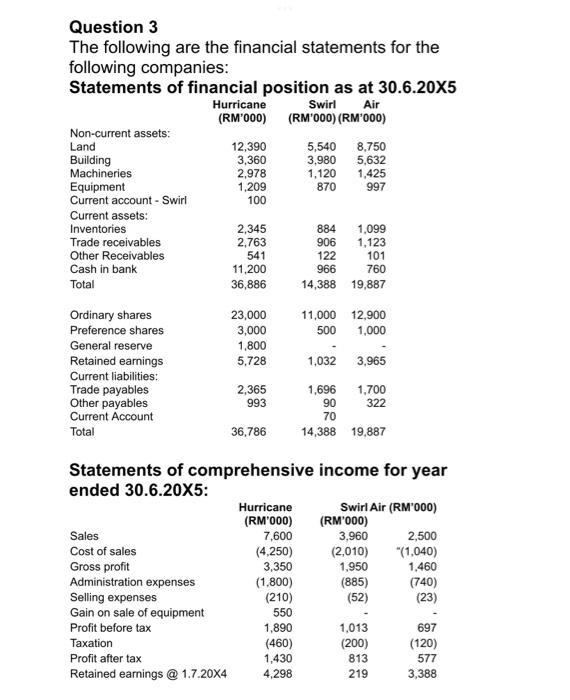

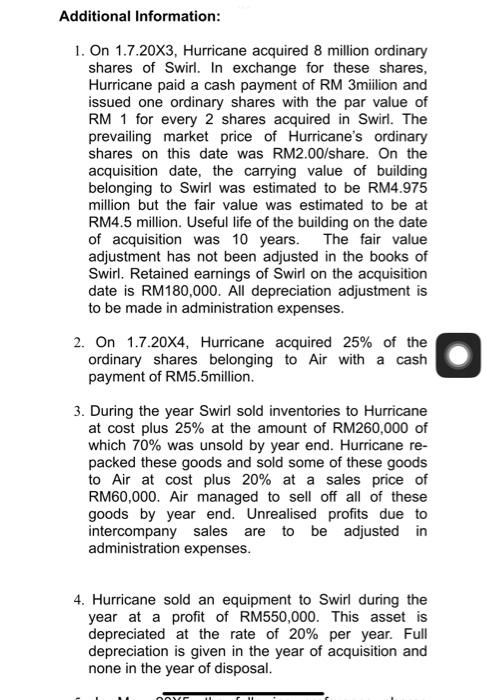

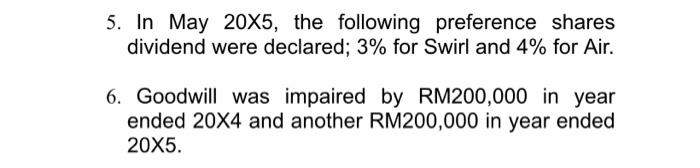

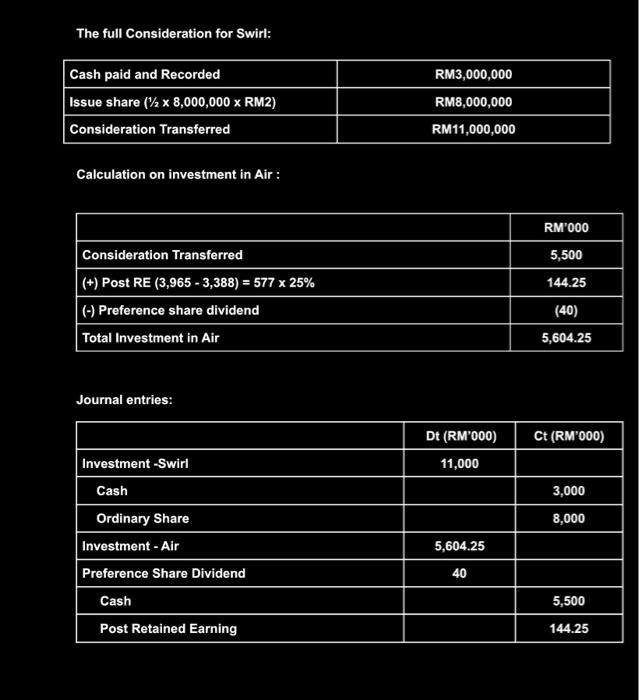

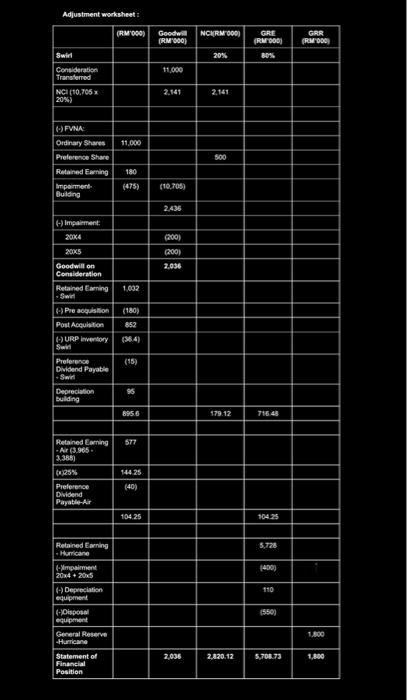

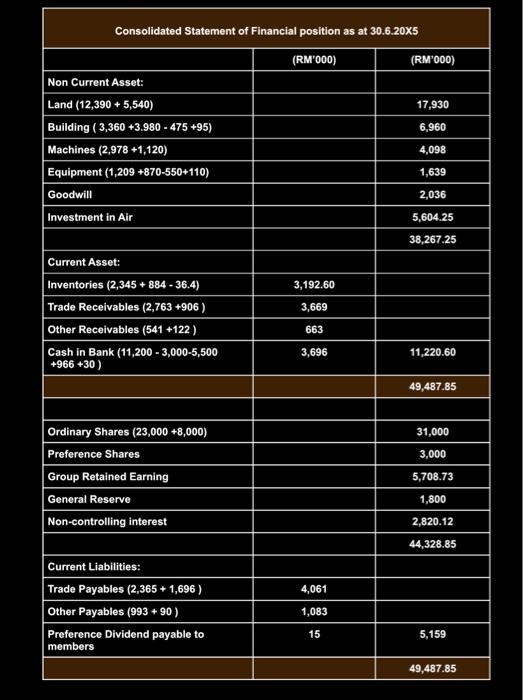

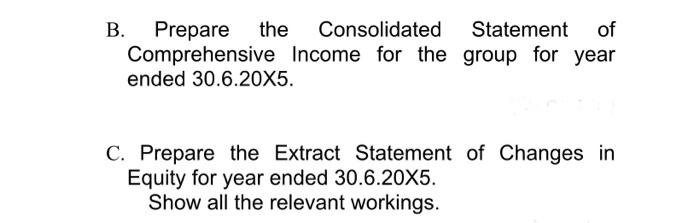

Question 3 The following are the financial statements for the following companies: Statements of comprehensive income for year ended 30.6.205 : Additional Information: 1. On 1.7.20X3, Hurricane acquired 8 million ordinary shares of Swirl. In exchange for these shares, Hurricane paid a cash payment of RM 3milion and issued one ordinary shares with the par value of RM 1 for every 2 shares acquired in Swirl. The prevailing market price of Hurricane's ordinary shares on this date was RM2.00/share. On the acquisition date, the carrying value of building belonging to Swirl was estimated to be RM4.975 million but the fair value was estimated to be at RM4.5 million. Useful life of the building on the date of acquisition was 10 years. The fair value adjustment has not been adjusted in the books of Swirl. Retained earnings of Swirl on the acquisition date is RM180,000. All depreciation adjustment is to be made in administration expenses. 2. On 1.7.20X4, Hurricane acquired 25% of the ordinary shares belonging to Air with a cash payment of RM5.5million. 3. During the year Swirl sold inventories to Hurricane at cost plus 25% at the amount of RM260,000 of which 70% was unsold by year end. Hurricane repacked these goods and sold some of these goods to Air at cost plus 20% at a sales price of RM60,000. Air managed to sell off all of these goods by year end. Unrealised profits due to intercompany sales are to be adjusted in administration expenses. 4. Hurricane sold an equipment to Swirl during the year at a profit of RM550,000. This asset is depreciated at the rate of 20% per year. Full depreciation is given in the year of acquisition and none in the year of disposal. 5. In May 205, the following preference shares dividend were declared; 3% for Swirl and 4% for Air. 6. Goodwill was impaired by RM200,000 in year ended 20X4 and another RM200,000 in year ended 205. A. Prepare the Consolidated Statement of Financial position as at 30.6.20X5. Calculation unrealized profit : Calculation Dividends and interest receivable by H from S : The full Consideration for Swirl: \begin{tabular}{|l|c|} \hline Cash paid and Recorded & RM3,000,000 \\ \hline Issue share (1/28,000,000 RM2) & RM8,000,000 \\ \hline Consideration Transferred & RM11,000,000 \\ \hline \end{tabular} Calculation on investment in Air : \begin{tabular}{|l|c|} \hline & RM'000 \\ \hline Consideration Transferred & 5,500 \\ \hline(+) Post RE (3,9653,388)=57725% & 144.25 \\ \hline (-) Preference share dividend & (40) \\ \hline Total Investment in Air & 5,604.25 \\ \hline \end{tabular} Journal entries: \begin{tabular}{|c|c|c|} \hline & Dt (RM'000) & Ct (RM'000) \\ \hline Investment -Swirl & 11,000 & \\ \hline Cash & & 3,000 \\ \hline Ordinary Share & & 8,000 \\ \hline Investment - Air & 5,604.25 & \\ \hline Preference Share Dividend & & \\ \hline Cash & & 50 \\ \hline Post Retained Earning & & 144.25 \\ \hline \end{tabular} B. Prepare the Consolidated Statement of Comprehensive Income for the group for year ended 30.6.20X5. C. Prepare the Extract Statement of Changes in Equity for year ended 30.6.20X5. Show all the relevant workings. Question 3 The following are the financial statements for the following companies: Statements of comprehensive income for year ended 30.6.205 : Additional Information: 1. On 1.7.20X3, Hurricane acquired 8 million ordinary shares of Swirl. In exchange for these shares, Hurricane paid a cash payment of RM 3milion and issued one ordinary shares with the par value of RM 1 for every 2 shares acquired in Swirl. The prevailing market price of Hurricane's ordinary shares on this date was RM2.00/share. On the acquisition date, the carrying value of building belonging to Swirl was estimated to be RM4.975 million but the fair value was estimated to be at RM4.5 million. Useful life of the building on the date of acquisition was 10 years. The fair value adjustment has not been adjusted in the books of Swirl. Retained earnings of Swirl on the acquisition date is RM180,000. All depreciation adjustment is to be made in administration expenses. 2. On 1.7.20X4, Hurricane acquired 25% of the ordinary shares belonging to Air with a cash payment of RM5.5million. 3. During the year Swirl sold inventories to Hurricane at cost plus 25% at the amount of RM260,000 of which 70% was unsold by year end. Hurricane repacked these goods and sold some of these goods to Air at cost plus 20% at a sales price of RM60,000. Air managed to sell off all of these goods by year end. Unrealised profits due to intercompany sales are to be adjusted in administration expenses. 4. Hurricane sold an equipment to Swirl during the year at a profit of RM550,000. This asset is depreciated at the rate of 20% per year. Full depreciation is given in the year of acquisition and none in the year of disposal. 5. In May 205, the following preference shares dividend were declared; 3% for Swirl and 4% for Air. 6. Goodwill was impaired by RM200,000 in year ended 20X4 and another RM200,000 in year ended 205. A. Prepare the Consolidated Statement of Financial position as at 30.6.20X5. Calculation unrealized profit : Calculation Dividends and interest receivable by H from S : The full Consideration for Swirl: \begin{tabular}{|l|c|} \hline Cash paid and Recorded & RM3,000,000 \\ \hline Issue share (1/28,000,000 RM2) & RM8,000,000 \\ \hline Consideration Transferred & RM11,000,000 \\ \hline \end{tabular} Calculation on investment in Air : \begin{tabular}{|l|c|} \hline & RM'000 \\ \hline Consideration Transferred & 5,500 \\ \hline(+) Post RE (3,9653,388)=57725% & 144.25 \\ \hline (-) Preference share dividend & (40) \\ \hline Total Investment in Air & 5,604.25 \\ \hline \end{tabular} Journal entries: \begin{tabular}{|c|c|c|} \hline & Dt (RM'000) & Ct (RM'000) \\ \hline Investment -Swirl & 11,000 & \\ \hline Cash & & 3,000 \\ \hline Ordinary Share & & 8,000 \\ \hline Investment - Air & 5,604.25 & \\ \hline Preference Share Dividend & & \\ \hline Cash & & 50 \\ \hline Post Retained Earning & & 144.25 \\ \hline \end{tabular} B. Prepare the Consolidated Statement of Comprehensive Income for the group for year ended 30.6.20X5. C. Prepare the Extract Statement of Changes in Equity for year ended 30.6.20X5. Show all the relevant workings