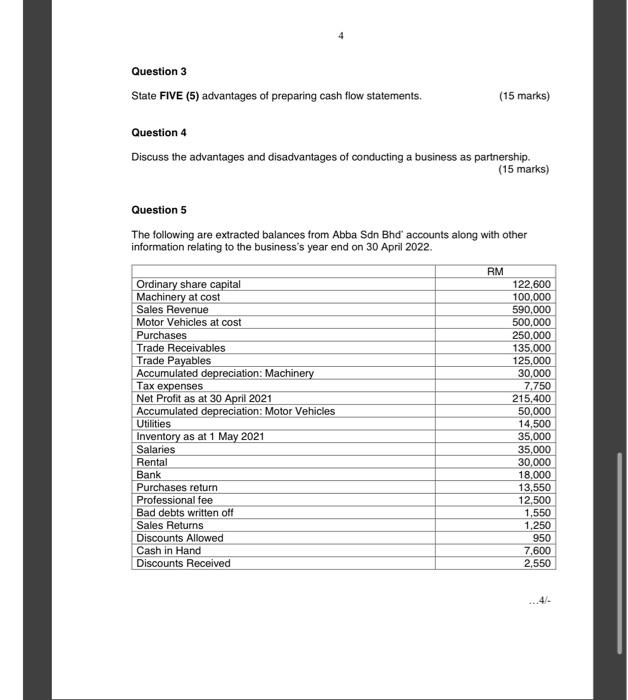

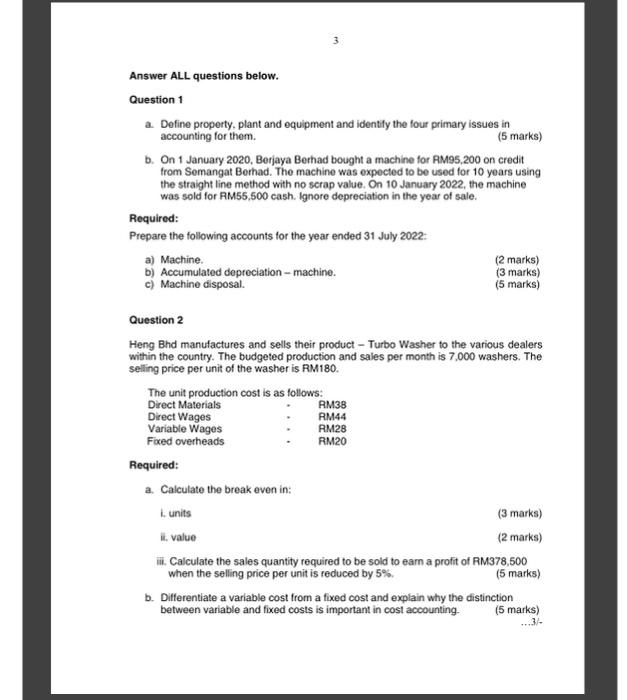

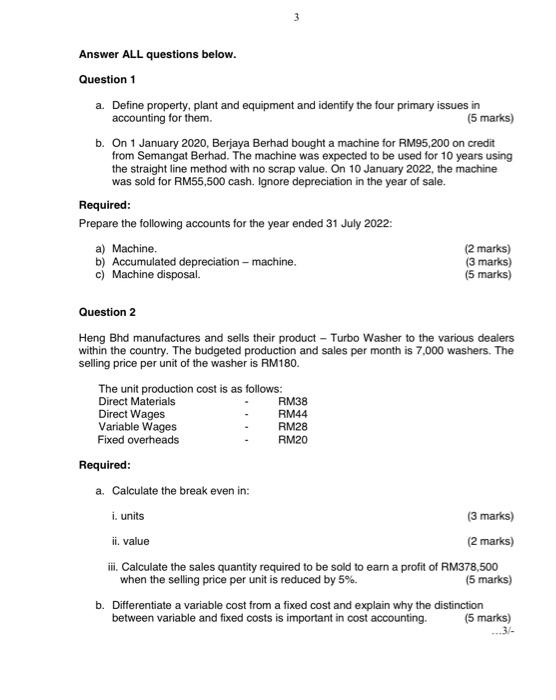

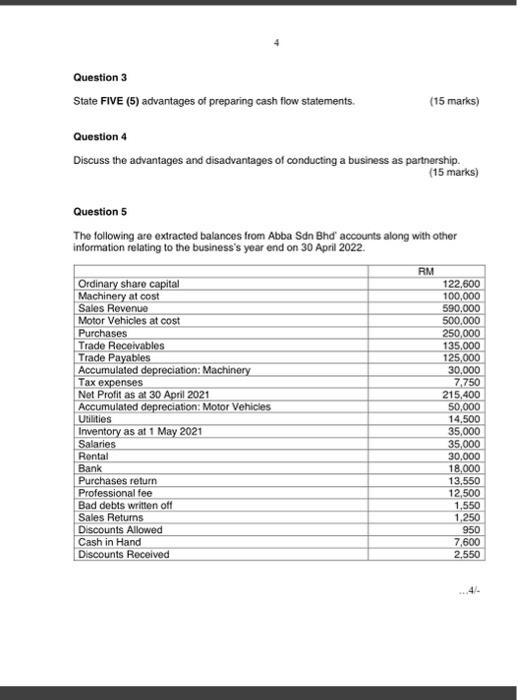

Question 3 State FIVE (5) advantages of preparing cash flow statements. (15 marks) Question 4 Discuss the advantages and disadvantages of conducting a business as partnership. (15 marks) Question 5 The following are extracted balances from Abba Sdn Bhd' accounts along with other information relating to the business's year end on 30 April 2022. .4/ Question 1 a. Define property. plant and equipment and identify the four primary issues in accounting for them. (5 marks) b. On 1 January 2020, Berjaya Berhad bought a machine for AM95,200 on credit from Semangat Berhad. The machine was expected to be used for 10 years using the straight line method with no scrap value. On 10 January 2022, the machine was sold for RM55,500 cash. Ignore depreciation in the year of sale. Required: Prepare the following accounts for the year ended 31 July 2022: a) Machine. (2 marks) b) Accumulated depreciation - machine. (3 marks) c) Machine disposal. (5 marks) Question 2 Heng Bhd manufactures and sells their product - Turbo Washer to the various dealers within the country. The budgeted production and sales per month is 7,000 washers. The selling price per unit of the washer is RM 180. Required: a. Calculate the break even in: i. units (3 marks) ii. value (2 marks) when the selling price per unit is reduced by 5%. (5 marks) b. Differentiate a variable cost from a fixed cost and explain why the distinction between variable and fixed costs is important in cost accounting. (5 marks) Question 1 a. Define property, plant and equipment and identify the four primary issues in accounting for them. (5 marks) b. On 1 January 2020, Berjaya Berhad bought a machine for RM95, 200 on credit from Semangat Berhad. The machine was expected to be used for 10 years using the straight line method with no scrap value. On 10 January 2022 , the machine was sold for RM55,500 cash. Ignore depreciation in the year of sale. Required: Prepare the following accounts for the year ended 31 July 2022: a) Machine. (2 marks) b) Accumulated depreciation - machine. (3 marks) c) Machine disposal. (5 marks) Question 2 Heng Bhd manufactures and sells their product - Turbo Washer to the various dealers within the country. The budgeted production and sales per month is 7,000 washers. The selling price per unit of the washer is RM180. Required: a. Calculate the break even in: i. units (3 marks) ii. value (2 marks) iii. Calculate the sales quantity required to be sold to earn a profit of RM378,500 when the selling price per unit is reduced by 5%. (5 marks) b. Differentiate a variable cost from a fixed cost and explain why the distinction between variable and fixed costs is important in cost accounting. (5 marks) Question 3 State FIVE (5) advantages of preparing cash flow statements. (15 marks) Question 4 Discuss the advantages and disadvantages of conducting a business as partnership. (15 marks) Question 5 The following are extracted balances from Abba Sdn Bhd' accounts along with other information relating to the business's year end on 30 April 2022. 4