Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 The bull/bear spread is the option trading strategy to profit from a moderate rise or bearish trend of underlying assets. Here we define

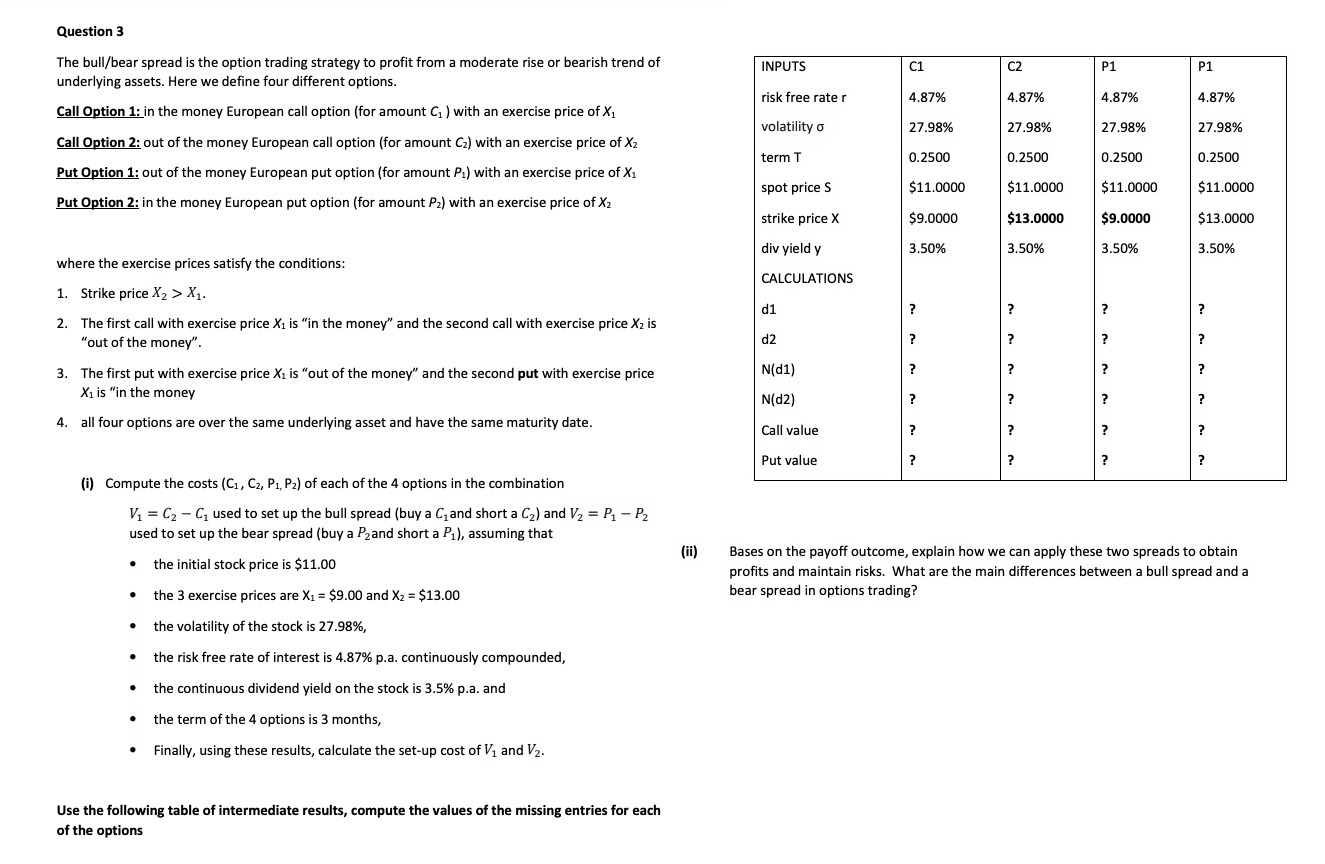

Question 3 The bull/bear spread is the option trading strategy to profit from a moderate rise or bearish trend of underlying assets. Here we define four different options. Call Option 1: in the money European call option (for amount C1 ) with an exercise price of X1 Call Option 2: out of the money European call option (for amount C2 ) with an exercise price of X2 Put Option 1: out of the money European put option (for amount P1 ) with an exercise price of X1 Put Option 2: in the money European put option (for amount P2 ) with an exercise price of X2 where the exercise prices satisfy the conditions: 1. Strike price X2>X1. 2. The first call with exercise price X1 is "in the money" and the second call with exercise price X2 is "out of the money". 3. The first put with exercise price X1 is "out of the money" and the second put with exercise price X1 is "in the money 4. all four options are over the same underlying asset and have the same maturity date. (i) Compute the costs (C1,C2,P1,P2) of each of the 4 options in the combination V1=C2C1 used to set up the bull spread (buy a C1 and short a C2 ) and V2=P1P2 used to set up the bear spread (buy a P2 and short a P1 ), assuming that - the initial stock price is $11.00 - the 3 exercise prices are X1=$9.00 and X2=$13.00 - the volatility of the stock is 27.98%, - the risk free rate of interest is 4.87% p.a. continuously compounded, - the continuous dividend yield on the stock is 3.5% p.a. and - the term of the 4 options is 3 months, - Finally, using these results, calculate the set-up cost of V1 and V2. (ii) Bases on the payoff outcome, explain how we can apply these two spreads to obtain profits and maintain risks. What are the main differences between a bull spread and a bear spread in options trading? Use the following table of intermediate results, compute the values of the missing entries for each of the options Question 3 The bull/bear spread is the option trading strategy to profit from a moderate rise or bearish trend of underlying assets. Here we define four different options. Call Option 1: in the money European call option (for amount C1 ) with an exercise price of X1 Call Option 2: out of the money European call option (for amount C2 ) with an exercise price of X2 Put Option 1: out of the money European put option (for amount P1 ) with an exercise price of X1 Put Option 2: in the money European put option (for amount P2 ) with an exercise price of X2 where the exercise prices satisfy the conditions: 1. Strike price X2>X1. 2. The first call with exercise price X1 is "in the money" and the second call with exercise price X2 is "out of the money". 3. The first put with exercise price X1 is "out of the money" and the second put with exercise price X1 is "in the money 4. all four options are over the same underlying asset and have the same maturity date. (i) Compute the costs (C1,C2,P1,P2) of each of the 4 options in the combination V1=C2C1 used to set up the bull spread (buy a C1 and short a C2 ) and V2=P1P2 used to set up the bear spread (buy a P2 and short a P1 ), assuming that - the initial stock price is $11.00 - the 3 exercise prices are X1=$9.00 and X2=$13.00 - the volatility of the stock is 27.98%, - the risk free rate of interest is 4.87% p.a. continuously compounded, - the continuous dividend yield on the stock is 3.5% p.a. and - the term of the 4 options is 3 months, - Finally, using these results, calculate the set-up cost of V1 and V2. (ii) Bases on the payoff outcome, explain how we can apply these two spreads to obtain profits and maintain risks. What are the main differences between a bull spread and a bear spread in options trading? Use the following table of intermediate results, compute the values of the missing entries for each of the options

Question 3 The bull/bear spread is the option trading strategy to profit from a moderate rise or bearish trend of underlying assets. Here we define four different options. Call Option 1: in the money European call option (for amount C1 ) with an exercise price of X1 Call Option 2: out of the money European call option (for amount C2 ) with an exercise price of X2 Put Option 1: out of the money European put option (for amount P1 ) with an exercise price of X1 Put Option 2: in the money European put option (for amount P2 ) with an exercise price of X2 where the exercise prices satisfy the conditions: 1. Strike price X2>X1. 2. The first call with exercise price X1 is "in the money" and the second call with exercise price X2 is "out of the money". 3. The first put with exercise price X1 is "out of the money" and the second put with exercise price X1 is "in the money 4. all four options are over the same underlying asset and have the same maturity date. (i) Compute the costs (C1,C2,P1,P2) of each of the 4 options in the combination V1=C2C1 used to set up the bull spread (buy a C1 and short a C2 ) and V2=P1P2 used to set up the bear spread (buy a P2 and short a P1 ), assuming that - the initial stock price is $11.00 - the 3 exercise prices are X1=$9.00 and X2=$13.00 - the volatility of the stock is 27.98%, - the risk free rate of interest is 4.87% p.a. continuously compounded, - the continuous dividend yield on the stock is 3.5% p.a. and - the term of the 4 options is 3 months, - Finally, using these results, calculate the set-up cost of V1 and V2. (ii) Bases on the payoff outcome, explain how we can apply these two spreads to obtain profits and maintain risks. What are the main differences between a bull spread and a bear spread in options trading? Use the following table of intermediate results, compute the values of the missing entries for each of the options Question 3 The bull/bear spread is the option trading strategy to profit from a moderate rise or bearish trend of underlying assets. Here we define four different options. Call Option 1: in the money European call option (for amount C1 ) with an exercise price of X1 Call Option 2: out of the money European call option (for amount C2 ) with an exercise price of X2 Put Option 1: out of the money European put option (for amount P1 ) with an exercise price of X1 Put Option 2: in the money European put option (for amount P2 ) with an exercise price of X2 where the exercise prices satisfy the conditions: 1. Strike price X2>X1. 2. The first call with exercise price X1 is "in the money" and the second call with exercise price X2 is "out of the money". 3. The first put with exercise price X1 is "out of the money" and the second put with exercise price X1 is "in the money 4. all four options are over the same underlying asset and have the same maturity date. (i) Compute the costs (C1,C2,P1,P2) of each of the 4 options in the combination V1=C2C1 used to set up the bull spread (buy a C1 and short a C2 ) and V2=P1P2 used to set up the bear spread (buy a P2 and short a P1 ), assuming that - the initial stock price is $11.00 - the 3 exercise prices are X1=$9.00 and X2=$13.00 - the volatility of the stock is 27.98%, - the risk free rate of interest is 4.87% p.a. continuously compounded, - the continuous dividend yield on the stock is 3.5% p.a. and - the term of the 4 options is 3 months, - Finally, using these results, calculate the set-up cost of V1 and V2. (ii) Bases on the payoff outcome, explain how we can apply these two spreads to obtain profits and maintain risks. What are the main differences between a bull spread and a bear spread in options trading? Use the following table of intermediate results, compute the values of the missing entries for each of the options Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started