Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Which of the following statements is correct regarding valuation multiples? 1. A critical assumption in using multiples of comparable firms is that the

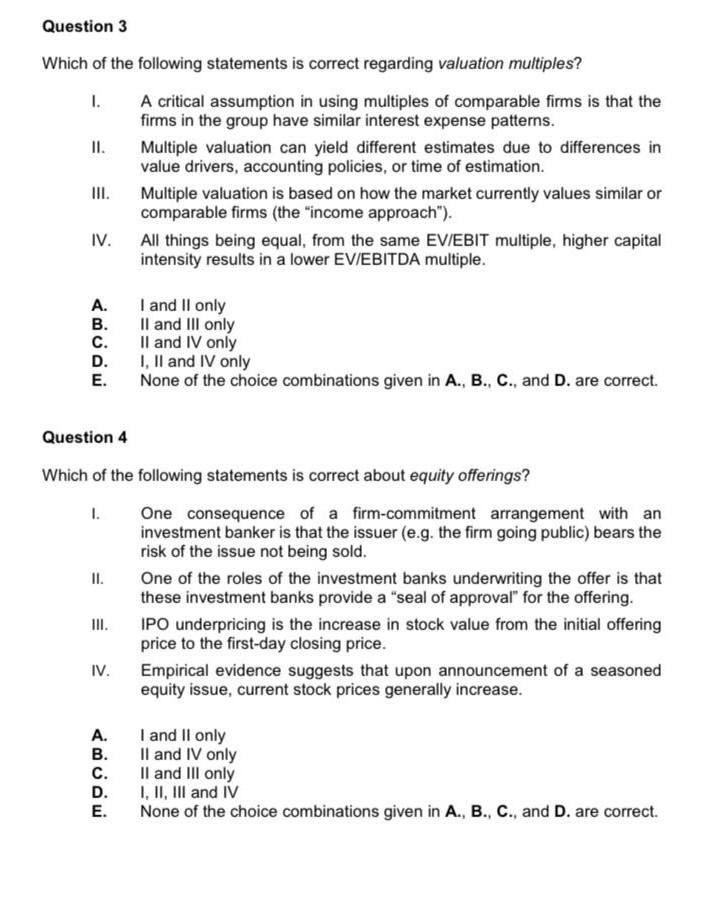

Question 3 Which of the following statements is correct regarding valuation multiples? 1. A critical assumption in using multiples of comparable firms is that the firms in the group have similar interest expense patterns. II. Multiple valuation can yield different estimates due to differences in value drivers, accounting policies, or time of estimation. III. Multiple valuation is based on how the market currently values similar or comparable firms (the "income approach"). IV. All things being equal, from the same EV/EBIT multiple, higher capital intensity results in a lower EV/EBITDA multiple. A. I and II only II and III only II and IV only I, II and IV only E. None of the choice combinations given in A., B., C., and D. are correct. Question 4 Which of the following statements is correct about equity offerings? I. One consequence of a firm-commitment arrangement with an investment banker is that the issuer (e.g. the firm going public) bears the risk of the issue not being sold. II. One of the roles of the investment banks underwriting the offer is that these investment banks provide a "seal of approval" for the offering. III. IPO underpricing is the increase in stock value from the initial offering price to the first-day closing price. IV. Empirical evidence suggests that upon announcement of a seasoned equity issue, current stock prices generally increase. C. D. I and II only II and IV only II and III only I, II, III and IV None of the choice combinations given in A., B., C., and D. are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started