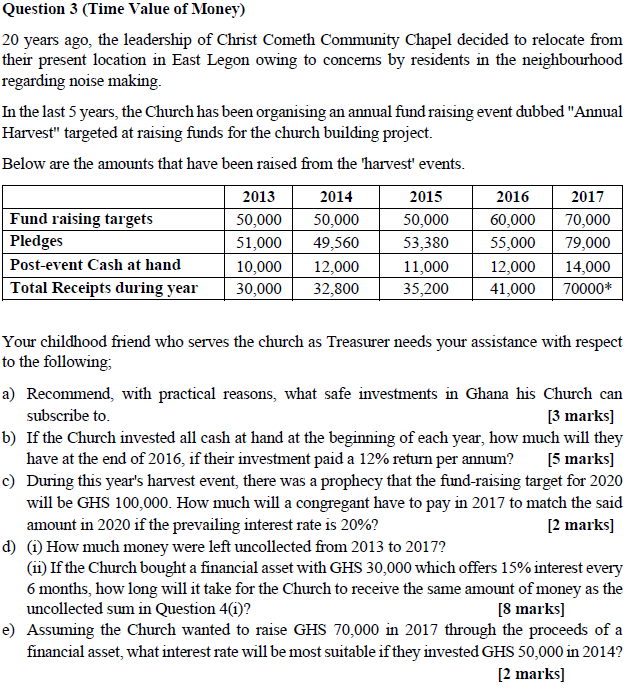

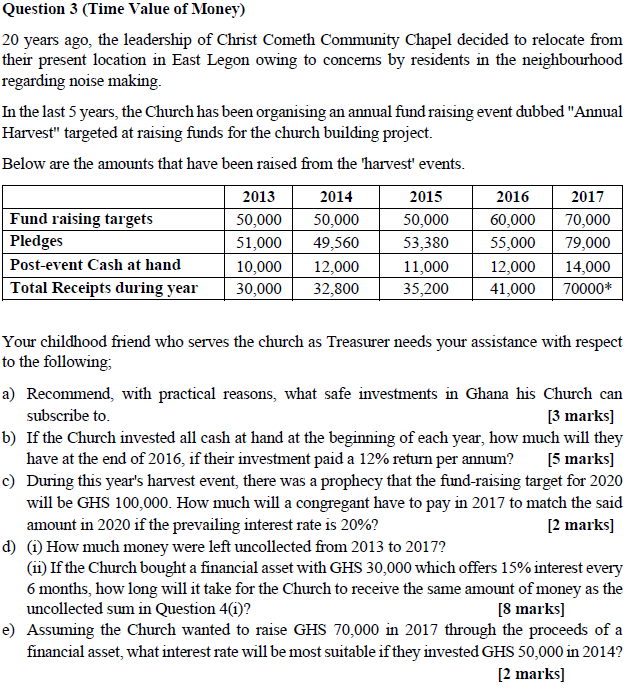

Question 3 (Time Value of Money) 20 years ago, the leadership of Christ Cometh Community Chapel decided to relocate from their present location in East Legon owing to concerns by residents in the neighbourhood regarding noise making In the last 5 years, the Church has been organising an annual fund raising event dubbed "Annual Harvest" targeted at raising funds for the church building project. Below are the amounts that have been raised from the 'harvest' events. 2013 2014 2015 2016 2017 60,000 70,000 Fund raising targets Pledges 55,000 79,000 50,000 51,000 10,000 30,000 50,000 49,560 12,000 32,800 50,000 53,380 11,000 35,200 Post-event Cash at hand 12,000 41,000 14,000 70000* Total Receipts during year Your childhood friend who serves the church as Treasurer needs your assistance with respect to the following a) Recommend, with practical reasons, what safe investments in Ghana his Church can subscribe to. [3 marks] b) If the Church invested all cash at hand at the beginning of each year, how much will they have at the end of 2016, if their investment paid a 12% return per annum? (5 marks] c) During this year's harvest event, there was a prophecy that the fund-raising target for 2020 will be GHS 100,000. How much will a congregant have to pay in 2017 to match the said amount in 2020 if the prevailing interest rate is 20%? [2 marks] d) (1) How much money were left uncollected from 2013 to 2017? (11) If the Church bought a financial asset with GHS 30,000 which offers 15% interest every 6 months, how long will it take for the Church to receive the same amount of money as the uncollected sum in Question 4(1)? [8 marks] e) Assuming the Church wanted to raise GHS 70,000 in 2017 through the proceeds of a financial asset, what interest rate will be most suitable if they invested GHS 50,000 in 2014? [2 marks] Question 3 (Time Value of Money) 20 years ago, the leadership of Christ Cometh Community Chapel decided to relocate from their present location in East Legon owing to concerns by residents in the neighbourhood regarding noise making In the last 5 years, the Church has been organising an annual fund raising event dubbed "Annual Harvest" targeted at raising funds for the church building project. Below are the amounts that have been raised from the 'harvest' events. 2013 2014 2015 2016 2017 60,000 70,000 Fund raising targets Pledges 55,000 79,000 50,000 51,000 10,000 30,000 50,000 49,560 12,000 32,800 50,000 53,380 11,000 35,200 Post-event Cash at hand 12,000 41,000 14,000 70000* Total Receipts during year Your childhood friend who serves the church as Treasurer needs your assistance with respect to the following a) Recommend, with practical reasons, what safe investments in Ghana his Church can subscribe to. [3 marks] b) If the Church invested all cash at hand at the beginning of each year, how much will they have at the end of 2016, if their investment paid a 12% return per annum? (5 marks] c) During this year's harvest event, there was a prophecy that the fund-raising target for 2020 will be GHS 100,000. How much will a congregant have to pay in 2017 to match the said amount in 2020 if the prevailing interest rate is 20%? [2 marks] d) (1) How much money were left uncollected from 2013 to 2017? (11) If the Church bought a financial asset with GHS 30,000 which offers 15% interest every 6 months, how long will it take for the Church to receive the same amount of money as the uncollected sum in Question 4(1)? [8 marks] e) Assuming the Church wanted to raise GHS 70,000 in 2017 through the proceeds of a financial asset, what interest rate will be most suitable if they invested GHS 50,000 in 2014? [2 marks]