Answered step by step

Verified Expert Solution

Question

1 Approved Answer

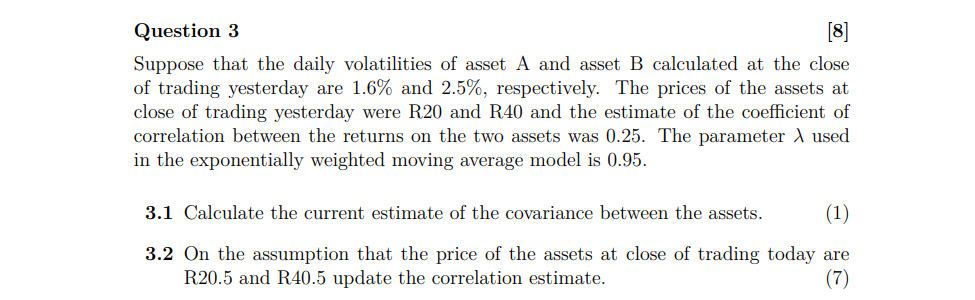

Question 3 Suppose that the daily volatilities of asset A and asset B calculated at the close of trading yesterday are 1.6 and 2.5, respectively.

Question 3 Suppose that the daily volatilities of asset A and asset B calculated at the close of trading yesterday are \1.6 and \2.5, respectively. The prices of the assets at close of trading yesterday were R20 and R40 and the estimate of the coefficient of correlation between the returns on the two assets was 0.25 . The parameter \\( \\lambda \\) used in the exponentially weighted moving average model is 0.95 . 3.1 Calculate the current estimate of the covariance between the assets. 3.2 On the assumption that the price of the assets at close of trading today are R20.5 and R40.5 update the correlation estimate. (7)

Question 3 Suppose that the daily volatilities of asset A and asset B calculated at the close of trading yesterday are \1.6 and \2.5, respectively. The prices of the assets at close of trading yesterday were R20 and R40 and the estimate of the coefficient of correlation between the returns on the two assets was 0.25 . The parameter \\( \\lambda \\) used in the exponentially weighted moving average model is 0.95 . 3.1 Calculate the current estimate of the covariance between the assets. 3.2 On the assumption that the price of the assets at close of trading today are R20.5 and R40.5 update the correlation estimate. (7) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started