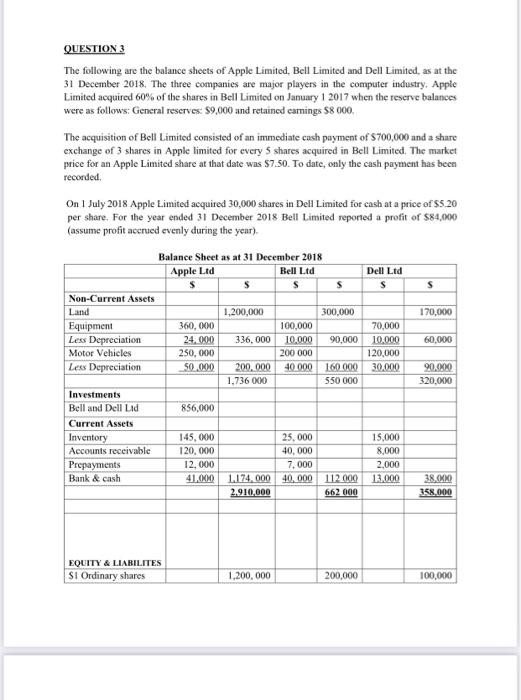

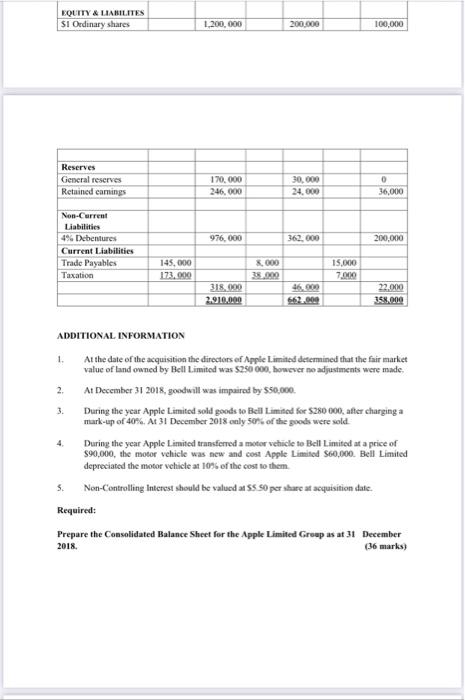

QUESTION 3 The following are the balance sheets of Apple Limited, Bell Limited and Dell Limited, as at the 31 December 2018. The three companies are major players in the computer industry. Apple Limited acquired 60% of the shares in Bell Limited on January 1 2017 when the reserve balances were as follows: General reserves: 89,000 and retained carings $8000, The acquisition of Bell Limited consisted of an immediate cash payment of S700,000 and a share exchange of 3 shares in Apple limited for every 5 shares acquired in Bell Limited. The market price for an Apple Limited share at that date was $7.50. To date, only the cash payment has been recorded On 1 July 2018 Apple Limited acquired 30,000 shares in Dell Limited for cash at a price of 5.20 per share. For the year ended 31 December 2018 Bell Limited reported a profit of $84,000 (assume profit accrued evenly during the year). Dell Ltd s s 170,000 60.000 70,000 10,000 120,000 30,000 Balance Sheet as at 31 December 2018 Apple Ltd Bell Ltd $ $ S s Non-Current Assets Land 1,200,000 300,000 Equipment 360,000 100,000 Less Depreciation 24.000 336,000 10,000 90,000 Motor Vehicles 250,000 200 000 Less Depreciation 50.000 200.000 40 000 160 000 1,736 000 550 000 Investments Bell and Dell Lid 856,000 Current Assets Inventory 145,000 25,000 Accounts receivable 120,000 40,000 Prepayments 12,000 7.000 Bank & cash 41,000 1.174.000 40.000 112 000 2.910.000 662 000 90.000 320,000 15,000 8,000 2.000 13.000 3800 358.000 EQUITY & LIABILITES Si Ordinary shares 1,200,000 200,000 100,000 EQUITY & LIABILITES S1 Ordinary shares 1.200,000 200.000 100,000 Reserves Gencral reserves Retained earrings 170,000 246.000 30,000 24.000 0 36,000 976,000 362.000 200,000 Non-Current Liabilities 496 Debentures Current Liabilities Trade Payables Taxation 15.000 145.000 173.000 7.000 &.000 38.000 318.000 46000 2.910.000 66.00 22.000 38.000 ADDITIONAL INFORMATION 1. At the date of the acquisition the directors of Apple Limited determined that the fair market value of land owned by Bell Limited was $250 000, however no adjustments were made. 2. At December 31 2018, goodwill was impaired by $50,000. During the year Apple Limited sold goods to Bell Limited for S280 000 after charging a mark-up of 40%. At 31 December 2018 only sers of the goods were sold During the year Apple Limited transferred a motor vehicle to Bell Limited at a price of $90,000, the motor vehicle was new and cost Apple Limited $60,000. Bell Limited depreciated the motor vehicle at 10% of the cost to them 5. Non-Controlling Interest should be valued at 55.50 per share at acquisition date. Required: Prepare the Consolidated Balance Sheet for the Apple Limited Group as at 31 December 2018 (36 marks) 4 QUESTION 3 The following are the balance sheets of Apple Limited, Bell Limited and Dell Limited, as at the 31 December 2018. The three companies are major players in the computer industry. Apple Limited acquired 60% of the shares in Bell Limited on January 1 2017 when the reserve balances were as follows: General reserves: 89,000 and retained carings $8000, The acquisition of Bell Limited consisted of an immediate cash payment of S700,000 and a share exchange of 3 shares in Apple limited for every 5 shares acquired in Bell Limited. The market price for an Apple Limited share at that date was $7.50. To date, only the cash payment has been recorded On 1 July 2018 Apple Limited acquired 30,000 shares in Dell Limited for cash at a price of 5.20 per share. For the year ended 31 December 2018 Bell Limited reported a profit of $84,000 (assume profit accrued evenly during the year). Dell Ltd s s 170,000 60.000 70,000 10,000 120,000 30,000 Balance Sheet as at 31 December 2018 Apple Ltd Bell Ltd $ $ S s Non-Current Assets Land 1,200,000 300,000 Equipment 360,000 100,000 Less Depreciation 24.000 336,000 10,000 90,000 Motor Vehicles 250,000 200 000 Less Depreciation 50.000 200.000 40 000 160 000 1,736 000 550 000 Investments Bell and Dell Lid 856,000 Current Assets Inventory 145,000 25,000 Accounts receivable 120,000 40,000 Prepayments 12,000 7.000 Bank & cash 41,000 1.174.000 40.000 112 000 2.910.000 662 000 90.000 320,000 15,000 8,000 2.000 13.000 3800 358.000 EQUITY & LIABILITES Si Ordinary shares 1,200,000 200,000 100,000 EQUITY & LIABILITES S1 Ordinary shares 1.200,000 200.000 100,000 Reserves Gencral reserves Retained earrings 170,000 246.000 30,000 24.000 0 36,000 976,000 362.000 200,000 Non-Current Liabilities 496 Debentures Current Liabilities Trade Payables Taxation 15.000 145.000 173.000 7.000 &.000 38.000 318.000 46000 2.910.000 66.00 22.000 38.000 ADDITIONAL INFORMATION 1. At the date of the acquisition the directors of Apple Limited determined that the fair market value of land owned by Bell Limited was $250 000, however no adjustments were made. 2. At December 31 2018, goodwill was impaired by $50,000. During the year Apple Limited sold goods to Bell Limited for S280 000 after charging a mark-up of 40%. At 31 December 2018 only sers of the goods were sold During the year Apple Limited transferred a motor vehicle to Bell Limited at a price of $90,000, the motor vehicle was new and cost Apple Limited $60,000. Bell Limited depreciated the motor vehicle at 10% of the cost to them 5. Non-Controlling Interest should be valued at 55.50 per share at acquisition date. Required: Prepare the Consolidated Balance Sheet for the Apple Limited Group as at 31 December 2018 (36 marks) 4