3.1 3.27: Fill in the table below. CAREFULLY READ the title for the block and fill each with your attempts. Scenario #1 $200 Scenario #2 Changed to $160 Scenario #3 $200 Not changed Changed to $75 $80 $80 Not changed Unit Selling price ($ per unit) Total variable costs ($ per unit) Unit contribution ($ per unit) I= Gross margin per unit) Contribution Margin Ratio (%) Fixed costs ($) 3.1) 3.10) 3.19) 3.2) 3.11) 3.20) $300,000 Changed to $240,000 $300,000 Not changed Unit break-even volume (No. of 3.3) 3.12) 3.21) units) Dollar break-even ($) 3.4) 3.13) 3.22) 3.12) 3.21) 3.13) 3.22) 3.14) 3.23) 3.15) 3.24) Unit break-even volume (No. of 3.3) units) Dollar break-even ($) $) 3.4) Total Contribution ($) when break- 3.5) even is achieved. No. of units to achieve a profit 3.6) goal of $300,000 . (Sales) Dollars to ( achieve a profit 3.7) goal of $300,000 Total Contribution ($) when a profit 3.8) goal of $300,000 is achieved. Total Net Profit ($) when a profit goal 3.9) of $300,000 is achieved. 3.16) 3.25) 3.17) 3.26) 3.18) 3.27) 3.28: Youthe strategic marketer and decision maker of Boston Corp.just estimated that "Company Sales Force (Make decision)" will receive 4% commission on total sales ($) and all the relevant salary and administrative expenses are expected to be $30,000, while "Independent Sales Professionals (Buy decision)" receive 7% commission with no other costs involved. At what sales level (X; A.K.A. Switching point) would a company's sales force cost more or less than independent sales professionals? (4pts) 3.29: Depending on the computed '(Sales) Dollars to achieve a dollar profit goal of $ 300,000 ($)' of each scenario case above, you will have to choose different decisionsMake or Buy. State your choice for each scenario and explain your rational. (4pts) 3.28: Youthe strategic marketer and decision maker of Boston Corp. just estimated that "Company Sales Force (Make decision) will receive 4% commission on total sales ($) and all the relevant salary and administrative expenses are expected to be $30,000, while Independent Sales Professionals (Buy decision)" receive 7% commission with no other costs involved. At what sales level (X; A.K.A. Switching point) would a company's sales force cost more or less than independent sales professionals? (4pts) 3.29: Depending on the computed '(Sales) Dollars to achieve a dollar profit goal of $ 300,000 ($)' of each scenario case above, you will have to choose different decisionsMake or Buy. State your choice for each scenario and explain your rational. (4pts) . 3.30: Due to the New California Labor and Employment Laws for 2023, all the relevant salary and administrative expenses for Company Sales Force (Make decision) are expected to increase to $60,000, while all other conditions will stay the same, which are 4% commission for "Company Sales Force and 7% commission for "Independent Sales Professionals. Based on the changed sales level (X, A.K.A. Switching point) and your computed "(Sales) Dollars to achieve a dollar profit goal of $ 300,000 ($)' of each scenario case above, state your choice-Make or Buy-for each scenario and explain your rational. (4pts)