Answered step by step

Verified Expert Solution

Question

1 Approved Answer

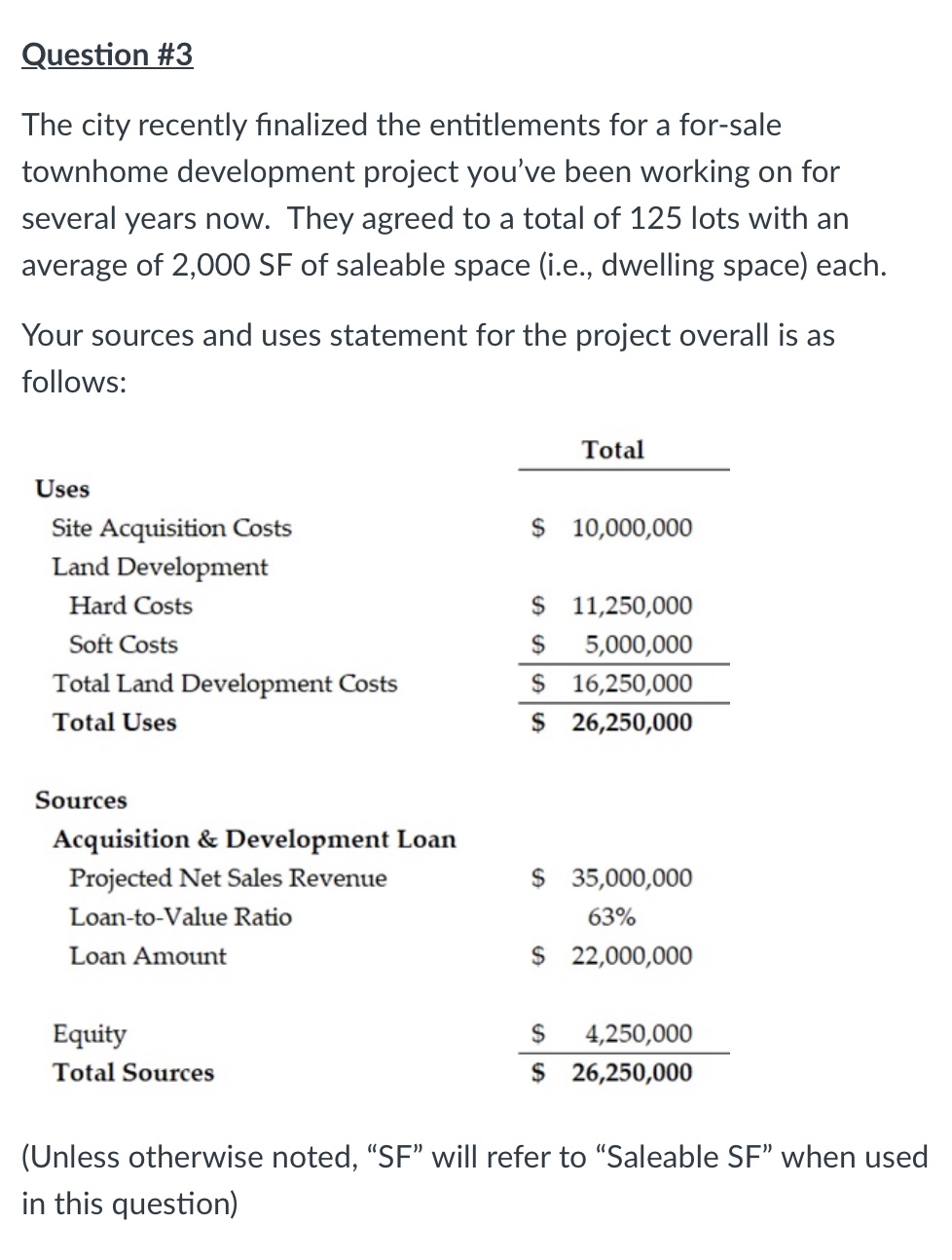

Question # 3 The city recently finalized the entitlements for a for - sale townhome development project you've been working on for several years now.

Question #

The city recently finalized the entitlements for a forsale

townhome development project you've been working on for

several years now. They agreed to a total of lots with an

average of of saleable space ie dwelling space each.

Your sources and uses statement for the project overall is as

follows:

Unless otherwise noted, SF will refer to "Saleable SF when used

in this question

Qa What is your projected sale price per SF

Group of answer choices

$

$

$

$

Qb As an opening gambit in your negotiations, you propose a pro rata release price structure to your lender.

If they accepted, what would the release price be per SF

Group of answer choices

$

$

$

$

QcAfter picking themselves off the ground and wiping away their tears of laughter, your lender informs you that they were thinking of requiring paydowns equal to of net sale proceeds.

What release price per square foot is your lender requesting?

Group of answer choices

$

$

$

$

Qe What is the lenders release percentage under their proposed release price structure rounded to the nearest percent

Group of answer choices

Qf With few other options, you begrudgingly agree to the lenders request.

And thats when they casually mention that they also require a minimum release price by applying a x multiple on the pro rata debt for each parcel being sold.

What minimum release price per SF would this second approach necessitate?

Group of answer choices

$

$

$

$

QgWhat would the release percentage be based solely on the minimum release price in Qfrounded to the nearest percent

Group of answer choices

Qi Briefly explain the rationale behind using both of the two accelerated release price methods from a lenders perspective What is the lender looking for from each?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started