Question

Question 3 The following balances were taken from the book of Syringe Berhad on 31 December 2020: Additional information: Inventory amounting to RM2,000 was damaged

Question 3

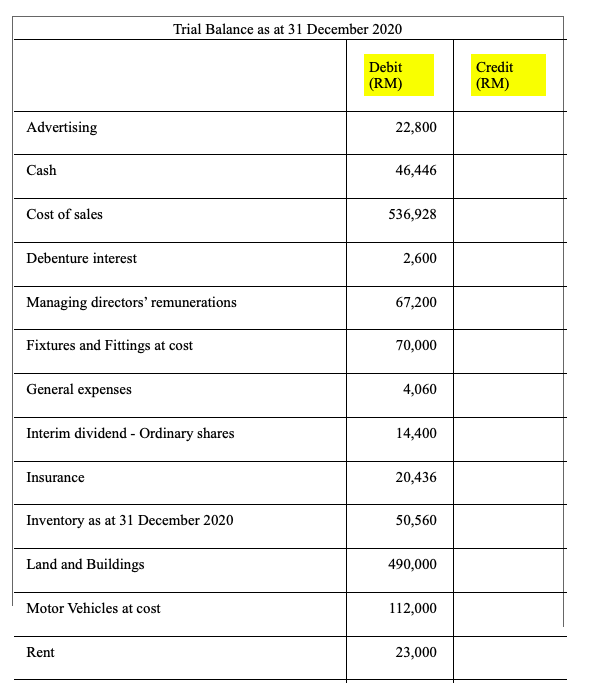

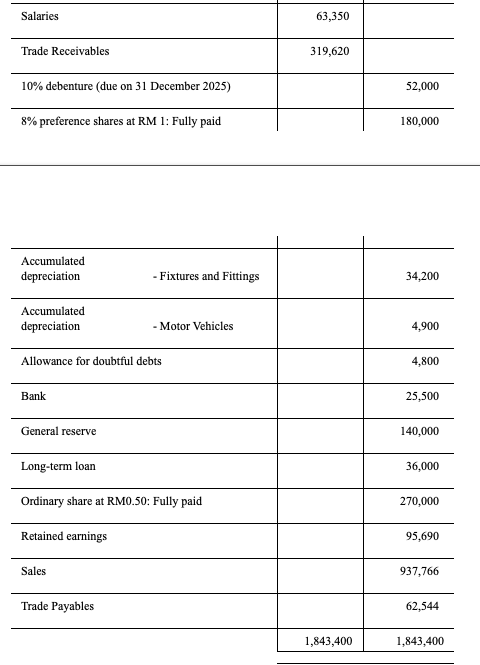

The following balances were taken from the book of Syringe Berhad on 31 December 2020:

Additional information:

- Inventory amounting to RM2,000 was damaged due to fire accident. The remaining inventories as at 31 December 2020 was valued at RM 46,000 at net realizable value.

- RM2,000 has been paid in advance for rent as at 31 December 2020.

- Allowance for doubtful debts has been reduced by RM1,000

- General expense, insurance expense, rent expense and salaries expense are shared between selling & distribution and general & administrative cost in the ratio of 40% and 60% each respectively.

- Land & building above is represented by land RM240,000 and building - RM250,000. Land & building and fixtures and fittings are shared between selling & distribution and general & administrative cost in the ratio of 50% and 50% each respectively whereas motor vehicle is shared between selling & distribution and general & administrative cost in the ratio of 80% and 20% each respectively. Depreciation for non-current assets to be provided as follows: Motor vehicles - 20% on cost, Fixtures and fittings - 30% on cost and building 10% on cost.

- On 31 December 2020, the land was revalued to RM300,000. The directors decided that this revaluation must be incorporated int the final accounts.

- The board of directors proposed:

-

- A dividend of RM0.10 per share to be paid on the ordinary shares and preference shares.

-

- Corporate tax is 25% and

- To transfer RM2,000 from retained earnings to the general reserve.

In in accordance with MFRS101(IAS 1) Presentation of financial statements, required:

a. Prepare notes to account for cost of sales, selling & distribution cost, general & administrative cost, finance cost and property plant and equipment.

b. Prepare Statement of comprehensive income for the year ended 31 December 2020.

c. Prepare Statement of changes in equity for the year ended 31 December 2020.

d. Prepare Statement of financial position as at 31 December 2020.

Trial Balance as at 31 December 2020 Debit (RM) Credit (RM) Advertising 22,800 Cash 46,446 Cost of sales 536,928 Debenture interest 2,600 Managing directors' remunerations 67,200 Fixtures and Fittings at cost 70,000 General expenses 4,060 Interim dividend - Ordinary shares 14,400 Insurance 20,436 Inventory as at 31 December 2020 50,560 Land and Buildings 490,000 Motor Vehicles at cost 112,000 Rent 23,000 Salaries 63,350 Trade Receivables 319,620 10% debenture (due on 31 December 2025) 52,000 8% preference shares at RM 1: Fully paid 180,000 Accumulated depreciation - Fixtures and Fittings 34,200 Accumulated depreciation -Motor Vehicles 4,900 Allowance for doubtful debts 4,800 Bank 25,500 General reserve 140,000 Long-term loan 36,000 Ordinary share at RM0.50: Fully paid 270,000 Retained earnings 95,690 Sales 937,766 Trade Payables 62,544 1,843,400 1,843,400 Trial Balance as at 31 December 2020 Debit (RM) Credit (RM) Advertising 22,800 Cash 46,446 Cost of sales 536,928 Debenture interest 2,600 Managing directors' remunerations 67,200 Fixtures and Fittings at cost 70,000 General expenses 4,060 Interim dividend - Ordinary shares 14,400 Insurance 20,436 Inventory as at 31 December 2020 50,560 Land and Buildings 490,000 Motor Vehicles at cost 112,000 Rent 23,000 Salaries 63,350 Trade Receivables 319,620 10% debenture (due on 31 December 2025) 52,000 8% preference shares at RM 1: Fully paid 180,000 Accumulated depreciation - Fixtures and Fittings 34,200 Accumulated depreciation -Motor Vehicles 4,900 Allowance for doubtful debts 4,800 Bank 25,500 General reserve 140,000 Long-term loan 36,000 Ordinary share at RM0.50: Fully paid 270,000 Retained earnings 95,690 Sales 937,766 Trade Payables 62,544 1,843,400 1,843,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started