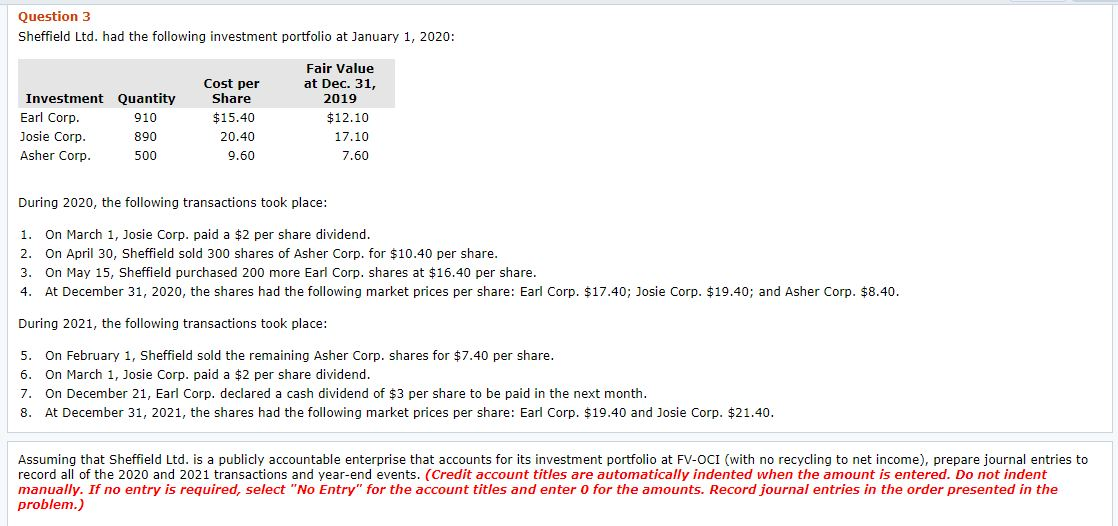

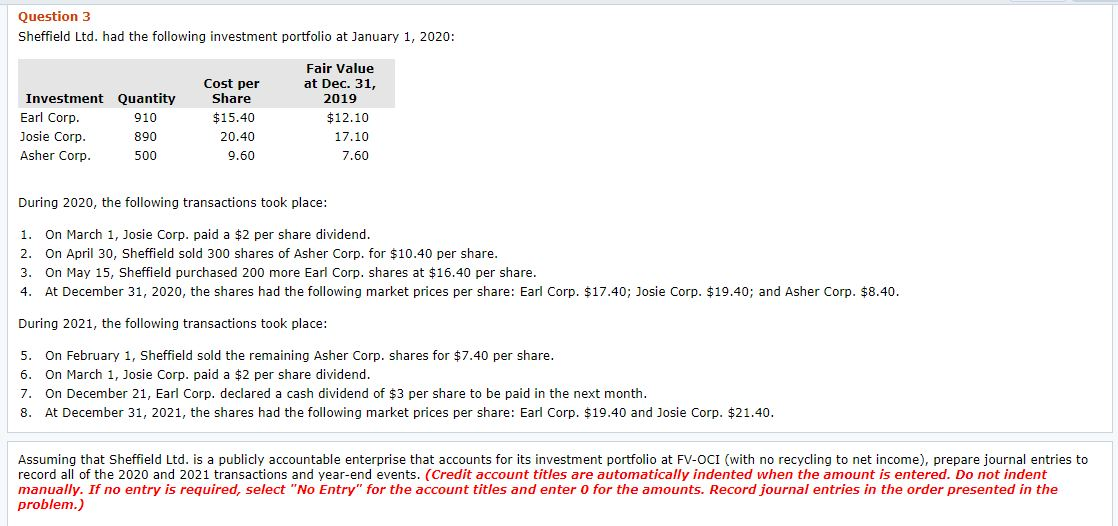

Question 3 Sheffield Ltd. had the following investment portfolio at January 1, 2020: Investment Quantity Earl Corp. 910 Josie Corp. 890 Asher Corp. 500 Cost per Share $15.40 20.40 9.60 Fair Value at Dec. 31, 2019 $12.10 17.10 7.60 During 2020, the following transactions took place: 1. On March 1, Josie Corp. paid a $2 per share dividend. 2. On April 30, Sheffield sold 300 shares of Asher Corp. for $10.40 per share. 3. On May 15, Sheffield purchased 200 more Earl Corp. shares at $16.40 per share. 4. At December 31, 2020, the shares had the following market prices per share: Earl Corp. $17.40; Josie Corp. $19.40; and Asher Corp. $8.40. During 2021, the following transactions took place: 5. On February 1, Sheffield sold the remaining Asher Corp. shares for $7.40 per share. 6. On March 1, Josie Corp. paid a $2 per share dividend. 7. On December 21, Earl Corp. declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31, 2021, the shares had the following market prices per share: Earl Corp. $19.40 and Josie Corp. $21.40. Assuming that Sheffield Ltd. is a publicly accountable enterprise that accounts for its investment portfolio at FV-OCI (with no recycling to net income), prepare journal entries to record all of the 2020 and 2021 transactions and year-end events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Question 3 Sheffield Ltd. had the following investment portfolio at January 1, 2020: Investment Quantity Earl Corp. 910 Josie Corp. 890 Asher Corp. 500 Cost per Share $15.40 20.40 9.60 Fair Value at Dec. 31, 2019 $12.10 17.10 7.60 During 2020, the following transactions took place: 1. On March 1, Josie Corp. paid a $2 per share dividend. 2. On April 30, Sheffield sold 300 shares of Asher Corp. for $10.40 per share. 3. On May 15, Sheffield purchased 200 more Earl Corp. shares at $16.40 per share. 4. At December 31, 2020, the shares had the following market prices per share: Earl Corp. $17.40; Josie Corp. $19.40; and Asher Corp. $8.40. During 2021, the following transactions took place: 5. On February 1, Sheffield sold the remaining Asher Corp. shares for $7.40 per share. 6. On March 1, Josie Corp. paid a $2 per share dividend. 7. On December 21, Earl Corp. declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31, 2021, the shares had the following market prices per share: Earl Corp. $19.40 and Josie Corp. $21.40. Assuming that Sheffield Ltd. is a publicly accountable enterprise that accounts for its investment portfolio at FV-OCI (with no recycling to net income), prepare journal entries to record all of the 2020 and 2021 transactions and year-end events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.)