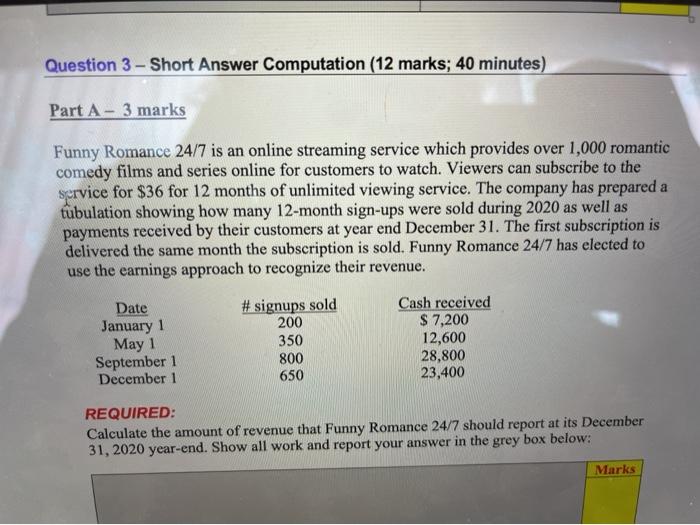

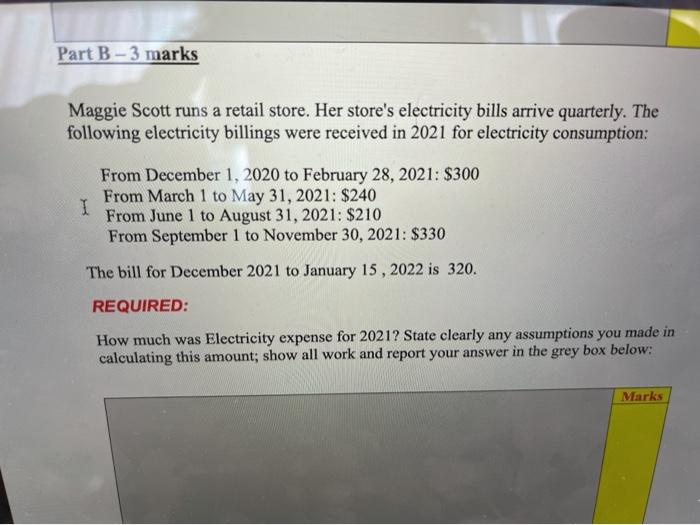

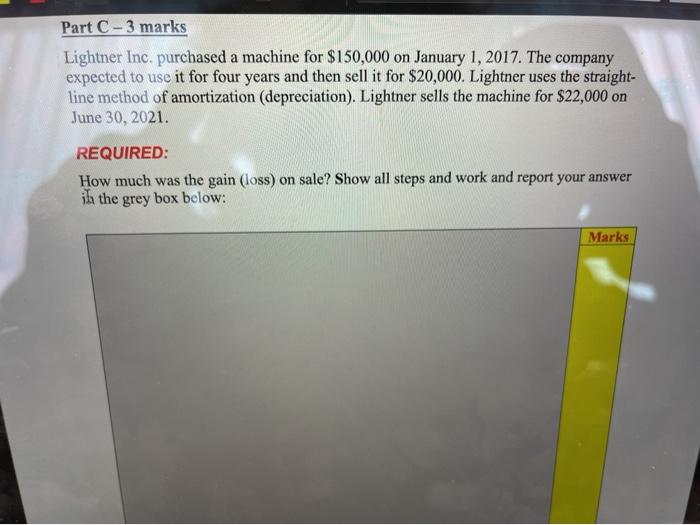

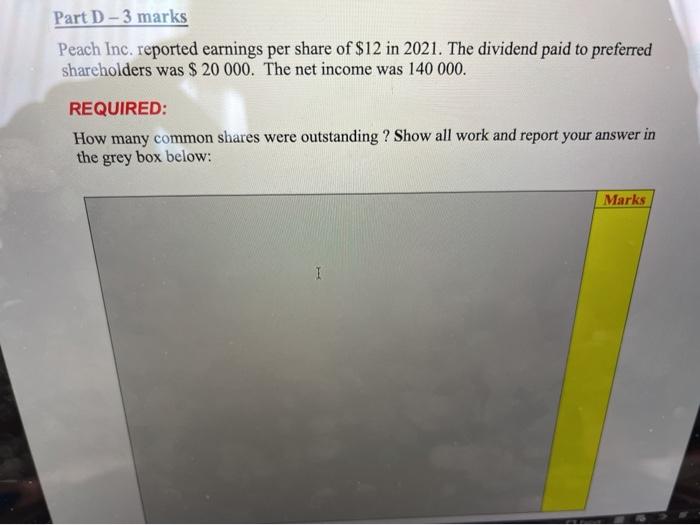

Question 3 - Short Answer Computation (12 marks; 40 minutes) Part A- 3 marks Funny Romance 24/7 is an online streaming service which provides over 1,000 romantic comedy films and series online for customers to watch. Viewers can subscribe to the service for $36 for 12 months of unlimited viewing service. The company has prepared a tubulation showing how many 12-month sign-ups were sold during 2020 as well as payments received by their customers at year end December 31. The first subscription is delivered the same month the subscription is sold. Funny Romance 24/7 has elected to use the earnings approach to recognize their revenue. Date January 1 May 1 September 1 December 1 # signups sold 200 350 800 650 Cash received $ 7,200 12,600 28,800 23,400 REQUIRED: Calculate the amount of revenue that Funny Romance 24/7 should report at its December 31, 2020 year-end. Show all work and report your answer in the grey box below: Marks Part B - 3 marks Maggie Scott runs a retail store. Her store's electricity bills arrive quarterly. The following electricity billings were received in 2021 for electricity consumption: From December 1, 2020 to February 28, 2021: $300 I From March 1 to May 31, 2021: $240 From June 1 to August 31, 2021: $210 From September 1 to November 30, 2021: $330 The bill for December 2021 to January 15, 2022 is 320. REQUIRED: How much was Electricity expense for 2021? State clearly any assumptions you made in calculating this amount; show all work and report your answer in the grey box below: Marks Part C-3 marks Lightner Inc. purchased a machine for $150,000 on January 1, 2017. The company expected to use it for four years and then sell it for $20,000. Lightner uses the straight- line method of amortization (depreciation). Lightner sells the machine for $22,000 on June 30, 2021. REQUIRED: How much was the gain (loss) on sale? Show all steps and work and report your answer ih the grey box below: Marks Part D-3 marks Peach Inc. reported earnings per share of $12 in 2021. The dividend paid to preferred shareholders was $ 20 000. The net income was 140 000. REQUIRED: How many common shares were outstanding ? Show all work and report your answer in the grey box below: Marks