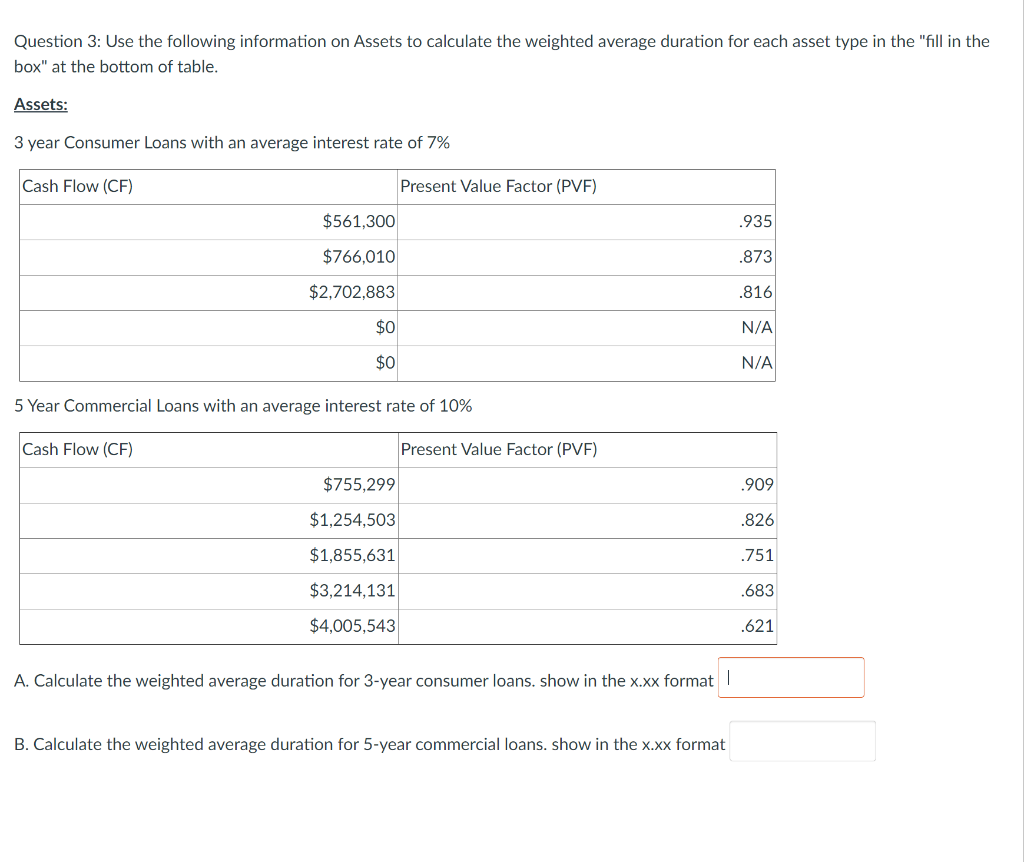

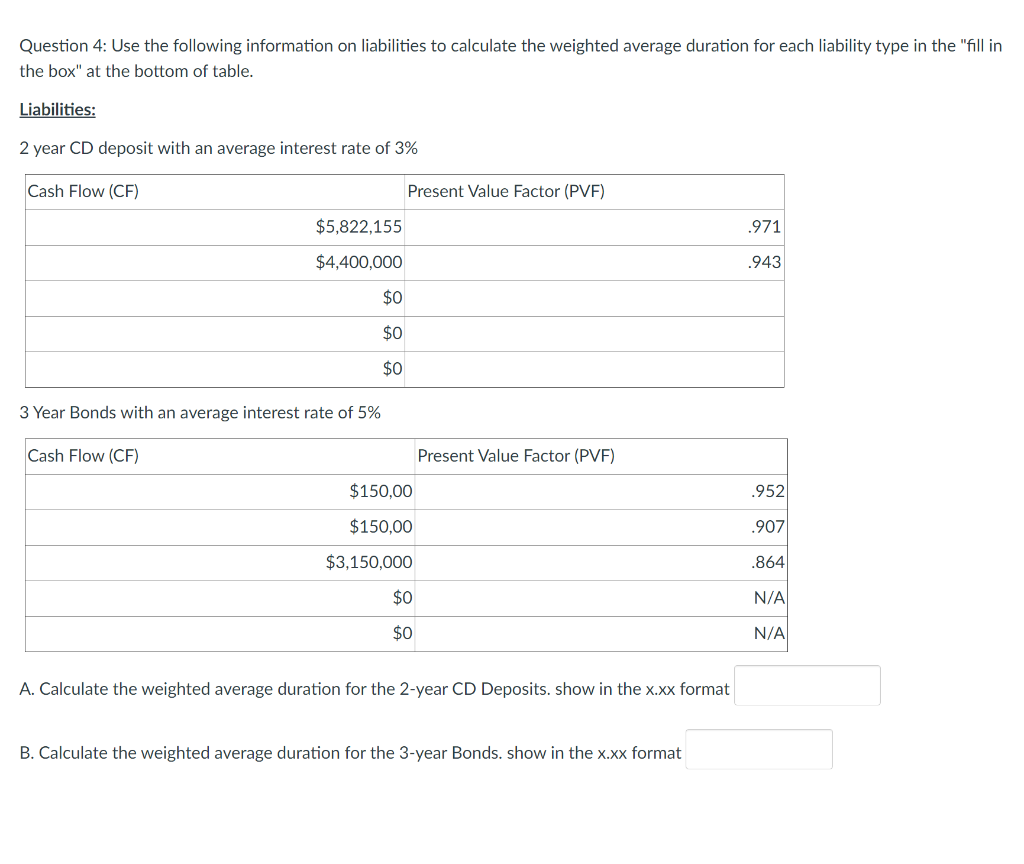

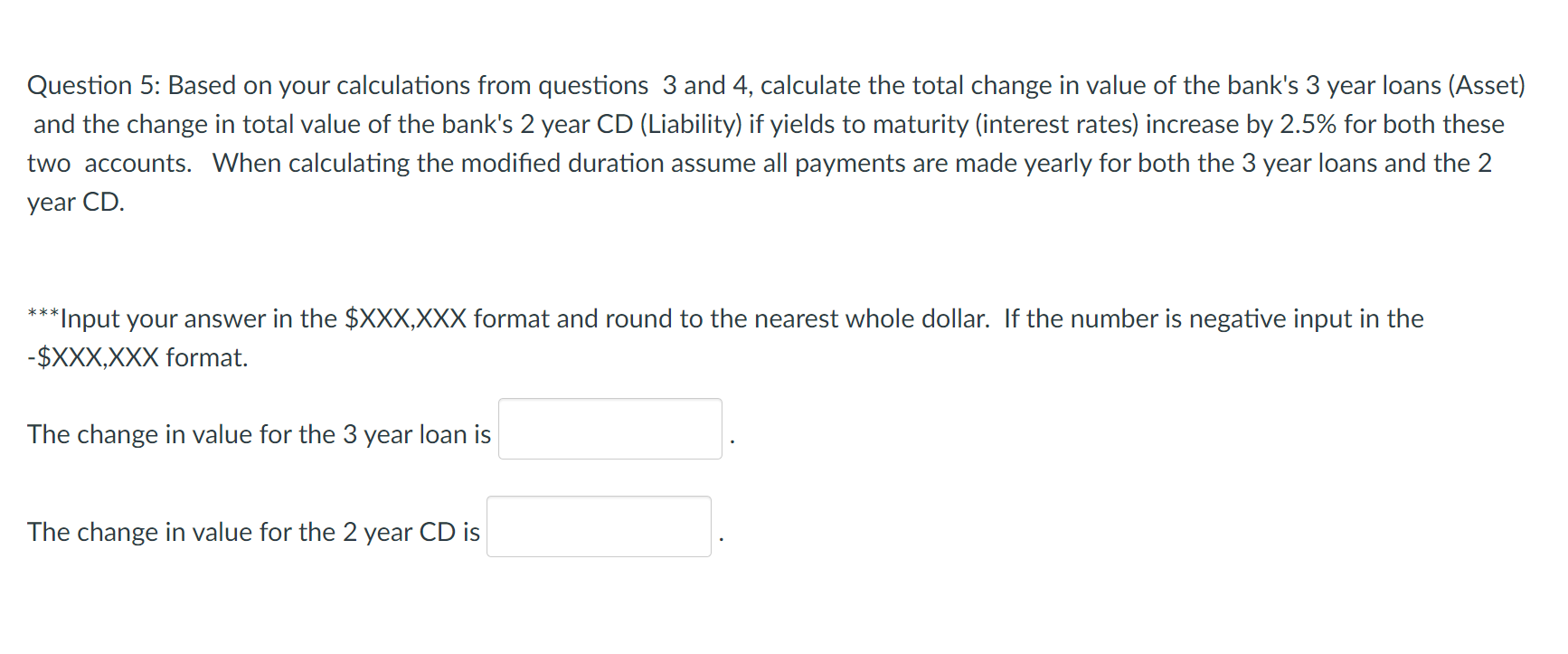

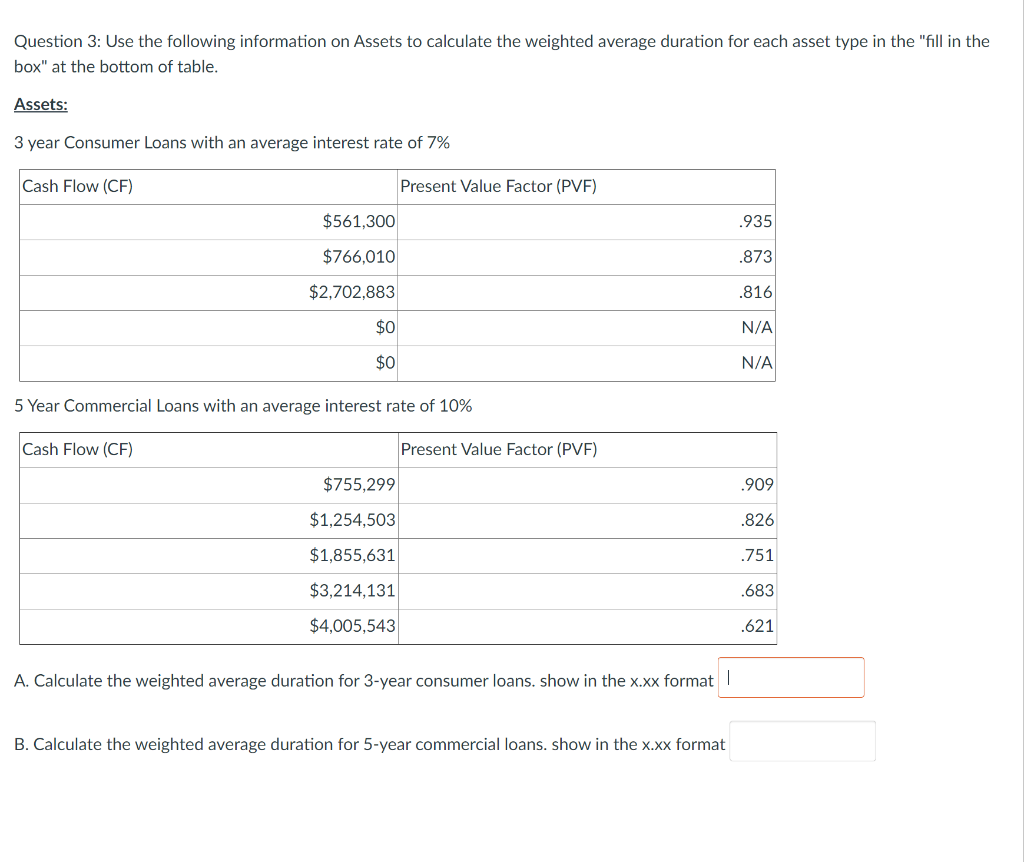

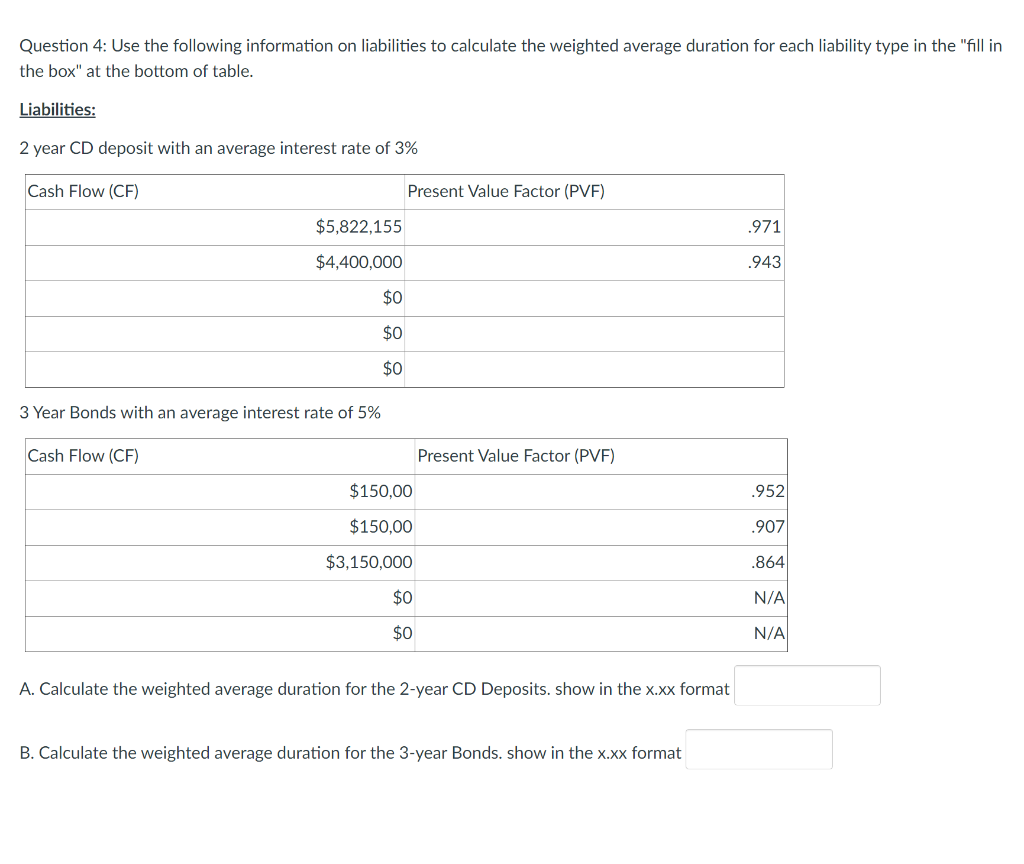

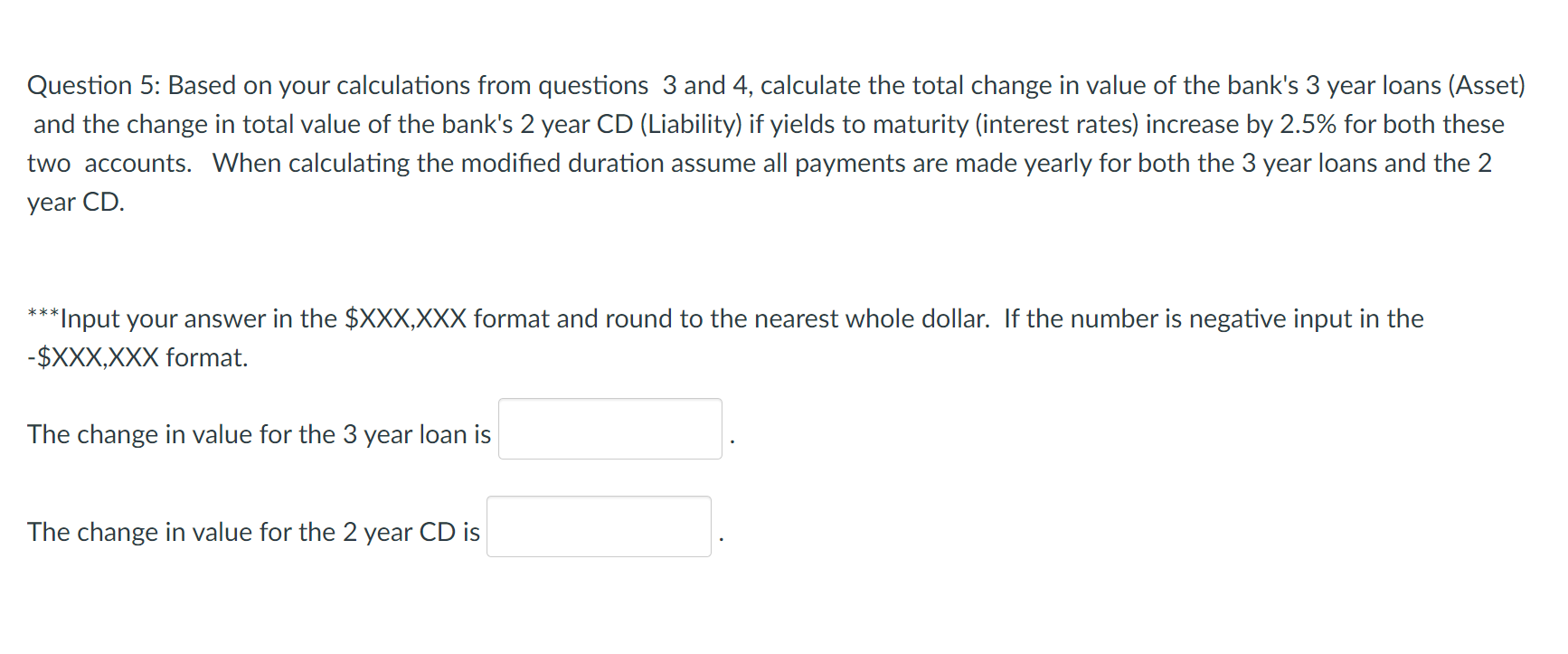

Question 3: Use the following information on Assets to calculate the weighted average duration for each asset type in the "fill in the box" at the bottom of table. Assets: 3 year Consumer Loans with an average interest rate of 7% Cash Flow (CF) Present Value Factor (PVF) $561,300 935 $766,010 .873 $2,702,883 .816 $0 N/A $0 N/A 5 Year Commercial Loans with an average interest rate of 10% Cash Flow (CF) Present Value Factor (PVF) $755,299 .909 $1,254,503 .826 $1,855,631 .751 $3,214,131 .683 $4,005,543 .621 A. Calculate the weighted average duration for 3-year consumer loans. show in the x.xx format | B. Calculate the weighted average duration for 5-year commercial loans. show in the x.xx format Question 4: Use the following information on liabilities to calculate the weighted average duration for each liability type in the "fill in the box" at the bottom of table. Liabilities: 2 year CD deposit with an average interest rate of 3% Cash Flow (CF) Present Value Factor (PVF) $5,822,155 .971 $4,400,000 .943 $0 $0 $0 3 Year Bonds with an average interest rate of 5% Cash Flow (CF) Present Value Factor (PVF) $150,00 .952 $150,00 .907 $3,150,000 .864 $0 N/A $0 N/A A. Calculate the weighted average duration for the 2-year CD Deposits. show in the x.xx format B. Calculate the weighted average duration for the 3-year Bonds. show in the x.xx format Question 5: Based on your calculations from questions 3 and 4, calculate the total change in value of the bank's 3 year loans (Asset) and the change in total value of the bank's 2 year CD (Liability) if yields to maturity (interest rates) increase by 2.5% for both these two accounts. When calculating the modified duration assume all payments are made yearly for both the 3 year loans and the 2 year CD. *** *** Input your answer in the $XXX,XXX format and round to the nearest whole dollar. If the number is negative input in the -$XXX, XXX format. The change in value for the 3 year loan is The change in value for the 2 year CD is Question 3: Use the following information on Assets to calculate the weighted average duration for each asset type in the "fill in the box" at the bottom of table. Assets: 3 year Consumer Loans with an average interest rate of 7% Cash Flow (CF) Present Value Factor (PVF) $561,300 935 $766,010 .873 $2,702,883 .816 $0 N/A $0 N/A 5 Year Commercial Loans with an average interest rate of 10% Cash Flow (CF) Present Value Factor (PVF) $755,299 .909 $1,254,503 .826 $1,855,631 .751 $3,214,131 .683 $4,005,543 .621 A. Calculate the weighted average duration for 3-year consumer loans. show in the x.xx format | B. Calculate the weighted average duration for 5-year commercial loans. show in the x.xx format Question 4: Use the following information on liabilities to calculate the weighted average duration for each liability type in the "fill in the box" at the bottom of table. Liabilities: 2 year CD deposit with an average interest rate of 3% Cash Flow (CF) Present Value Factor (PVF) $5,822,155 .971 $4,400,000 .943 $0 $0 $0 3 Year Bonds with an average interest rate of 5% Cash Flow (CF) Present Value Factor (PVF) $150,00 .952 $150,00 .907 $3,150,000 .864 $0 N/A $0 N/A A. Calculate the weighted average duration for the 2-year CD Deposits. show in the x.xx format B. Calculate the weighted average duration for the 3-year Bonds. show in the x.xx format Question 5: Based on your calculations from questions 3 and 4, calculate the total change in value of the bank's 3 year loans (Asset) and the change in total value of the bank's 2 year CD (Liability) if yields to maturity (interest rates) increase by 2.5% for both these two accounts. When calculating the modified duration assume all payments are made yearly for both the 3 year loans and the 2 year CD. *** *** Input your answer in the $XXX,XXX format and round to the nearest whole dollar. If the number is negative input in the -$XXX, XXX format. The change in value for the 3 year loan is The change in value for the 2 year CD is