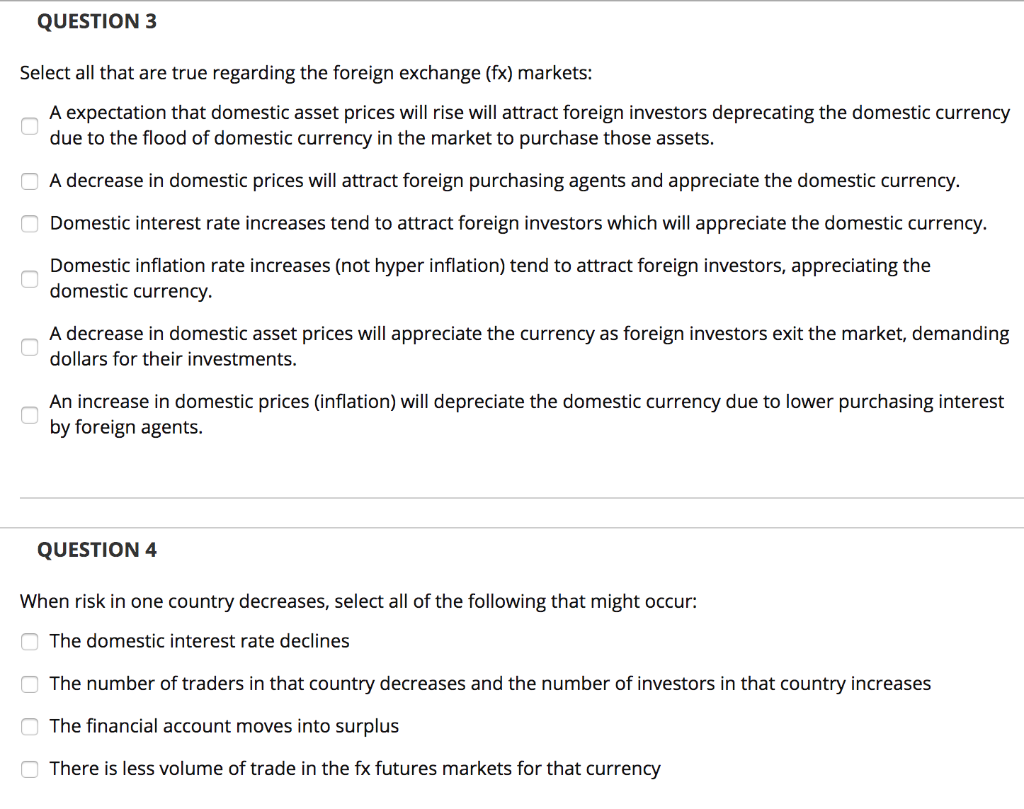

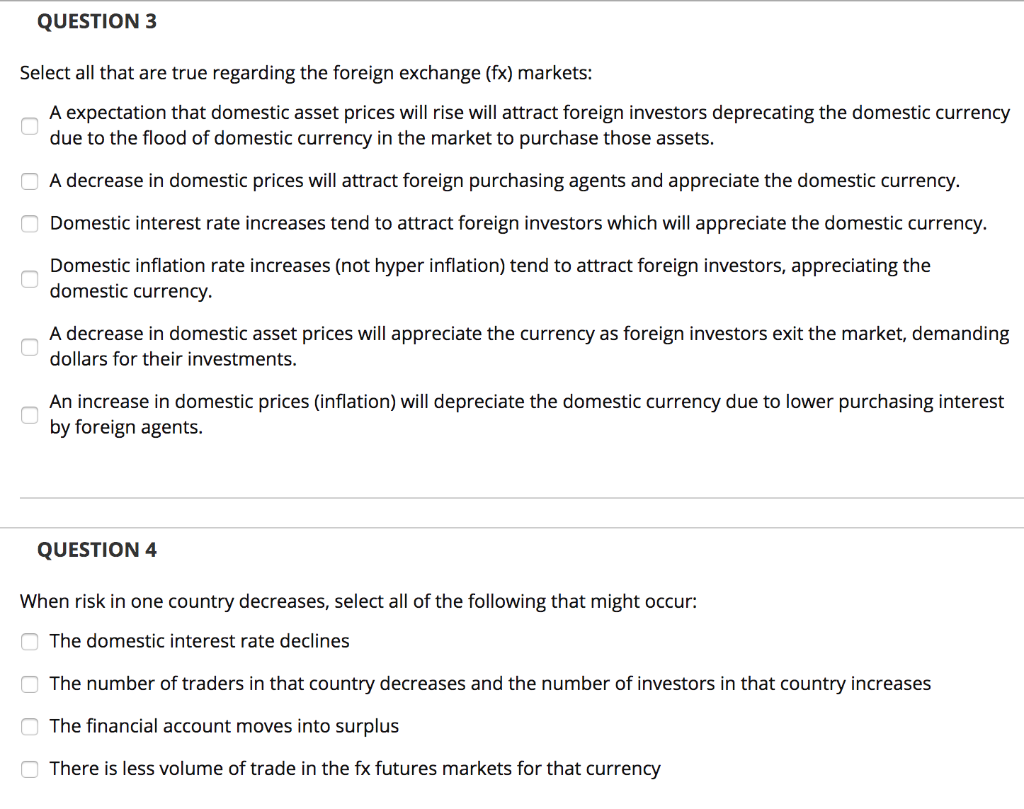

QUESTION 3 Select all that are true regarding the foreign exchange (fx) markets: A expectation that domestic asset prices will rise will attract foreign investors deprecating the domestic currency due to the flood of domestic currency in the market to purchase those assets. A decrease in domestic prices will attract foreign purchasing agents and appreciate the domestic currency. Domestic interest rate increases tend to attract foreign investors which will appreciate the domestic currency. Domestic inflation rate increases (not hyper inflation) tend to attract foreign investors, appreciating the domestic currency. O A decrease in domestic asset prices will appreciate the currency as foreign investors exit the market, demanding dollars for their investments. An increase in domestic prices (inflation) will depreciate the domestic currency due to lower purchasing interest by foreign agents. QUESTION 4 When risk in one country decreases, select all of the following that might occur: The domestic interest rate declines The number of traders in that country decreases and the number of investors in that country increases The financial account moves into surplus There is less volume of trade in the fx futures markets for that currency QUESTION 3 Select all that are true regarding the foreign exchange (fx) markets: A expectation that domestic asset prices will rise will attract foreign investors deprecating the domestic currency due to the flood of domestic currency in the market to purchase those assets. A decrease in domestic prices will attract foreign purchasing agents and appreciate the domestic currency. Domestic interest rate increases tend to attract foreign investors which will appreciate the domestic currency. Domestic inflation rate increases (not hyper inflation) tend to attract foreign investors, appreciating the domestic currency. O A decrease in domestic asset prices will appreciate the currency as foreign investors exit the market, demanding dollars for their investments. An increase in domestic prices (inflation) will depreciate the domestic currency due to lower purchasing interest by foreign agents. QUESTION 4 When risk in one country decreases, select all of the following that might occur: The domestic interest rate declines The number of traders in that country decreases and the number of investors in that country increases The financial account moves into surplus There is less volume of trade in the fx futures markets for that currency