Question 3

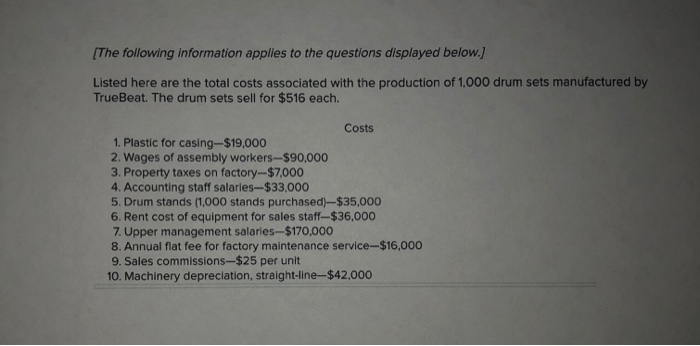

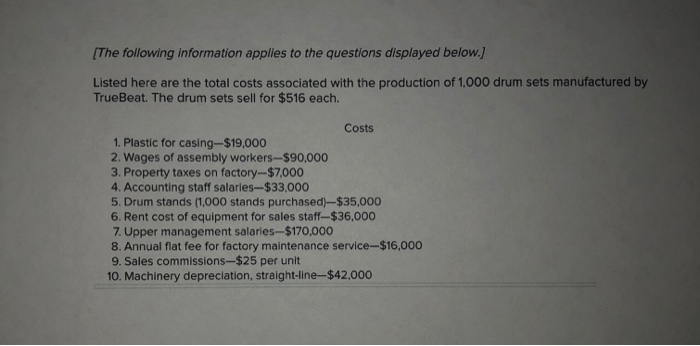

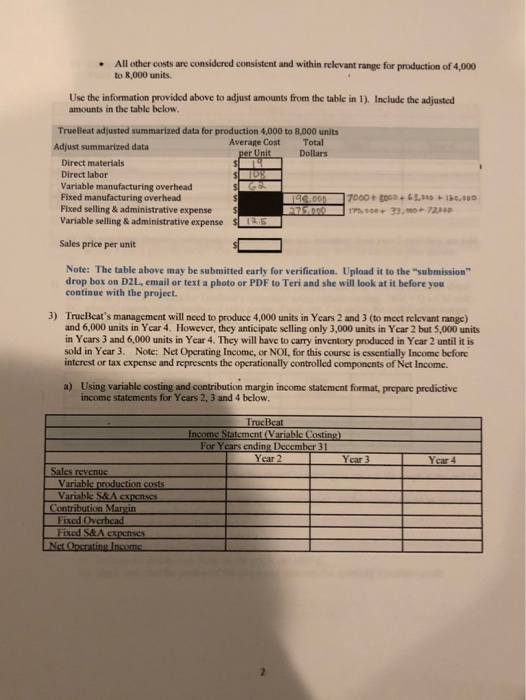

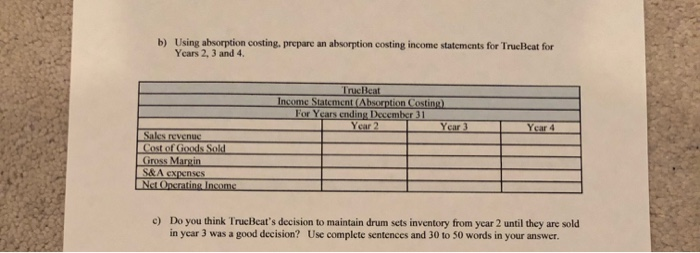

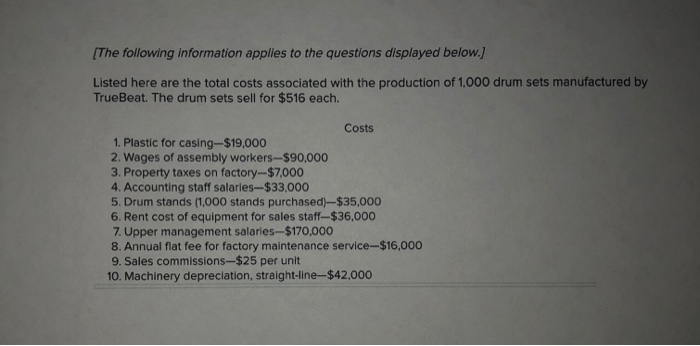

(The following information applies to the questions displayed below.) Listed here are the total costs associated with the production of 1.000 drum sets manufactured by True Beat. The drum sets sell for $516 each. Costs 1. Plastic for casing-$19,000 2. Wages of assembly workers-$90,000 3. Property taxes on factory-$7.000 4. Accounting staff salaries-$33,000 5. Drum stands (1,000 stands purchased)-$35,000 6. Rent cost of equipment for sales staff-$36,000 7. Upper management salaries 10,000 8. Annual flat fee for factory maintenance service-$16,000 9. Sales commissions-$25 per unit 10. Machinery depreciation, straight-line--$42.000 All other costs are considered consistent and within relevant range for production of 4,000 to 8,000 units. Use the information provided above to adjust amounts from the table in 1). Include the adjusted amounts in the table below. TrueBeat adjusted summarized data for production 4,000 to 8,000 units Adjust summarized data Average Cost Total per Unit Dollars Direct materials 19 Direct labor T08 Variable manufacturing overhead Fixed manufacturing overhead 199.000 7000 + 3000 63,01 0,00 Fixed selling & administrative expense 77510 170,000 33.00 72.00 Variable selling & administrative expense $15 Sales price per unit $ Note: The table above may be submitted early for verification. Upload it to the "submission drop box on D2, email or text a photo or PDF to Teri and she will look at it before you continue with the project. 3) TrucBeat's management will need to produce 4,000 units in Years 2 and 3 (to meet relevant range) and 6,000 units in Year 4. However, they anticipate selling only 3,000 units in Year 2 but 5,000 units in Ycars 3 and 6,000 units in Year 4. They will have to carry inventory produced in Year 2 until it is sold in Year 3. Note: Net Operating Income, or NOI, for this course is essentially Income before interest or tax expense and represents the operationally controlled components of Net Income. a) Using variable costing and contribution margin income statement format, prepare predictive income statements for Years 2, 3 and 4 below. TrueBeat Income Statement (Variable Costing) For Years ending December 31 Year 2 Year 3 Year 4 Sales revenue Variable production costs Variable S&A expenses Contribution Margin Fixed Overhead Fixed S&A expenses Not Onting Income b) Using absorption costing, prepare an absorption costing income statements for TrueBeat for Years 2, 3 and 4. TrueBeat Income Statement(Absorption Costing) For Years ending December 31 Year 2 Year) Year 4 Sales revenus Cost of Goods Sold Gross Margin S&A expenses NetOncrating Income c) Do you think TrueBeat's decision to maintain drum sets inventory from year 2 until they are sold in year 3 was a good decision? Use complete sentences and 30 to 50 words in your answer. (The following information applies to the questions displayed below.) Listed here are the total costs associated with the production of 1.000 drum sets manufactured by True Beat. The drum sets sell for $516 each. Costs 1. Plastic for casing-$19,000 2. Wages of assembly workers-$90,000 3. Property taxes on factory-$7.000 4. Accounting staff salaries-$33,000 5. Drum stands (1,000 stands purchased)-$35,000 6. Rent cost of equipment for sales staff-$36,000 7. Upper management salaries 10,000 8. Annual flat fee for factory maintenance service-$16,000 9. Sales commissions-$25 per unit 10. Machinery depreciation, straight-line--$42.000 All other costs are considered consistent and within relevant range for production of 4,000 to 8,000 units. Use the information provided above to adjust amounts from the table in 1). Include the adjusted amounts in the table below. TrueBeat adjusted summarized data for production 4,000 to 8,000 units Adjust summarized data Average Cost Total per Unit Dollars Direct materials 19 Direct labor T08 Variable manufacturing overhead Fixed manufacturing overhead 199.000 7000 + 3000 63,01 0,00 Fixed selling & administrative expense 77510 170,000 33.00 72.00 Variable selling & administrative expense $15 Sales price per unit $ Note: The table above may be submitted early for verification. Upload it to the "submission drop box on D2, email or text a photo or PDF to Teri and she will look at it before you continue with the project. 3) TrucBeat's management will need to produce 4,000 units in Years 2 and 3 (to meet relevant range) and 6,000 units in Year 4. However, they anticipate selling only 3,000 units in Year 2 but 5,000 units in Ycars 3 and 6,000 units in Year 4. They will have to carry inventory produced in Year 2 until it is sold in Year 3. Note: Net Operating Income, or NOI, for this course is essentially Income before interest or tax expense and represents the operationally controlled components of Net Income. a) Using variable costing and contribution margin income statement format, prepare predictive income statements for Years 2, 3 and 4 below. TrueBeat Income Statement (Variable Costing) For Years ending December 31 Year 2 Year 3 Year 4 Sales revenue Variable production costs Variable S&A expenses Contribution Margin Fixed Overhead Fixed S&A expenses Not Onting Income b) Using absorption costing, prepare an absorption costing income statements for TrueBeat for Years 2, 3 and 4. TrueBeat Income Statement(Absorption Costing) For Years ending December 31 Year 2 Year) Year 4 Sales revenus Cost of Goods Sold Gross Margin S&A expenses NetOncrating Income c) Do you think TrueBeat's decision to maintain drum sets inventory from year 2 until they are sold in year 3 was a good decision? Use complete sentences and 30 to 50 words in your