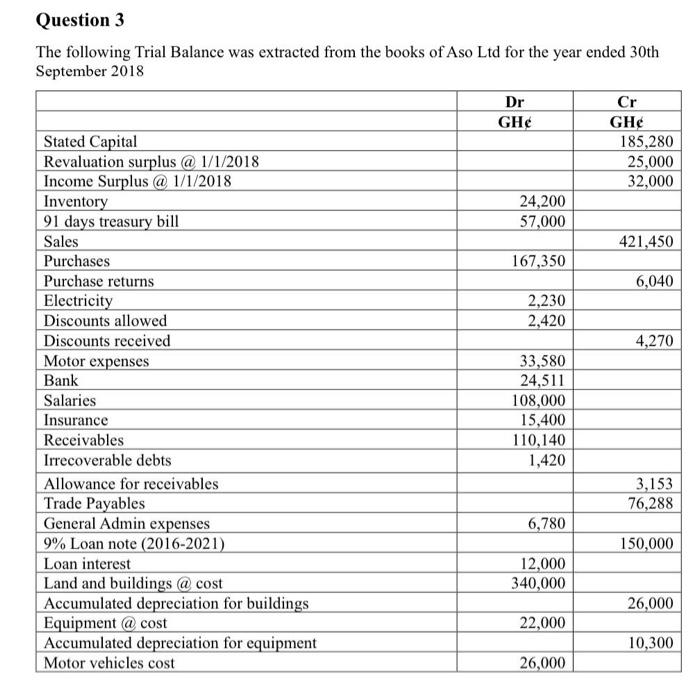

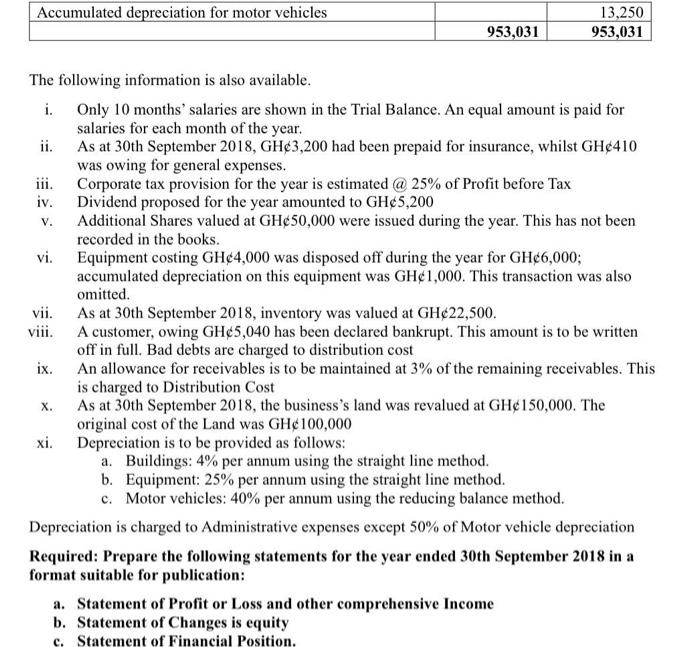

Question 3 The following Trial Balance was extracted from the books of Aso Ltd for the year ended 30th September 2018 Dr GHE Cr GHe 185,280 25,000 32,000 24,200 57,000 421,450 167,350 6,040 2,230 2,420 4,270 Stated Capital Revaluation surplus @ 1/1/2018 Income Surplus @ 1/1/2018 Inventory 91 days treasury bill Sales Purchases Purchase returns Electricity Discounts allowed Discounts received Motor expenses Bank Salaries Insurance Receivables Irrecoverable debts Allowance for receivables Trade Payables General Admin expenses 9% Loan note (2016-2021) Loan interest Land and buildings @ cost Accumulated depreciation for buildings Equipment @ cost Accumulated depreciation for equipment Motor vehicles cost 33,580 24,511 108,000 15,400 110,140 1,420 3,153 76,288 6,780 150,000 12,000 340,000 26,000 22,000 10,300 26,000 Accumulated depreciation for motor vehicles 13,250 953,031 953,031 iii. V. The following information is also available. i. Only 10 months' salaries are shown in the Trial Balance. An equal amount is paid for salaries for each month of the year. ii. As at 30th September 2018, GH3,200 had been prepaid for insurance, whilst GH410 was owing for general expenses. Corporate tax provision for the year is estimated @ 25% of Profit before Tax iv. Dividend proposed for the year amounted to GH5,200 Additional Shares valued at GH50,000 were issued during the year. This has not been recorded in the books. vi. Equipment costing GH4,000 was disposed off during the year for GH6,000; accumulated depreciation on this equipment was GH1,000. This transaction was also omitted. vii. As at 30th September 2018, inventory was valued at GH22,500. viii. A customer, owing GH5,040 has been declared bankrupt. This amount is to be written off in full. Bad debts are charged to distribution cost ix. An allowance for receivables is to be maintained at 3% of the remaining receivables. This is charged to Distribution Cost As at 30th September 2018, the business's land was revalued at GH150,000. The original cost of the Land was GH100,000 xi. Depreciation is to be provided as follows: a. Buildings: 4% per annum using the straight line method. b. Equipment: 25% per annum using the straight line method. c. Motor vehicles: 40% per annum using the reducing balance method. Depreciation is charged to Administrative expenses except 50% of Motor vehicle depreciation Required: Prepare the following statements for the year ended 30th September 2018 in a format suitable for publication: a. Statement of Profit or Loss and other comprehensive Income b. Statement of Changes is equity c. Statement of Financial Position. X. Question 3 The following Trial Balance was extracted from the books of Aso Ltd for the year ended 30th September 2018 Dr GHE Cr GHe 185,280 25,000 32,000 24,200 57,000 421,450 167,350 6,040 2,230 2,420 4,270 Stated Capital Revaluation surplus @ 1/1/2018 Income Surplus @ 1/1/2018 Inventory 91 days treasury bill Sales Purchases Purchase returns Electricity Discounts allowed Discounts received Motor expenses Bank Salaries Insurance Receivables Irrecoverable debts Allowance for receivables Trade Payables General Admin expenses 9% Loan note (2016-2021) Loan interest Land and buildings @ cost Accumulated depreciation for buildings Equipment @ cost Accumulated depreciation for equipment Motor vehicles cost 33,580 24,511 108,000 15,400 110,140 1,420 3,153 76,288 6,780 150,000 12,000 340,000 26,000 22,000 10,300 26,000 Accumulated depreciation for motor vehicles 13,250 953,031 953,031 iii. V. The following information is also available. i. Only 10 months' salaries are shown in the Trial Balance. An equal amount is paid for salaries for each month of the year. ii. As at 30th September 2018, GH3,200 had been prepaid for insurance, whilst GH410 was owing for general expenses. Corporate tax provision for the year is estimated @ 25% of Profit before Tax iv. Dividend proposed for the year amounted to GH5,200 Additional Shares valued at GH50,000 were issued during the year. This has not been recorded in the books. vi. Equipment costing GH4,000 was disposed off during the year for GH6,000; accumulated depreciation on this equipment was GH1,000. This transaction was also omitted. vii. As at 30th September 2018, inventory was valued at GH22,500. viii. A customer, owing GH5,040 has been declared bankrupt. This amount is to be written off in full. Bad debts are charged to distribution cost ix. An allowance for receivables is to be maintained at 3% of the remaining receivables. This is charged to Distribution Cost As at 30th September 2018, the business's land was revalued at GH150,000. The original cost of the Land was GH100,000 xi. Depreciation is to be provided as follows: a. Buildings: 4% per annum using the straight line method. b. Equipment: 25% per annum using the straight line method. c. Motor vehicles: 40% per annum using the reducing balance method. Depreciation is charged to Administrative expenses except 50% of Motor vehicle depreciation Required: Prepare the following statements for the year ended 30th September 2018 in a format suitable for publication: a. Statement of Profit or Loss and other comprehensive Income b. Statement of Changes is equity c. Statement of Financial Position. X