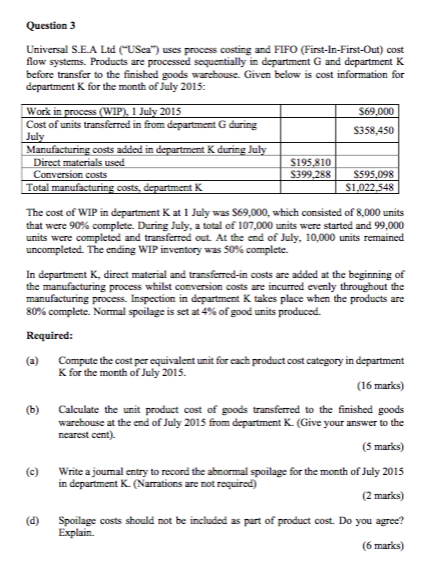

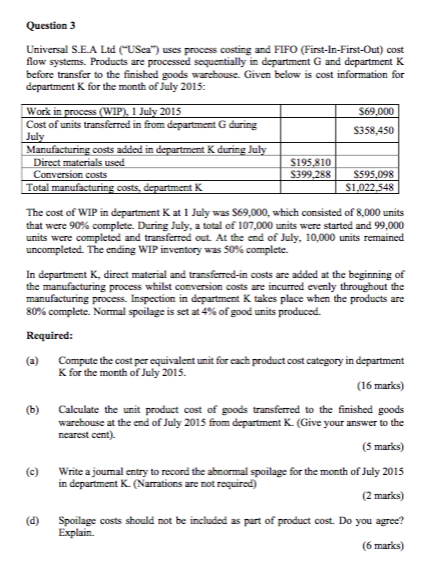

Question 3 Universal S.E.A Ltd USea uses process costing and FIFO (First-In-First-Out) cost flow systems. Products are processed sequentially in department G and department K before transfer to the finished goods warehouse. Given below is cost information for department K for the month of July 2015: Work in Cost of units transferred in from WIP) 1 July 2015 S69 G during S358,450 Manufacturing costs added in Direct materials Conversion costs S195,810 399,288 S595,098 Total The cost of WIP in department K at 1 July was $69,000, which consisted of 8,000 units that were 90% complete. During July, a total of 107,000 units were started and 99,000 units were completed and transferred out. At the end of July, 10,000 units remained uncompleted. The ending WIP inventory was 50% complete. In department K, direct material and transferred-in costs are added at the beginning of the manufacturing process whilst conversion costs are incurred evenly throughout the manufacturing process. Inspection in department K takes place when the products are 80% complete. Normal spoilage is set at 4% of good units produced. Required: a Compute the cost per equivalent unit for each product cost category in department (16 marks) (b) Calculate the unit product cost of goods transferred to the finished goods K for the month of July 2015. warebouse at the end of July 2015 from department K. Giveyour answer to the (5 marks) (c)Write a journal entry to record the abnormal spoilage for the month of July 2015 2 marks) (d) Spoilage costs should not be included as t of product cost. Do you agree? (6 marks) nearest cent). in department K. (Narrations are not required) Explain. Question 3 Universal S.E.A Ltd USea uses process costing and FIFO (First-In-First-Out) cost flow systems. Products are processed sequentially in department G and department K before transfer to the finished goods warehouse. Given below is cost information for department K for the month of July 2015: Work in Cost of units transferred in from WIP) 1 July 2015 S69 G during S358,450 Manufacturing costs added in Direct materials Conversion costs S195,810 399,288 S595,098 Total The cost of WIP in department K at 1 July was $69,000, which consisted of 8,000 units that were 90% complete. During July, a total of 107,000 units were started and 99,000 units were completed and transferred out. At the end of July, 10,000 units remained uncompleted. The ending WIP inventory was 50% complete. In department K, direct material and transferred-in costs are added at the beginning of the manufacturing process whilst conversion costs are incurred evenly throughout the manufacturing process. Inspection in department K takes place when the products are 80% complete. Normal spoilage is set at 4% of good units produced. Required: a Compute the cost per equivalent unit for each product cost category in department (16 marks) (b) Calculate the unit product cost of goods transferred to the finished goods K for the month of July 2015. warebouse at the end of July 2015 from department K. Giveyour answer to the (5 marks) (c)Write a journal entry to record the abnormal spoilage for the month of July 2015 2 marks) (d) Spoilage costs should not be included as t of product cost. Do you agree? (6 marks) nearest cent). in department K. (Narrations are not required) Explain