Question

Question 3 Study the information provided below and calculate the following: 3.1 Manufacturing costs per unit for each product using the traditional absorption costing system

Question 3 Study the information provided below and calculate the following: 3.1 Manufacturing costs per unit for each product using the traditional absorption costing system (6 marks)

3.2 Manufacturing overheads cost per unit for each product using the ABC system. (14 marks) I

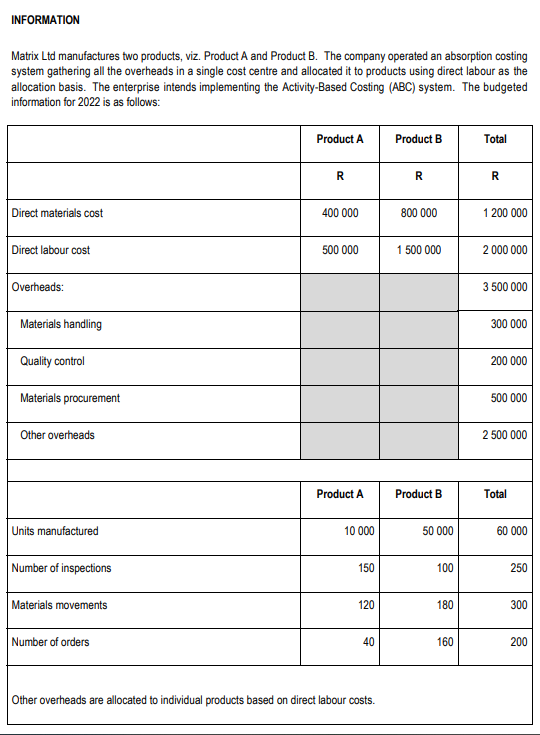

NFORMATION Matrix Ltd manufactures two products, viz. Product A and Product B. The company operated an absorption costing system gathering all the overheads in a single cost centre and allocated it to products using direct labour as the allocation basis. The enterprise intends implementing the Activity-Based Costing (ABC) system.

The budgeted information for 2022 is as follows:

Product A Product B Total R R R Direct materials cost 400 000 800 000 1 200 000 Direct labour cost 500 000 1 500 000 2 000 000 Overheads: 3 500 000 Materials handling 300 000 Quality control 200 000 Materials procurement 500 000 Other overheads 2 500 000 Product A Product B Total Units manufactured 10 000 50 000 60 000 Number of inspections 150 100 250 Materials movements 120 180 300 Number of orders 40 160 200 Other overheads are allocated to individual products based on direct labour costs.

Product A Product B Total R R R Direct materials cost 400 000 800 000 1 200 000 Direct labour cost 500 000 1 500 000 2 000 000 Overheads: 3 500 000 Materials handling 300 000 Quality control 200 000 Materials procurement 500 000 Other overheads 2 500 000 Product A Product B Total Units manufactured 10 000 50 000 60 000 Number of inspections 150 100 250 Materials movements 120 180 300 Number of orders 40 160 200 Other overheads are allocated to individual products based on direct labour costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started