Answered step by step

Verified Expert Solution

Question

1 Approved Answer

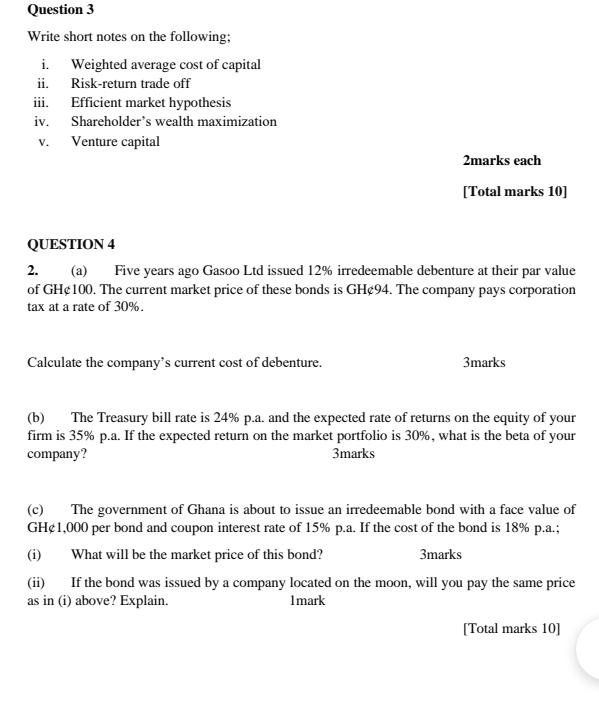

Question 3 Write short notes on the following: i. Weighted average cost of capital ii. Risk-return trade off iii. Efficient market hypothesis iv. V.

Question 3 Write short notes on the following: i. Weighted average cost of capital ii. Risk-return trade off iii. Efficient market hypothesis iv. V. Shareholder's wealth maximization Venture capital 2marks each [Total marks 10] QUESTION 4 2. Five years ago Gasoo Ltd issued 12% irredeemable debenture at their par value of GH100. The current market price of these bonds is GH94. The company pays corporation tax at a rate of 30%. Calculate the company's current cost of debenture. 3marks (b) The Treasury bill rate is 24% p.a. and the expected rate of returns on the equity of your firm is 35% p.a. If the expected return on the market portfolio is 30%, what is the beta of your company? 3marks (c) The government of Ghana is about to issue an irredeemable bond with a face value of GH1,000 per bond and coupon interest rate of 15% p.a. If the cost of the bond is 18% p.a.; What will be the market price of this bond? 3marks (i) (ii) If the bond was issued by a company located on the moon, will you pay the same price as in (i) above? Explain. Imark [Total marks 10]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Weighted Average Cost of Capital WACC The average cost of capital used by a company considering both debt and equity financing Calculated by weighting the cost of debt and cost of equity based on th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started