Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: This question tests your understanding of the various form of break-evens. A proposed project has the following facts: o Investment required today,

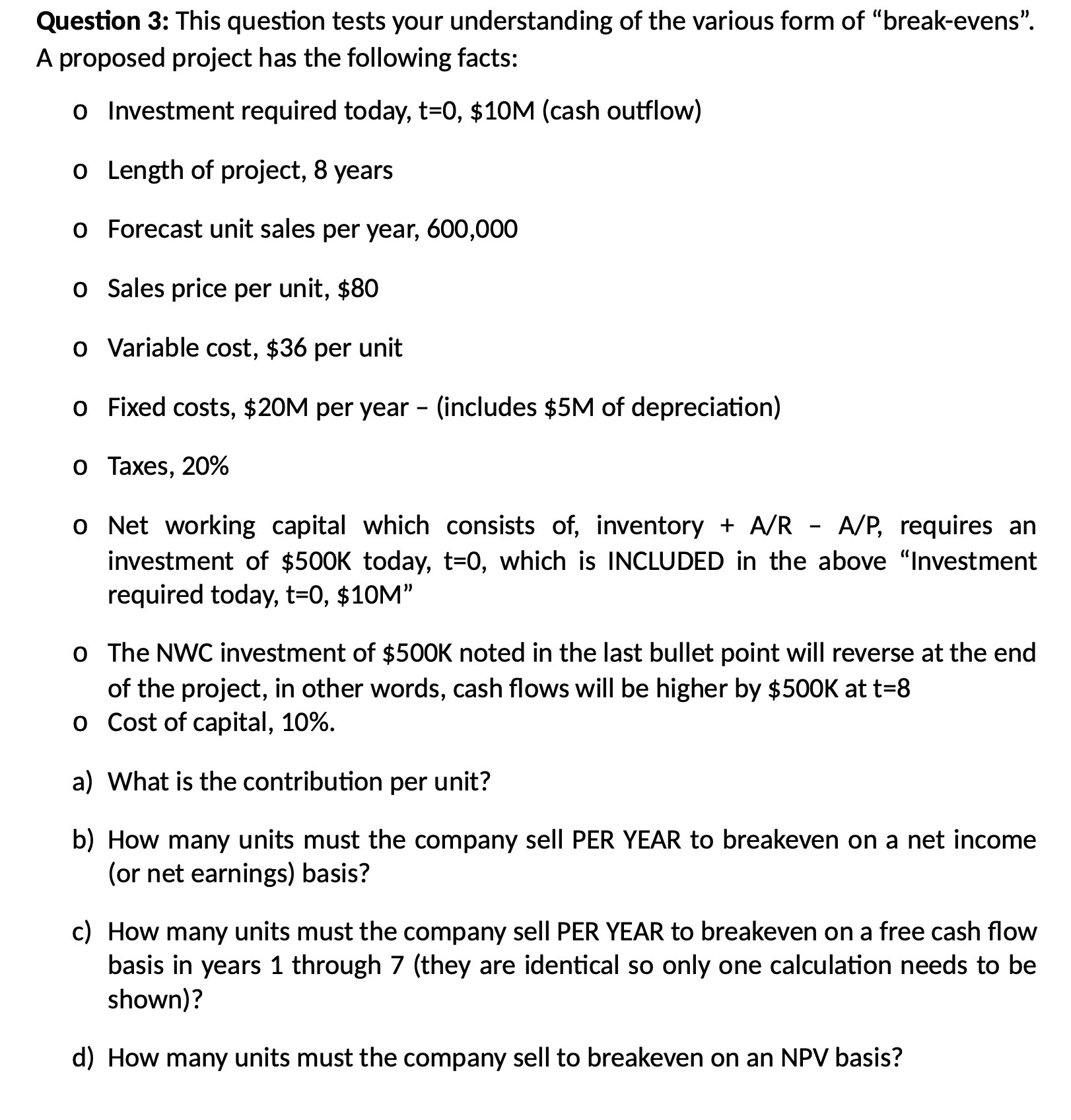

Question 3: This question tests your understanding of the various form of "break-evens". A proposed project has the following facts: o Investment required today, t=0, $10M (cash outflow) o Length of project, 8 years o Forecast unit sales per year, 600,000 o Sales price per unit, $80 o Variable cost, $36 per unit o Fixed costs, $20M per year - (includes $5M of depreciation) O Taxes, 20% o Net working capital which consists of, inventory + A/R - A/P, requires an investment of $500K today, t=0, which is INCLUDED in the above "Investment required today, t=0, $10M" o The NWC investment of $500K noted in the last bullet point will reverse at the end of the project, in other words, cash flows will be higher by $500K at t=8 o Cost of capital, 10%. a) What is the contribution per unit? b) How many units must the company sell PER YEAR to breakeven on a net income (or net earnings) basis? c) How many units must the company sell PER YEAR to breakeven on a free cash flow basis in years 1 through 7 (they are identical so only one calculation needs to be shown)? d) How many units must the company sell to breakeven on an NPV basis?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Contribution per unit is calculated as the difference between the sales price per unit and the var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started