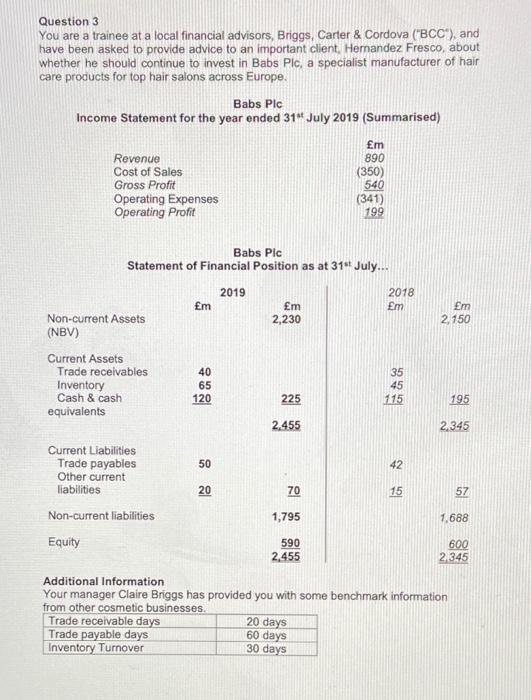

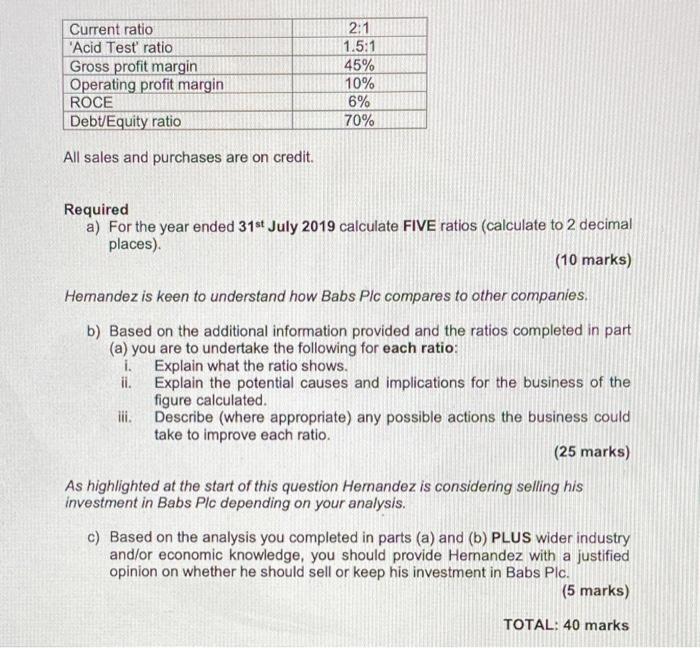

Question 3 You are a trainee at a local financial advisors, Briggs, Carter & Cordova ("BCC"), and have been asked to provide advice to an important client, Hernandez Fresco, about whether he should continue to invest in Babs Plc, a specialist manufacturer of hair care products for top hair salons across Europe. Babs PIC Income Statement for the year ended 31** July 2019 (Summarised) m 890 (350) Revenue Cost of Sales Gross Profit Operating Expenses Operating Profit 540 (341) 199 Em 2.150 Babs Pic Statement of Financial Position as at 31** July... 2019 2018 m m Em Non-current Assets 2,230 (NBV) Current Assets Trade receivables 40 35 Inventory 65 45 Cash & cash 225 115 equivalents 2.455 120 195 2.345 50 Current Liabilities Trade payables Other current liabilities 42 20 70 15 57 1,795 1.688 Non-current liabilities Equity 590 2,455 600 2 345 Additional Information Your manager Claire Briggs has provided you with some benchmark information from other cosmetic businesses. Trade receivable days 20 days Trade payable days 60 days Inventory Turnover 30 days Current ratio 'Acid Test ratio Gross profit margin Operating profit margin ROCE Debt/Equity ratio 2:1 1.5:1 45% 10% 6% 70% All sales and purchases are on credit. Required a) For the year ended 31st July 2019 calculate FIVE ratios (calculate to 2 decimal places) (10 marks) Hernandez is keen to understand how Babs Plc compares to other companies. b) Based on the additional information provided and the ratios completed in part (a) you are to undertake the following for each ratio: i. Explain what the ratio shows. ii. Explain the potential causes and implications for the business of the figure calculated. iii. Describe (where appropriate) any possible actions the business could take to improve each ratio. (25 marks) As highlighted at the start of this question Hernandez is considering selling his investment in Babs Plc depending on your analysis. c) Based on the analysis you completed in parts (a) and (b) PLUS wider industry and/or economic knowledge, you should provide Hernandez with a justified opinion on whether he should sell or keep his investment in Babs Plc. (5 marks) TOTAL: 40 marks