Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (this question has four parts, (a), (b), (c) and (d)) (12 marks) You are the audit senior of MMS Associates, currently planning the

Question 3 (this question has four parts, (a), (b), (c) and (d)) (12 marks)

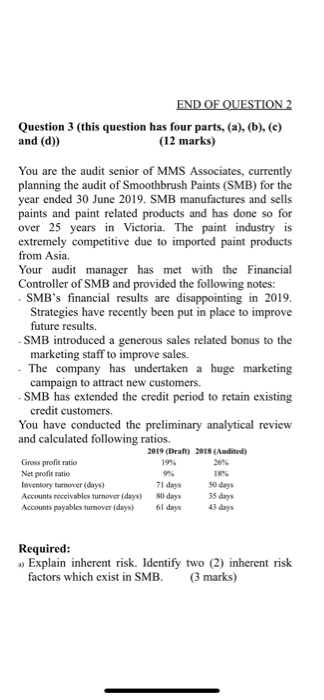

You are the audit senior of MMS Associates, currently planning the audit of Smoothbrush Paints (SMB) for the year ended 30 June 2019. SMB manufactures and sells paints and paint related products and has done so for over 25 years in Victoria. The paint industry is extremely competitive due to imported paint products from Asia.

Your audit manager has met with the Financial Controller of SMB and provided the following notes:

- SMBs financial results are disappointing in 2019. Strategies have recently been put in place to improve future results.

- SMB introduced a generous sales related bonus to the marketing staff to improve sales.

- The company has undertaken a huge marketing campaign to attract new customers.

- SMB has extended the credit period to retain existing credit customers.

You have conducted the preliminary analytical review and calculated following ratios.

2019 (Draft)

2018 (Audited)

Gross profit ratio

19%

26%

Net profit ratio

9%

18%

Inventory turnover (days)

71 days

50 days

Accounts receivables turnover (days)

80 days

35 days

Accounts payables turnover (days)

61 days

43 days

Required:

a) Explain inherent risk. Identify two (2) inherent risk factors which exist in SMB. (3 marks)

ANSWER HERE

Inherent risk is the possibility of material misstatements could occur in financial reports before considering controls.

- SMBs financial results are disappointing in 2019 and strategies have been put in place to improve future results. It is reasonable to doubt the integrity of SMB management because they did not do well in the prior year.

- SMB introduced a generous sales related bonus to the marketing staff to improve sale. There is a possibility of material misstatements. The marketing staff may have recorded non-existence transactions in order to achieve the goal.

Question 3 (Continued)

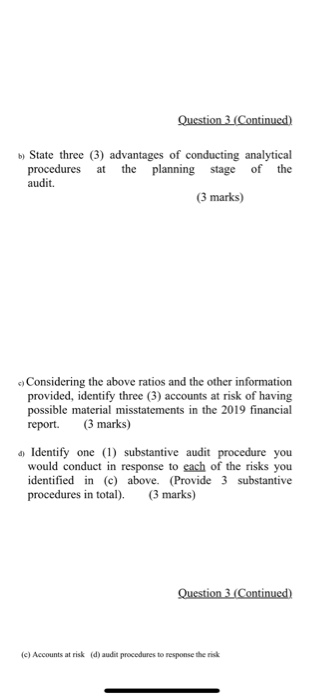

b) State three (3) advantages of conducting analytical procedures at the planning stage of the audit. (3 marks)

ANSWER HERE

1. It is cost effective and is effective at identifying possible material misstatements that the auditor should pay attention.

2. Analytical procedures as a substantive test are time sufficient. It helps to decide the course of action should be taken in the future.

3. By using the reliable input data, the outcome is more likely to be accurate.

c) Considering the above ratios and the other information provided, identify three (3) accounts at risk of having possible material misstatements in the 2019 financial report.(3 marks)

d) Identify one (1) substantive audit procedure you would conduct in response to each of the risks you identified in (c) above. (Provide 3 substantive procedures in total).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started