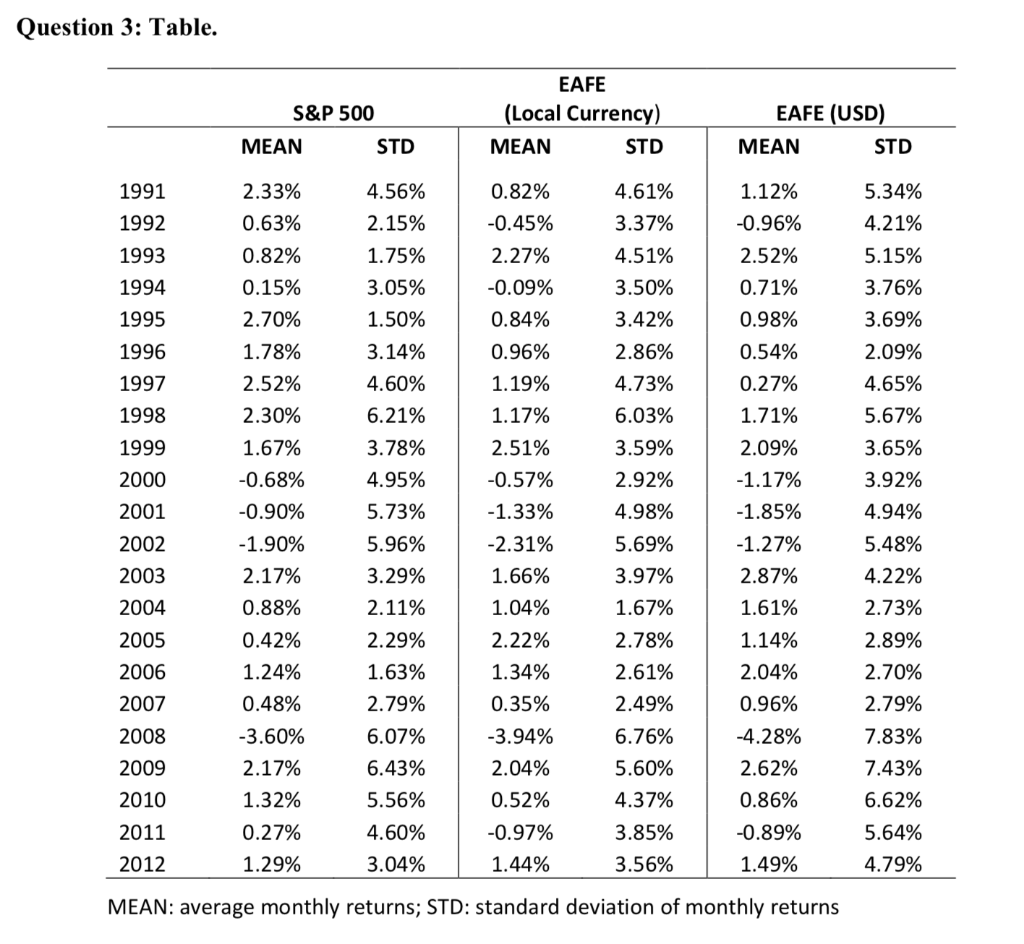

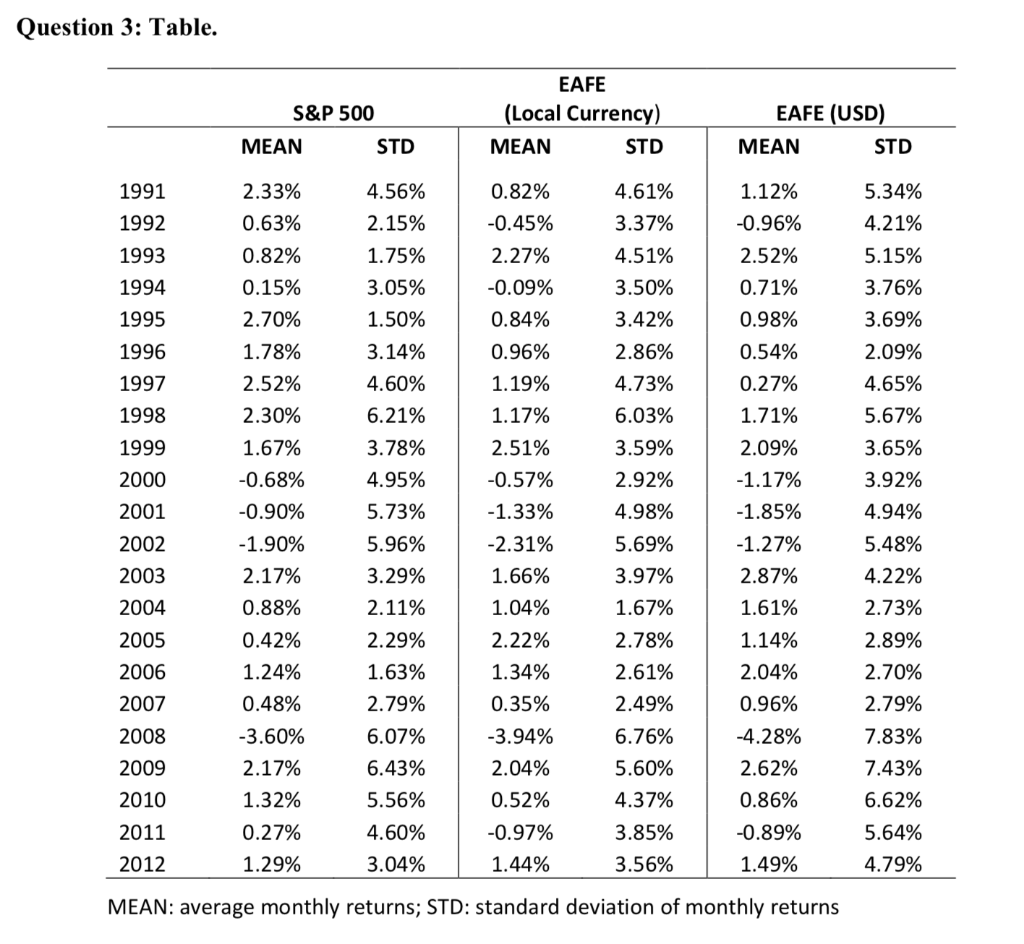

Question 3: Table. S&P 500 EAFE (Local Currency) MEAN STD EAFE (USD) MEAN STD MEAN STD 1991 1992 1.12% -0.96% 2.52% 1993 1994 0.71% 0.98% 1995 0.54% 0.27% 1.71% 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2.33% 0.63% 0.82% 0.15% 2.70% 1.78% 2.52% 2.30% 1.67% -0.68% -0.90% -1.90% 2.17% 0.88% 0.42% 1.24% 0.48% -3.60% 2.17% 1.32% 0.27% 1.29% 4.56% 2.15% 1.75% 3.05% 1.50% 3.14% 4.60% 6.21% 3.78% 4.95% 5.73% 5.96% 3.29% 2.11% 2.29% 1.63% 2.79% 6.07% 6.43% 5.56% 4.60% 3.04% 0.82% -0.45% 2.27% -0.09% 0.84% 0.96% 1.19% 1.17% 2.51% -0.57% -1.33% -2.31% 1.66% 1.04% 2.22% 1.34% 0.35% -3.94% 2.04% 0.52% -0.97% 1.44% 4.61% 3.37% 4.51% 3.50% 3.42% 2.86% 4.73% 6.03% 3.59% 2.92% 4.98% 5.69% 3.97% 1.67% 2.78% 2.61% 2.49% 6.76% 5.60% 4.37% 2.09% -1.17% -1.85% -1.27% 2.87% 1.61% 5.34% 4.21% 5.15% 3.76% 3.69% 2.09% 4.65% 5.67% 3.65% 3.92% 4.94% 5.48% 4.22% 2.73% 2.89% 2.70% 2.79% 7.83% 7.43% 6.62% 5.64% 4.79% 1.14% 2.04% 0.96% -4.28% 2008 2009 2010 2.62% 0.86% 2011 2012 3.85% 3.56% -0.89% 1.49% MEAN: average monthly returns; STD: standard deviation of monthly returns Question 3 (15 points) your first You have landed a coveted internship at a prestigious money manager in Singapore. For assignment your supervisor has asked you to do the calculations needed to convince a valued client on the benefits of international diversification. You have been assigned this task instead of the other intern, because of your impeccable understanding of the principles of finance, especially that of diversification and the role that of currencies play in international investments. The data given to you in the following table (on the next page and the CSV file) contains the average monthly returns and standard deviations for the S&P 500 index (in USD) and, EAFE index (in Local currency and USD) for the period 1991 to 2012. The correlation between S&P 500 and the EAFE (Local currency) over the entire period is 0.7927 (for local currency). The correlation between S&P 500 and the EAFE (USD) over the entire period is 0.7805. You are asked to present three computations: (a) The currency effect of investing in these market indices over the entire period. (5 points) (b) Risk and performance of the indices over the entire period. (5 points) (c) Graphically depict the benefits the investor derives from investing in these market indices (S&P 500 and EAFE) assuming both are denominated in USD. You should show your workings. (5 points) Question 3: Table. S&P 500 EAFE (Local Currency) MEAN STD EAFE (USD) MEAN STD MEAN STD 1991 1992 1.12% -0.96% 2.52% 1993 1994 0.71% 0.98% 1995 0.54% 0.27% 1.71% 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2.33% 0.63% 0.82% 0.15% 2.70% 1.78% 2.52% 2.30% 1.67% -0.68% -0.90% -1.90% 2.17% 0.88% 0.42% 1.24% 0.48% -3.60% 2.17% 1.32% 0.27% 1.29% 4.56% 2.15% 1.75% 3.05% 1.50% 3.14% 4.60% 6.21% 3.78% 4.95% 5.73% 5.96% 3.29% 2.11% 2.29% 1.63% 2.79% 6.07% 6.43% 5.56% 4.60% 3.04% 0.82% -0.45% 2.27% -0.09% 0.84% 0.96% 1.19% 1.17% 2.51% -0.57% -1.33% -2.31% 1.66% 1.04% 2.22% 1.34% 0.35% -3.94% 2.04% 0.52% -0.97% 1.44% 4.61% 3.37% 4.51% 3.50% 3.42% 2.86% 4.73% 6.03% 3.59% 2.92% 4.98% 5.69% 3.97% 1.67% 2.78% 2.61% 2.49% 6.76% 5.60% 4.37% 2.09% -1.17% -1.85% -1.27% 2.87% 1.61% 5.34% 4.21% 5.15% 3.76% 3.69% 2.09% 4.65% 5.67% 3.65% 3.92% 4.94% 5.48% 4.22% 2.73% 2.89% 2.70% 2.79% 7.83% 7.43% 6.62% 5.64% 4.79% 1.14% 2.04% 0.96% -4.28% 2008 2009 2010 2.62% 0.86% 2011 2012 3.85% 3.56% -0.89% 1.49% MEAN: average monthly returns; STD: standard deviation of monthly returns Question 3 (15 points) your first You have landed a coveted internship at a prestigious money manager in Singapore. For assignment your supervisor has asked you to do the calculations needed to convince a valued client on the benefits of international diversification. You have been assigned this task instead of the other intern, because of your impeccable understanding of the principles of finance, especially that of diversification and the role that of currencies play in international investments. The data given to you in the following table (on the next page and the CSV file) contains the average monthly returns and standard deviations for the S&P 500 index (in USD) and, EAFE index (in Local currency and USD) for the period 1991 to 2012. The correlation between S&P 500 and the EAFE (Local currency) over the entire period is 0.7927 (for local currency). The correlation between S&P 500 and the EAFE (USD) over the entire period is 0.7805. You are asked to present three computations: (a) The currency effect of investing in these market indices over the entire period. (5 points) (b) Risk and performance of the indices over the entire period. (5 points) (c) Graphically depict the benefits the investor derives from investing in these market indices (S&P 500 and EAFE) assuming both are denominated in USD. You should show your workings. (5 points)