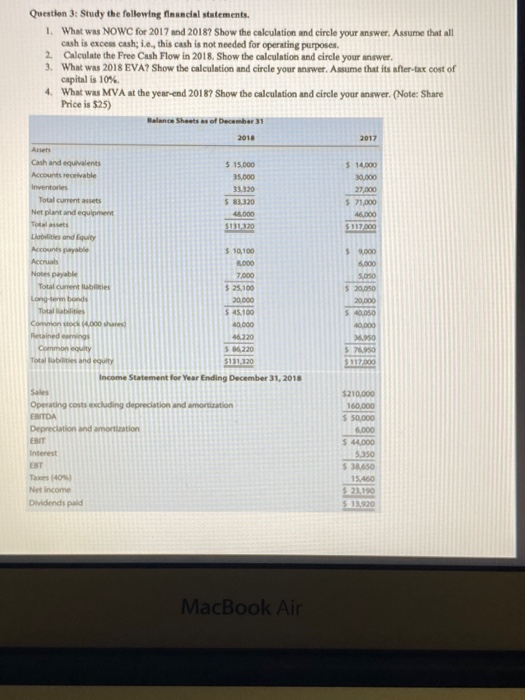

Question 3: Study the following financial statements. 1. What was NOW for 2017 and 2018? Show the calculatine and circle your answer. Assume that all cash is excess cash; ie, this cash is not needed for operating purposes. 2. Calculate the Free Cash Flow in 2018. Show the calculation and circle your answer 3. What was 2018 EVA? Show the calculation and circle your answer. Assume that its after-tax cost of capital is 10% 4. What was MVA at the year-end 2018? Show the calculation and circle your answer. (Note: Share Price is $25) Balance Sheets as of December 31 2018 Chand equivalent $15.000 35.000 5 00 30.000 Inventaris Ne plantandem 5.000 09 SH Arch 5300 3.000 700D 5.26.190 20.000 Long term bonds 11.30 ESTA EST EST 80 79 . FE > 4 FE FO # 3 $ 4 % 5 6 & 7 * - 9 0 E R T Y Question 3: Study the following financial statements. 1. What was NOW for 2017 and 2018? Show the calculation and circle your answer. Assume that all cash is excess cash; ie, this cash is not needed for operating purposes. 2. Calculate the Free Cash Flow in 2018. Show the calculation and circle your answer. 3. What was 2018 EVA? Show the calculation and circle your answer. Assume that its after-tax cost of capital is 10% 4. What was MVA at the year-end 2018? Show the calculation and circle your answer. (Note: Share Price is $25) Balance Sheets of December 31 2018 2017 3 14.000 30.000 27.000 $ 71.000 46.000 $112.000 $ 9.000 6.000 Cash and equivalents $ 15.000 Accounts receivable 35,000 Inventores 33,320 Total current assets $ 83.320 Net plant and equipment 000 Toats $131,320 Lities and Equity Accounts payable $ 10,100 Accrual 8.000 Notes payable 7 000 Total current lubles $ 25,100 Long-term bonds 20.000 Total abilities 5.45.100 Common stock 4.000 40.000 Retained amings 46.220 Common equity $ 220 Total band guity $131,320 Income Statement for Year Ending December 31, 2018 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and mortation 5.050 $ 20,050 20.000 $40.050 40.000 36.950 $ 76.950 $117.000 ESIT Interest Taxes 404 Net income Dividends paid $210,000 160,000 550,000 6.000 5.44.000 5.350 $ 38,650 15460 $ 23,190 5 13.920 MacBook Air Question 3: Study the following financial statements. 1. What was NOW for 2017 and 2018? Show the calculatine and circle your answer. Assume that all cash is excess cash; ie, this cash is not needed for operating purposes. 2. Calculate the Free Cash Flow in 2018. Show the calculation and circle your answer 3. What was 2018 EVA? Show the calculation and circle your answer. Assume that its after-tax cost of capital is 10% 4. What was MVA at the year-end 2018? Show the calculation and circle your answer. (Note: Share Price is $25) Balance Sheets as of December 31 2018 Chand equivalent $15.000 35.000 5 00 30.000 Inventaris Ne plantandem 5.000 09 SH Arch 5300 3.000 700D 5.26.190 20.000 Long term bonds 11.30 ESTA EST EST 80 79 . FE > 4 FE FO # 3 $ 4 % 5 6 & 7 * - 9 0 E R T Y Question 3: Study the following financial statements. 1. What was NOW for 2017 and 2018? Show the calculation and circle your answer. Assume that all cash is excess cash; ie, this cash is not needed for operating purposes. 2. Calculate the Free Cash Flow in 2018. Show the calculation and circle your answer. 3. What was 2018 EVA? Show the calculation and circle your answer. Assume that its after-tax cost of capital is 10% 4. What was MVA at the year-end 2018? Show the calculation and circle your answer. (Note: Share Price is $25) Balance Sheets of December 31 2018 2017 3 14.000 30.000 27.000 $ 71.000 46.000 $112.000 $ 9.000 6.000 Cash and equivalents $ 15.000 Accounts receivable 35,000 Inventores 33,320 Total current assets $ 83.320 Net plant and equipment 000 Toats $131,320 Lities and Equity Accounts payable $ 10,100 Accrual 8.000 Notes payable 7 000 Total current lubles $ 25,100 Long-term bonds 20.000 Total abilities 5.45.100 Common stock 4.000 40.000 Retained amings 46.220 Common equity $ 220 Total band guity $131,320 Income Statement for Year Ending December 31, 2018 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and mortation 5.050 $ 20,050 20.000 $40.050 40.000 36.950 $ 76.950 $117.000 ESIT Interest Taxes 404 Net income Dividends paid $210,000 160,000 550,000 6.000 5.44.000 5.350 $ 38,650 15460 $ 23,190 5 13.920 MacBook Air