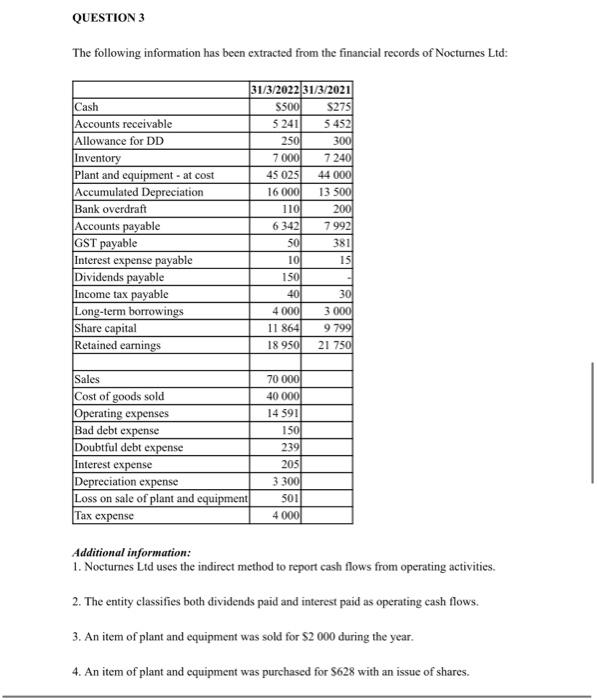

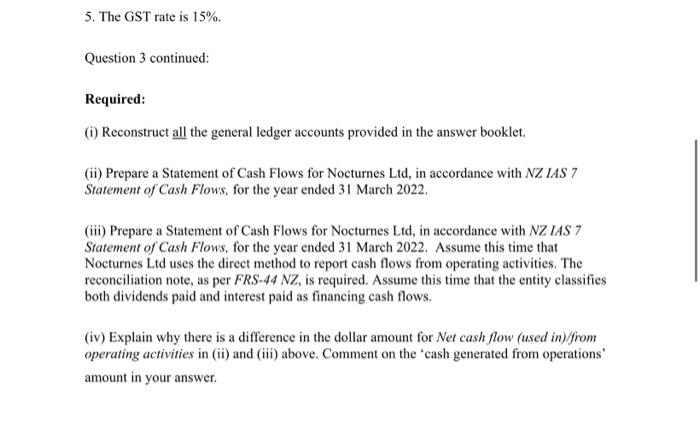

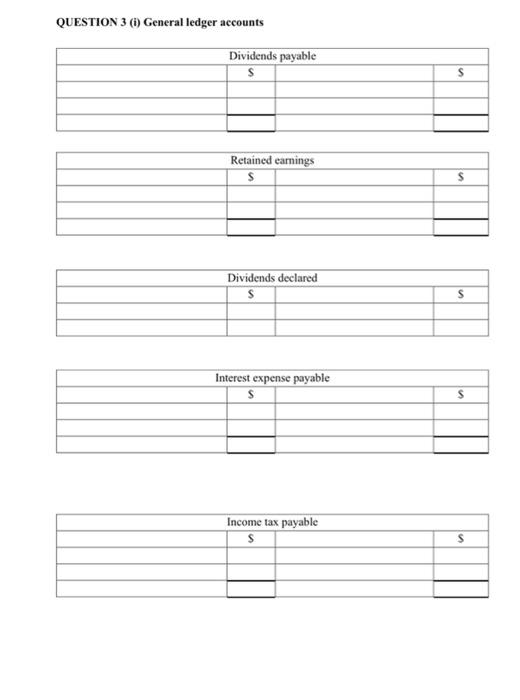

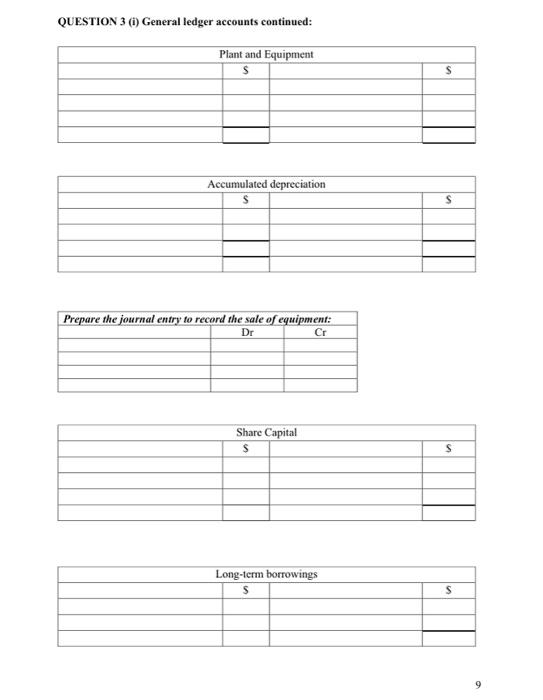

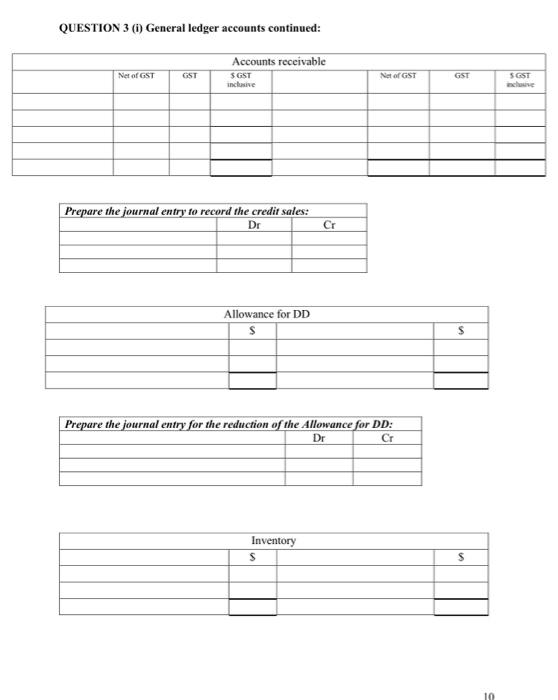

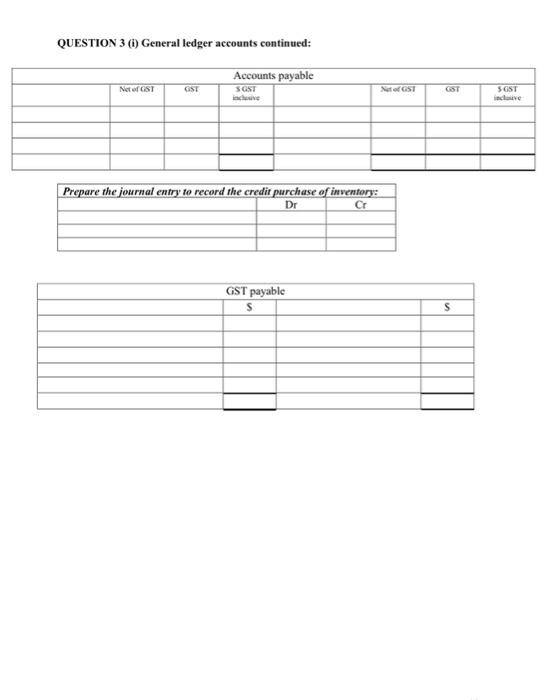

QUESTION 3 The following information has been extracted from the financial records of Nocturnes Ltd: 110 Cash Accounts receivable Allowance for DD Inventory Plant and equipment - at cost Accumulated Depreciation Bank overdraft Accounts payable GST payable Interest expense payable Dividends payable Income tax payable Long-term borrowings Share capital Retained earnings 31/3/2022 31/3/2021 $500 $275 5 241 5452 250 300 70001 7240 45 025 44 000 16 000 13 500 200 6 342 7992 SO 381 10 IS 150 40 30 40001 3 000 11 864 9 799 18 9501 21 750 Sales Cost of goods sold Operating expenses Bad debt expense Doubtful debt expense Interest expense Depreciation expense Loss on sale of plant and equipment Tax expense 70 000 40 000 14 591 150 239 205 3 300 501 4000 Additional information: 1. Nocturnes Ltd uses the indirect method to report cash flows from operating activities. 2. The entity classifies both dividends paid and interest paid as operating cash flows. 3. An item of plant and equipment was sold for 2 000 during the year. 4. An item of plant and equipment was purchased for $628 with an issue of shares. 5. The GST rate is 15% Question 3 continued: Required: (0) Reconstruct all the general ledger accounts provided in the answer booklet. (ii) Prepare a Statement of Cash Flows for Nocturnes Ltd, in accordance with NZ IAS 7 Statement of Cash Flows, for the year ended 31 March 2022. (iii) Prepare a Statement of Cash Flows for Nocturnes Ltd, in accordance with NZ IAS 7 Statement of Cash Flows, for the year ended 31 March 2022. Assume this time that Nocturnes Ltd uses the direct method to report cash flows from operating activities. The reconciliation note, as per FRS-44 NZ, is required. Assume this time that the entity classifies both dividends paid and interest paid as financing cash flows. (iv) Explain why there is a difference in the dollar amount for Net cash flow (used in)/from operating activities in (ii) and (iii) above. Comment on the cash generated from operations' amount in your answer. QUESTION 3 (1) General ledger accounts Dividends payable S s Retained earnings $ Dividends declared S Interest expense payable S s Income tax payable s S QUESTION 3 (1) General ledger accounts continued: Plant and Equipment $ $ Accumulated depreciation s $ s Prepare the journal entry to record the sale of equipment: Dr Cr Share Capital $ S Long-term borrowings S s QUESTION 3 (1) General ledger accounts continued: Net of GST GST Accounts receivable SGST inclusive Net of GST GST SGST che Prepare the journal entry fo record the credit sales: Dr Cr Allowance for DD S s Prepare the journal entry for the reduction of the Allowance for DD: Cr Dr Inventory S s 10 QUESTION 3 General ledger accounts continued: Accounts payable Net of GST GST SGST No GST OST SOST inde Prepare the journal entry to record the credit purchase of inventory: Dr Cr GST payable S S