Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 3 Question 1 The intrinsic value of a put is equal to the greater of the strike price minus the stock price or zero.

question 3

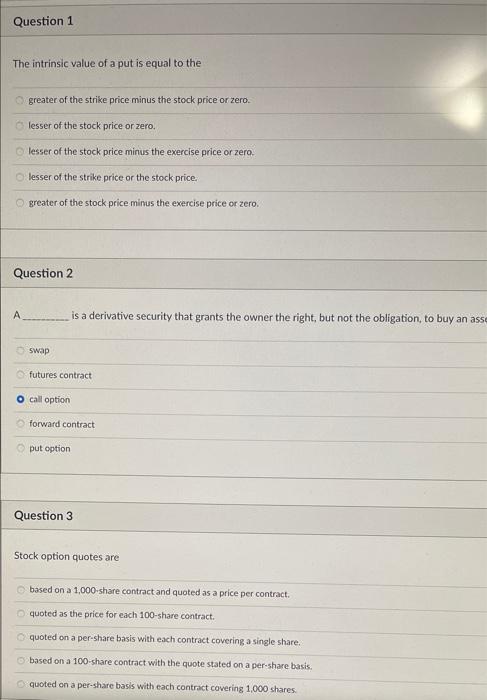

Question 1 The intrinsic value of a put is equal to the greater of the strike price minus the stock price or zero. lesser of the stock price or zero. lesser of the stock price minus the exercise price or zero. o lesser of the strike price or the stock price. greater of the stock price minus the exercise price or zero. Question 2 A is a derivative security that grants the owner the right, but not the obligation, to buy an asse swap futures contract call option forward contract put option Question 3 Stock option quotes are based on a 1,000-share contract and quoted as a price per contract. quoted as the price for each 100-share contract. quoted on a per-share basis with each contract covering a single share. based on a 100-share contract with the quote stated on a per-share basis quoted on a per-share basis with each contract covering 1,000 shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started