Answered step by step

Verified Expert Solution

Question

1 Approved Answer

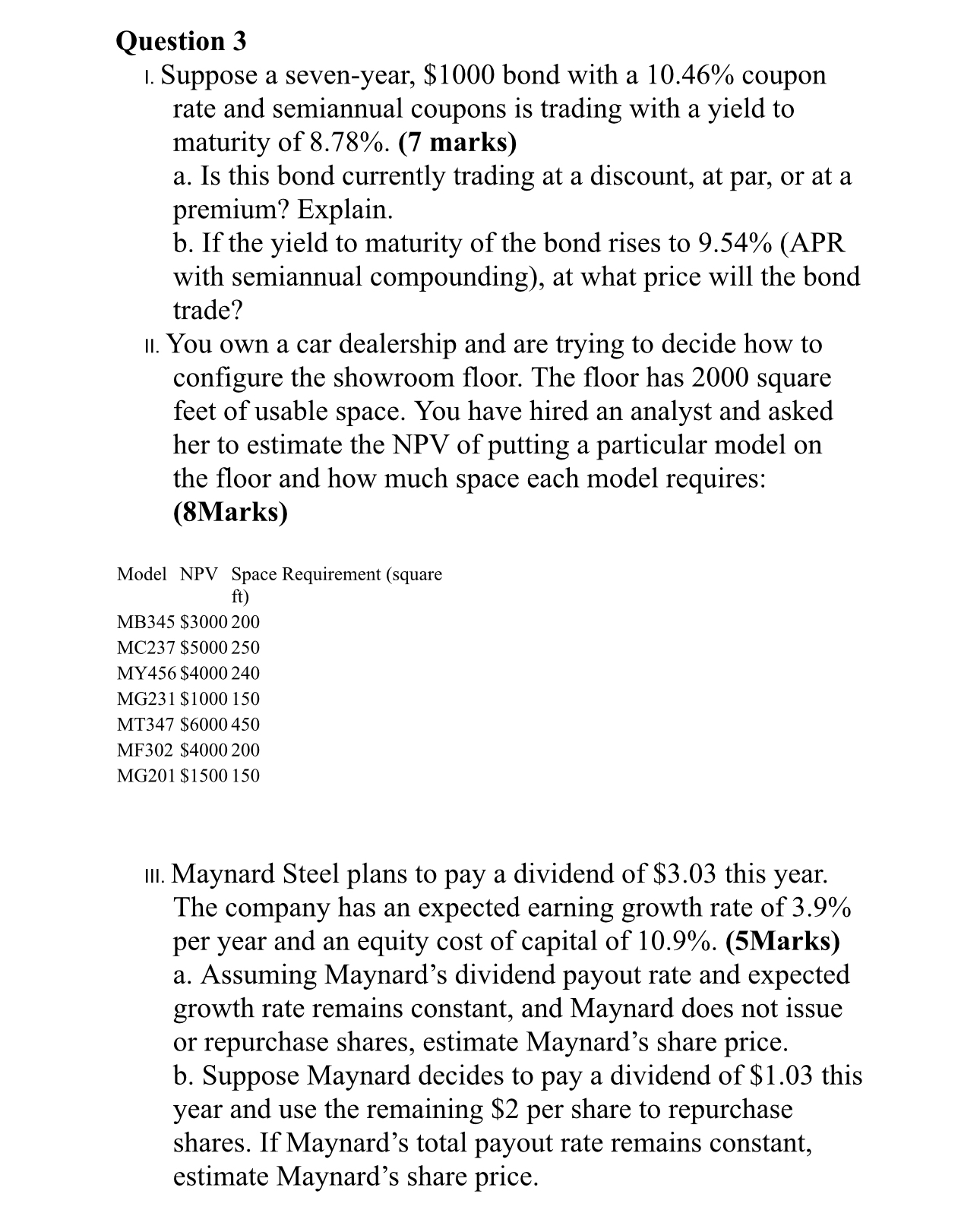

Question 3 . Suppose a seven - year, $ 1 0 0 0 bond with a 1 0 . 4 6 % coupon rate and

Question

Suppose a sevenyear, $ bond with a coupon rate and semiannual coupons is trading with a yield to maturity of marks

a Is this bond currently trading at a discount, at par, or at a premium? Explain.

b If the yield to maturity of the bond rises to APR with semiannual compounding at what price will the bond trade?

II You own a car dealership and are trying to decide how to configure the showroom floor. The floor has square feet of usable space. You have hired an analyst and asked her to estimate the NPV of putting a particular model on the floor and how much space each model requires: Marks

Model NPV Space Requirement square

MB $

MC $

MY $

MG $

MT $

MF $

MG $

III. Maynard Steel plans to pay a dividend of $ this year. The company has an expected earning growth rate of per year and an equity cost of capital of Marks a Assuming Maynard's dividend payout rate and expected growth rate remains constant, and Maynard does not issue or repurchase shares, estimate Maynard's share price. b Suppose Maynard decides to pay a dividend of $ this year and use the remaining $ per share to repurchase shares. If Maynard's total payout rate remains constant, estimate Maynard's share price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started