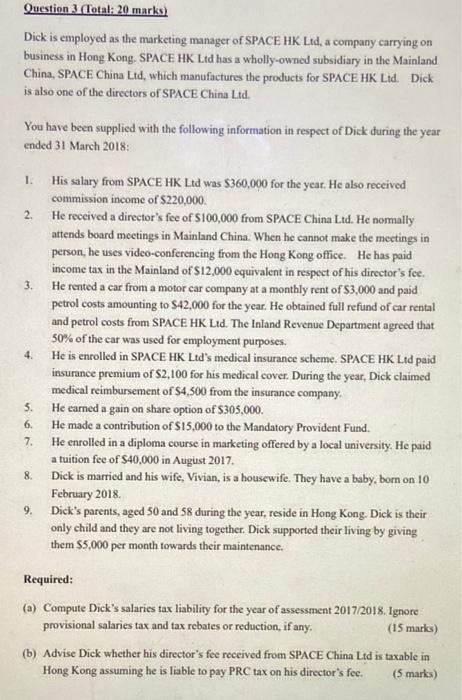

Question 3 (Total: 20 marks) Dick is employed as the marketing manager of SPACE HK Ltd, a company carrying on business in Hong Kong. SPACE HK Ltd has a wholly-owned subsidiary in the Mainland China, SPACE China Ltd, which manufactures the products for SPACE HK Lid. Dick is also one of the directors of SPACE China Ltd. You have been supplied with the following information in respect of Dick during the year ended 31 March 2018: 2. 4. 1. His salary from SPACE HK Ltd was $360,000 for the year. He also received commission income of $220,000. He received a director's fee of $100,000 from SPACE China Ltd. He normally attends board meetings in Mainland China. When he cannot make the meetings in person, he uses video-conferencing from the Hong Kong office. He has paid income tax in the Mainland of S12,000 equivalent in respect of his director's fee. 3. He rented a car from a motor car company at a monthly rent of $3,000 and paid petrol costs amounting to S42,000 for the year. He obtained full refund of car rental and petrol costs from SPACE HK Lid. The Inland Revenue Department agreed that 50% of the car was used for employment purposes. He is enrolled in SPACE HK Lid's medical insurance scheme. SPACE HK Lid paid insurance premium of $2,100 for his medical cover. During the year, Dick claimed medical reimbursement of $4,500 from the insurance company. He earned a gain on share option of $305,000 He made a contribution of S15,000 to the Mandatory Provident Fund, He enrolled in a diploma course in marketing offered by a local university. He paid a tuition fee of $40,000 in August 2017 Dick is married and his wife, Vivian, is a housewife. They have a baby, born on 10 February 2018, 9. Dick's parents, aged 50 and 58 during the year, reside in Hong Kong. Dick is their only child and they are not living together. Dick supported their living by giving them $5,000 per month towards their maintenance 5. 6. 7. 8 Required: (a) Compute Dick's salaries tax liability for the year of assessment 2017/2018. Ignore provisional salaries tax and tax rebates or reduction, if any. (15 marks) (b) Advise Dick whether his director's fee received from SPACE China Ltd is taxable in Hong Kong assuming he is liable to pay PRC tax on his director's fee. (5 marks) Question 3 (Total: 20 marks) Dick is employed as the marketing manager of SPACE HK Ltd, a company carrying on business in Hong Kong. SPACE HK Ltd has a wholly-owned subsidiary in the Mainland China, SPACE China Ltd, which manufactures the products for SPACE HK Lid. Dick is also one of the directors of SPACE China Ltd. You have been supplied with the following information in respect of Dick during the year ended 31 March 2018: 2. 4. 1. His salary from SPACE HK Ltd was $360,000 for the year. He also received commission income of $220,000. He received a director's fee of $100,000 from SPACE China Ltd. He normally attends board meetings in Mainland China. When he cannot make the meetings in person, he uses video-conferencing from the Hong Kong office. He has paid income tax in the Mainland of S12,000 equivalent in respect of his director's fee. 3. He rented a car from a motor car company at a monthly rent of $3,000 and paid petrol costs amounting to S42,000 for the year. He obtained full refund of car rental and petrol costs from SPACE HK Lid. The Inland Revenue Department agreed that 50% of the car was used for employment purposes. He is enrolled in SPACE HK Lid's medical insurance scheme. SPACE HK Lid paid insurance premium of $2,100 for his medical cover. During the year, Dick claimed medical reimbursement of $4,500 from the insurance company. He earned a gain on share option of $305,000 He made a contribution of S15,000 to the Mandatory Provident Fund, He enrolled in a diploma course in marketing offered by a local university. He paid a tuition fee of $40,000 in August 2017 Dick is married and his wife, Vivian, is a housewife. They have a baby, born on 10 February 2018, 9. Dick's parents, aged 50 and 58 during the year, reside in Hong Kong. Dick is their only child and they are not living together. Dick supported their living by giving them $5,000 per month towards their maintenance 5. 6. 7. 8 Required: (a) Compute Dick's salaries tax liability for the year of assessment 2017/2018. Ignore provisional salaries tax and tax rebates or reduction, if any. (15 marks) (b) Advise Dick whether his director's fee received from SPACE China Ltd is taxable in Hong Kong assuming he is liable to pay PRC tax on his director's fee