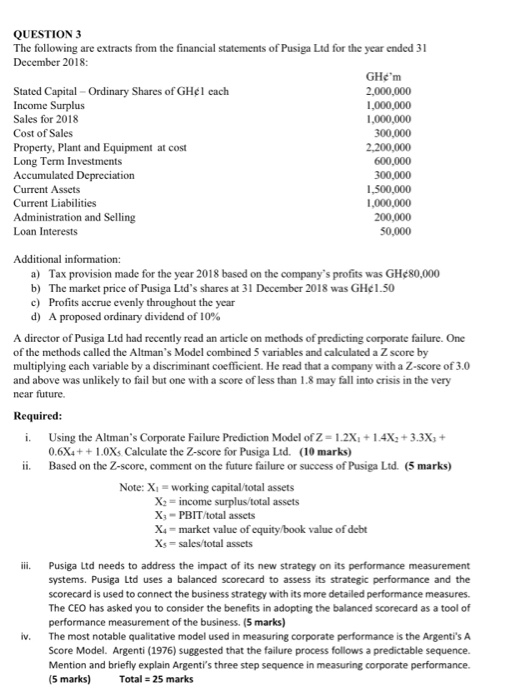

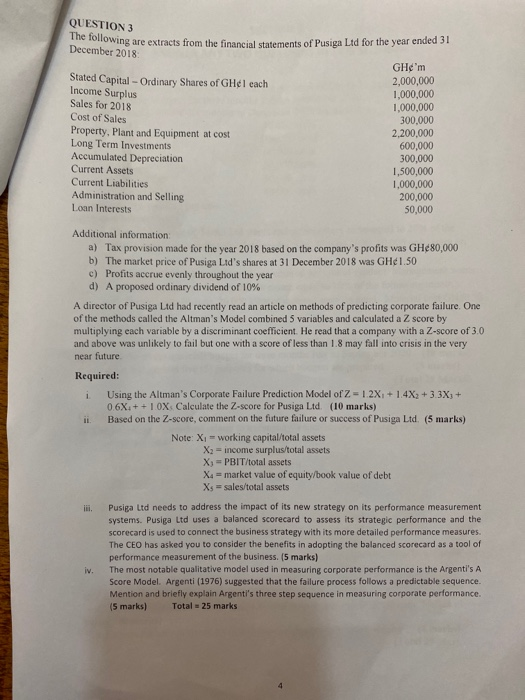

QUESTION 3 The following are extracts from the financial statements of Pusiga Lad for the year ended 31 December 2018 GHe'm Stated Capital - Ordinary Shares of GHl each 2,000,000 Income Surplus 1,000,000 Sales for 2018 1,000,000 Cost of Sales 300,000 Property, Plant and Equipment at cost 2,200,000 Long Term Investments 600,000 Accumulated Depreciation 300,000 Current Assets 1,500,000 Current Liabilities 1,000,000 Administration and Selling 200,000 Loan Interests 50,000 Additional information: a) Tax provision made for the year 2018 based on the company's profits was GH80,000 b) The market price of Pusiga Ltd's shares at 31 December 2018 was GH1.50 c) Profits accrue evenly throughout the year d) A proposed ordinary dividend of 10% A director of Pusiga Ltd had recently read an article on methods of predicting corporate failure. One of the methods called the Altman's Model combined 5 variables and calculated a Z score by multiplying each variable by a discriminant coefficient. He read that a company with a 2-score of 3.0 and above was unlikely to fail but one with a score of less than 1.8 may fall into crisis in the very near future Required: i. Using the Altman's Corporate Failure Prediction Model of Z=1.2X, + 1.4X2 + 3.3X+ 0.6X. + +1.0Xs Calculate the Z-score for Pusiga Ltd. (10 marks) ii. Based on the Z-score, comment on the future failure or success of Pusiga Ltd. (5 marks) Note: X = working capital/total assets X2 = income surplus/total assets X: - PBIT/total assets X4 - market value of equity/book value of debt Xs = sales/total assets Pusiga Ltd needs to address the impact of its new strategy on its performance measurement systems. Pusiga Ltd uses a balanced Scorecard to assess its strategic performance and the scorecard is used to connect the business strategy with its more detailed performance measures. The CEO has asked you to consider the benefits in adopting the balanced Scorecard as a tool of performance measurement of the business. (5 marks) The most notable qualitative model used in measuring corporate performance is the Argenti's A Score Model. Argenti (1976) suggested that the failure process follows a predictable sequence. Mention and briefly explain Argenti's three step sequence in measuring corporate performance. (5 marks) Total = 25 marks iii. iv. QUESTION 3 The following are extracts from the financial statements of Pusiga Ltd for the year ended 31 December 2018 Stated Capital - Ordinary Shares of GHI each Income Surplus Sales for 2018 Cost of Sales Property, Plant and Equipment at cost Long Term Investments Accumulated Depreciation Current Assets Current Liabilities Administration and Selling Loan Interests GHe'm 2,000,000 1,000,000 1,000,000 300,000 2,200,000 600,000 300,000 1,500,000 1,000,000 200,000 50,000 Additional information: a) Tax provision made for the year 2018 based on the company's profits was GH80,000 b) The market price of Pusiga Lid's shares at 31 December 2018 was GH1.50 c) Profits accrue evenly throughout the year d) A proposed ordinary dividend of 10% A director of Pusiga Led had recently read an article on methods of predicting corporate failure. One of the methods called the Altman's Model combined variables and calculated a Z score by multiplying each variable by a discriminant coefficient. He read that a company with a Z-score of 3.0 and above was unlikely to fail but one with a score of less than 1.8 may fall into crisis in the very near future Required: i Using the Altman's Corporate Failure Prediction Model of Z = 12X, + 1.4X: +3.3X: + 0.6X: ++ 1.0X Calculate the Z-score for Pusiga Ltd. (10 marks) Based on the Z-score, comment on the future failure or success of Pusiga Ltd. (5 marks) Note: Xi = working capital/total assets X2 = income surplus/total assets X; = PBIT/total assets X4 = market value of equity/book value of debt Xs = sales/total assets Pusiga Ltd needs to address the impact of its new strategy on its performance measurement systems. Pusiga Ltd uses a balanced Scorecard to assess its strategic performance and the scorecard is used to connect the business strategy with its more detailed performance measures. The CEO has asked you to consider the benefits in adopting the balanced Scorecard as a tool of performance measurement of the business. (5 marks) iv. The most notable qualitative model used in measuring corporate performance is the Argenti's A Score Model. Argenti (1976) suggested that the failure process follows a predictable sequence. Mention and briefly explain Argenti's three step sequence in measuring corporate performance. (5 marks) Total = 25 marks