Answered step by step

Verified Expert Solution

Question

1 Approved Answer

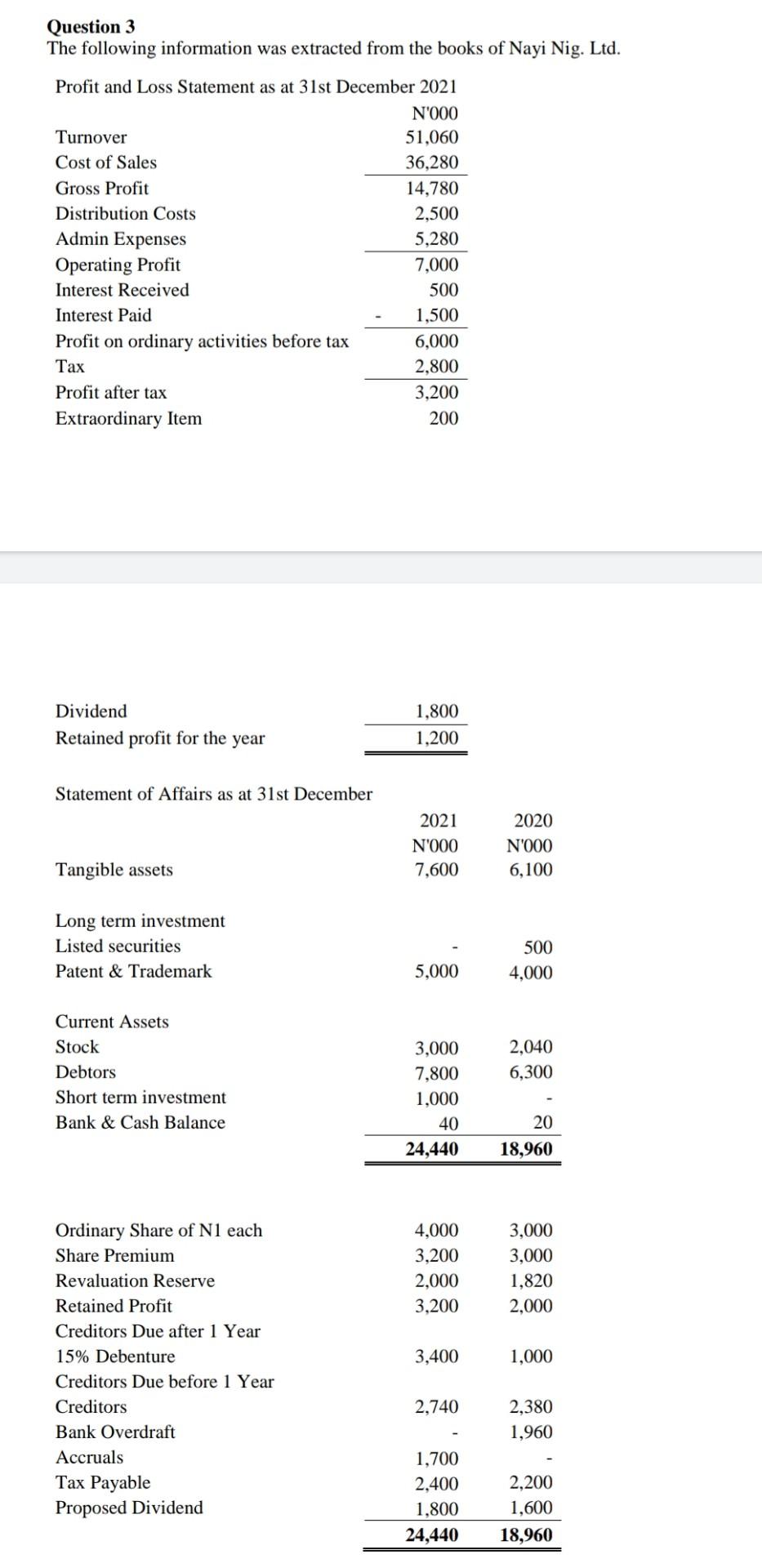

Question 3 The following information was extracted from the books of Nayi Nig. Ltd. Profit and Loss Statement as at 31st December 2021 N'000 Turnover

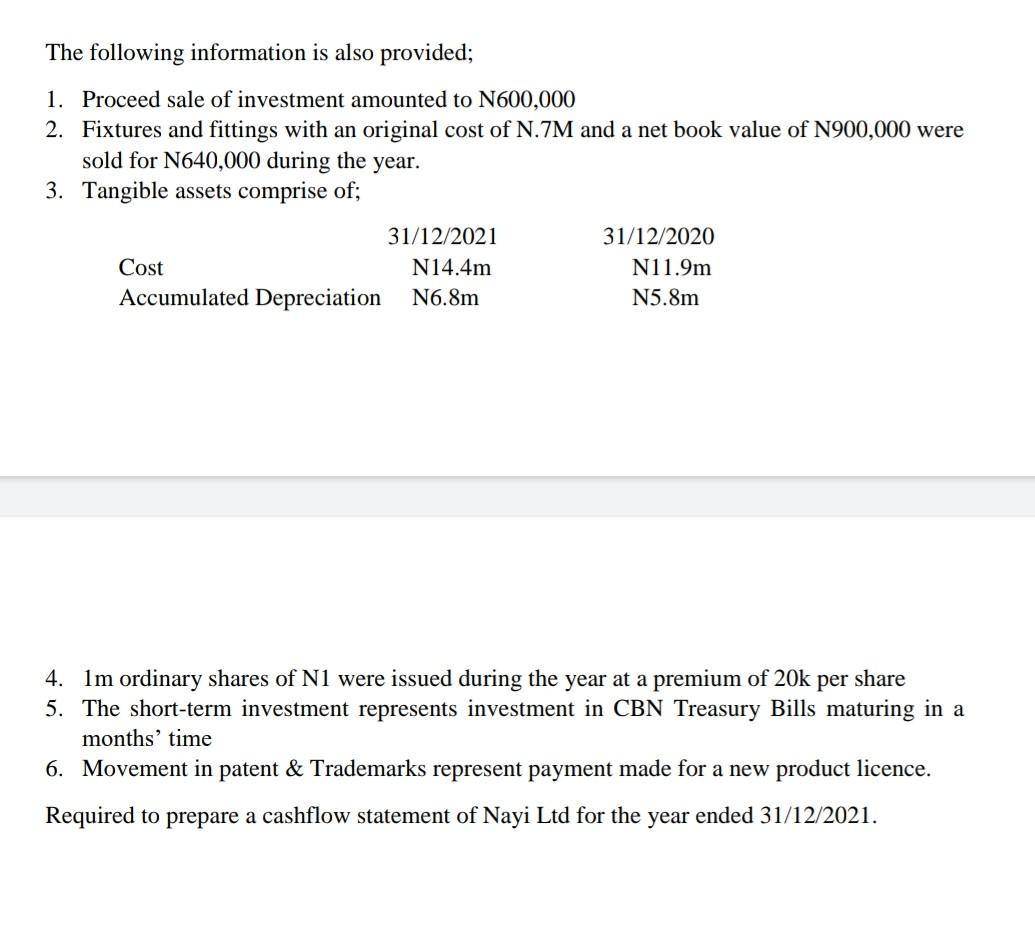

Question 3 The following information was extracted from the books of Nayi Nig. Ltd. Profit and Loss Statement as at 31st December 2021 N'000 Turnover 51,060 Cost of Sales 36,280 Gross Profit 14,780 Distribution Costs 2,500 Admin Expenses 5,280 Operating Profit 7,000 Interest Received 500 Interest Paid 1,500 Profit on ordinary activities before tax 6,000 Tax 2,800 Profit after tax 3,200 Extraordinary Item 200 Dividend Retained profit for the year 1,800 1,200 Statement of Affairs as at 31st December 2021 N'000 7,600 2020 N'000 6,100 Tangible assets Long term investment Listed securities Patent & Trademark 500 4,000 5,000 Current Assets Stock Debtors Short term investment Bank & Cash Balance 2,040 6,300 3.000 7,800 1,000 40 24,440 20 18,960 4,000 3,200 2,000 3,200 3,000 3,000 1,820 2,000 3,400 1,000 Ordinary Share of N1 each Share Premium Revaluation Reserve Retained Profit Creditors Due after 1 Year 15% Debenture Creditors Due before 1 Year Creditors Bank Overdraft Accruals Tax Payable Proposed Dividend 2,740 2,380 1,960 1,700 2,400 1,800 24,440 2,200 1,600 18,960 The following information is also provided; 1. Proceed sale of investment amounted to N600,000 2. Fixtures and fittings with an original cost of N.7M and a net book value of N900,000 were sold for N640,000 during the year. 3. Tangible assets comprise of; 31/12/2021 31/12/2020 Cost N14.4m N11.9m Accumulated Depreciation N6.8m N5.8m 4. Im ordinary shares of N1 were issued during the year at a premium of 20k per share 5. The short-term investment represents investment in CBN Treasury Bills maturing in a months' time 6. Movement in patent & Trademarks represent payment made for a new product licence. Required to prepare a cashflow statement of Nayi Ltd for the year ended 31/12/2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started