Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 Which of the following is true for the use of payback as a method for evaluating projects? O A. The time-value of money

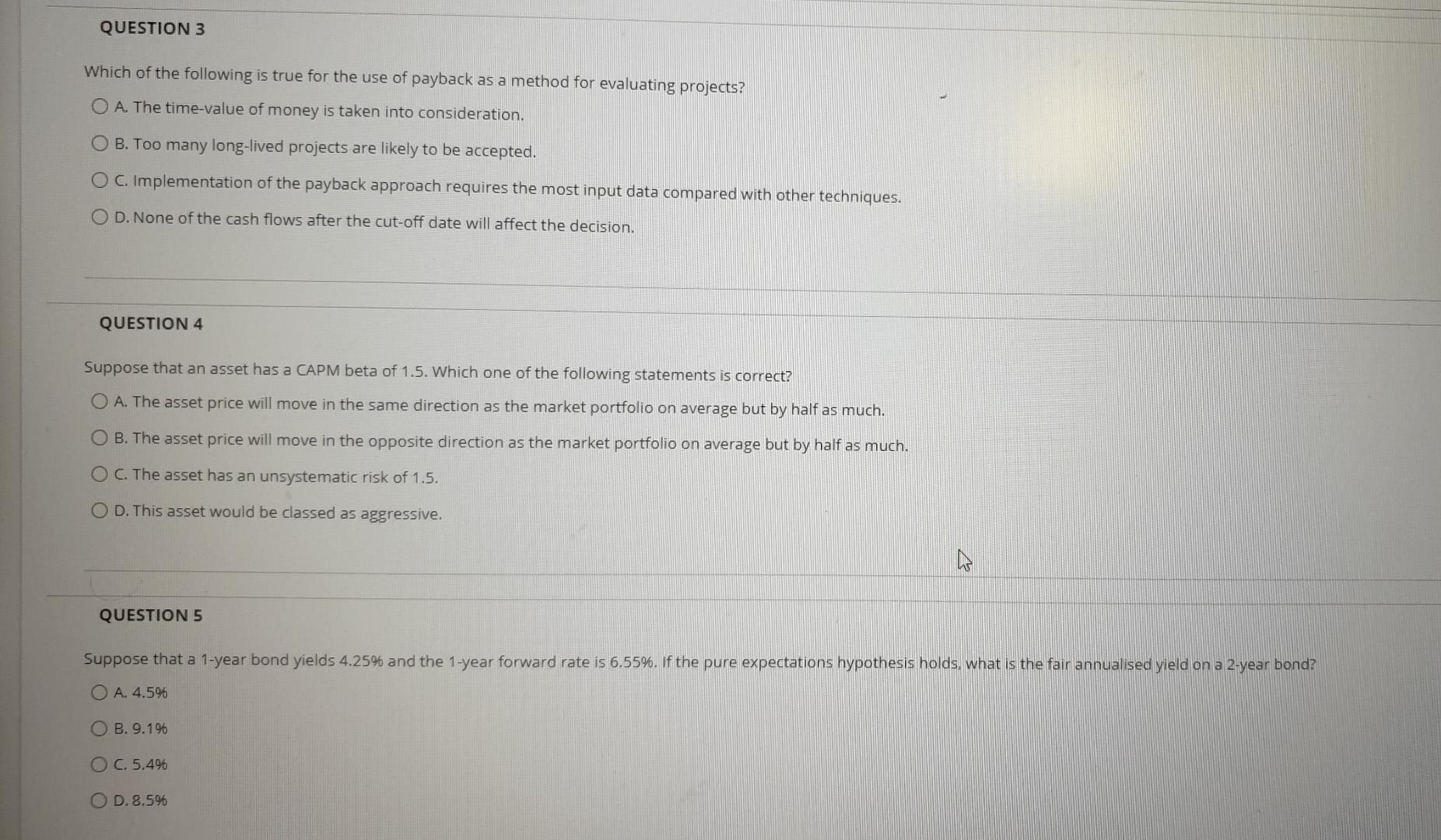

QUESTION 3 Which of the following is true for the use of payback as a method for evaluating projects? O A. The time-value of money is taken into consideration. O B. Too many long-lived projects are likely to be accepted. O C. Implementation of the payback approach requires the most input data compared with other techniques. O D. None of the cash flows after the cut-off date will affect the decision. QUESTION 4 Suppose that an asset has a CAPM beta of 1.5. Which one of the following statements is correct? O A. The asset price will move in the same direction as the market portfolio on average but by half as much. O B. The asset price will move in the opposite direction as the market portfolio on average but by half as much. O C. The asset has an unsystematic risk of 1.5. O D. This asset would be classed as aggressive. QUESTION 5 Suppose that a 1-year bond yields 4.25% and the 1-year forward rate is 6.55%. If the pure expectations hypothesis holds, what is the fair annualised yield on a 2-year bond? O A. 4.596 B. 9.1% O C.5.496 OD. 8.596

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started