Answered step by step

Verified Expert Solution

Question

1 Approved Answer

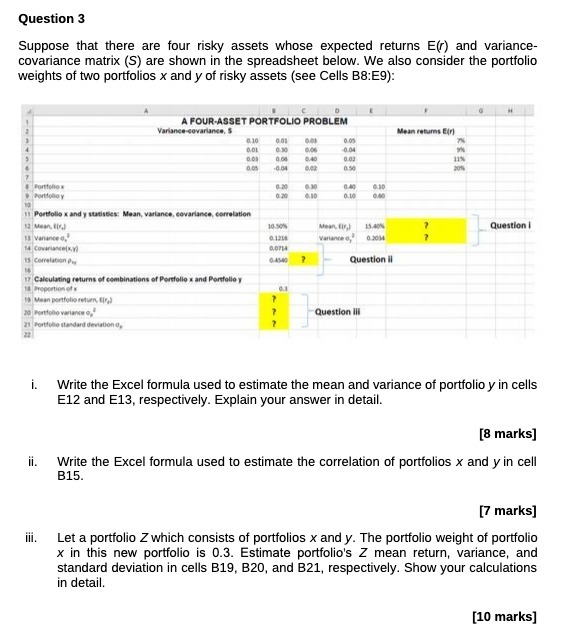

Question 3 Suppose that there are four risky assets whose expected returns E(r) and variance- covariance matrix (S) are shown in the spreadsheet below.

Question 3 Suppose that there are four risky assets whose expected returns E(r) and variance- covariance matrix (S) are shown in the spreadsheet below. We also consider the portfolio weights of two portfolios x and y of risky assets (see Cells B8:E9): A FOUR-ASSET PORTFOLIO PROBLEM Variance-covariance, S Mean returns E() 0.01 0.03 0.05 0.01 0.30 0.06 -0.04 0.00 0.06 0.40 0.02 11% 0.05 -0.04 0.02 0.50 20% 3532 7% 9% Portfolio Portfolio y 0.20 0.30 0.40 0.30 0.30 0.10 0.10 0.40 11 Portfolio x and y statistics: Mean, variance, covariance, correlation 12 Mean 10.50% Mean, 15.40% Question i 13 Varance o 0.1216 Variance o, 0.2034 ? 14 Covariance(xy) 0.0714 0.4540 ? Question il 15 Correlation 17 Calculating returns of combinations of Portfolio x and Portfolio y 18 Proportion of 19 Mean portfolio return) 20 Portfolio variance o 21 Portfolio standard deviation, i. ii. 0.3 ? ? Question ill ? Write the Excel formula used to estimate the mean and variance of portfolio y in cells E12 and E13, respectively. Explain your answer in detail. [8 marks] Write the Excel formula used to estimate the correlation of portfolios x and y in cell B15. [7 marks] III. Let a portfolio Z which consists of portfolios x and y. The portfolio weight of portfolio x in this new portfolio is 0.3. Estimate portfolio's Z mean return, variance, and standard deviation in cells B19, B20, and B21, respectively. Show your calculations in detail. [10 marks]

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Ans First of all I am sorry The sum has a lot of sub parts and I can answer only 4 as per Hom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started