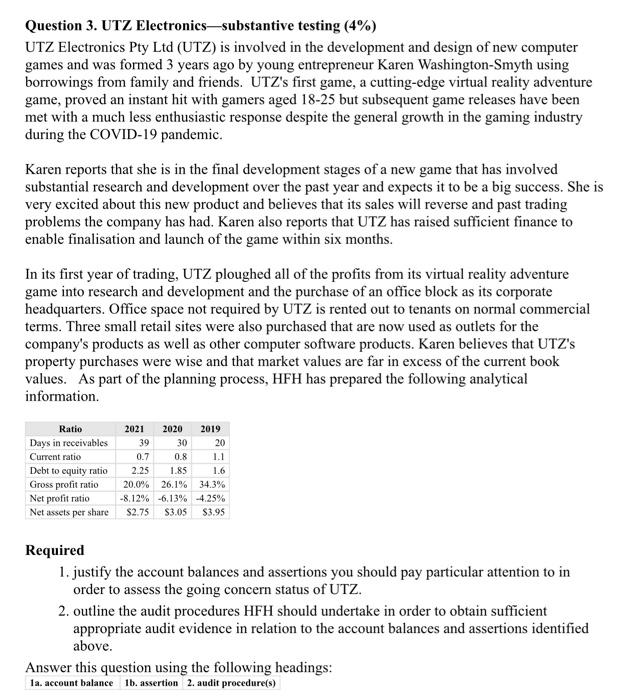

Question 3. UTZ Electronicssubstantive testing (4%) UTZ Electronics Pty Ltd (UTZ) is involved in the development and design of new computer games and was formed 3 years ago by young entrepreneur Karen Washington-Smyth using borrowings from family and friends. UTZ's first game, a cutting-edge virtual reality adventure game, proved an instant hit with gamers aged 18-25 but subsequent game releases have been met with a much less enthusiastic response despite the general growth in the gaming industry during the COVID-19 pandemic. Karen reports that she is in the final development stages of a new game that has involved substantial research and development over the past year and expects it to be a big success. She is very excited about this new product and believes that its sales will reverse and past trading problems the company has had. Karen also reports that UTZ has raised sufficient finance to enable finalisation and launch of the game within six months. In its first year of trading, UTZ ploughed all of the profits from its virtual reality adventure game into research and development and the purchase of an office block as its corporate headquarters. Office space not required by UTZ is rented out to tenants on normal commercial terms. Three small retail sites were also purchased that are now used as outlets for the company's products as well as other computer software products. Karen believes that UTZ's property purchases were wise and that market values are far in excess of the current book values. As part of the planning process, HFH has prepared the following analytical information. 0.7 1.1 Ratio Days in receivables Current ratio Debt to equity ratio Gross profit ratio Net profit ratio Net assets per share 2021 2020 2019 39 30 20 0.8 2.25 1.85 1.6 20.0% 26.1% 34.3% -8,12% -6,13% -4.25% S2.75 $3.05 $3.95 Required 1. justify the account balances and assertions you should pay particular attention to in order to assess the going concern status of UTZ. 2. outline the audit procedures HFH should undertake in order to obtain sufficient appropriate audit evidence in relation to the account balances and assertions identified above. Answer this question using the following headings: 1a. account balance 1b. assertion 2. audit procedure(s) Question 3. UTZ Electronicssubstantive testing (4%) UTZ Electronics Pty Ltd (UTZ) is involved in the development and design of new computer games and was formed 3 years ago by young entrepreneur Karen Washington-Smyth using borrowings from family and friends. UTZ's first game, a cutting-edge virtual reality adventure game, proved an instant hit with gamers aged 18-25 but subsequent game releases have been met with a much less enthusiastic response despite the general growth in the gaming industry during the COVID-19 pandemic. Karen reports that she is in the final development stages of a new game that has involved substantial research and development over the past year and expects it to be a big success. She is very excited about this new product and believes that its sales will reverse and past trading problems the company has had. Karen also reports that UTZ has raised sufficient finance to enable finalisation and launch of the game within six months. In its first year of trading, UTZ ploughed all of the profits from its virtual reality adventure game into research and development and the purchase of an office block as its corporate headquarters. Office space not required by UTZ is rented out to tenants on normal commercial terms. Three small retail sites were also purchased that are now used as outlets for the company's products as well as other computer software products. Karen believes that UTZ's property purchases were wise and that market values are far in excess of the current book values. As part of the planning process, HFH has prepared the following analytical information. 0.7 1.1 Ratio Days in receivables Current ratio Debt to equity ratio Gross profit ratio Net profit ratio Net assets per share 2021 2020 2019 39 30 20 0.8 2.25 1.85 1.6 20.0% 26.1% 34.3% -8,12% -6,13% -4.25% S2.75 $3.05 $3.95 Required 1. justify the account balances and assertions you should pay particular attention to in order to assess the going concern status of UTZ. 2. outline the audit procedures HFH should undertake in order to obtain sufficient appropriate audit evidence in relation to the account balances and assertions identified above. Answer this question using the following headings: 1a. account balance 1b. assertion 2. audit procedure(s)