Question 3:

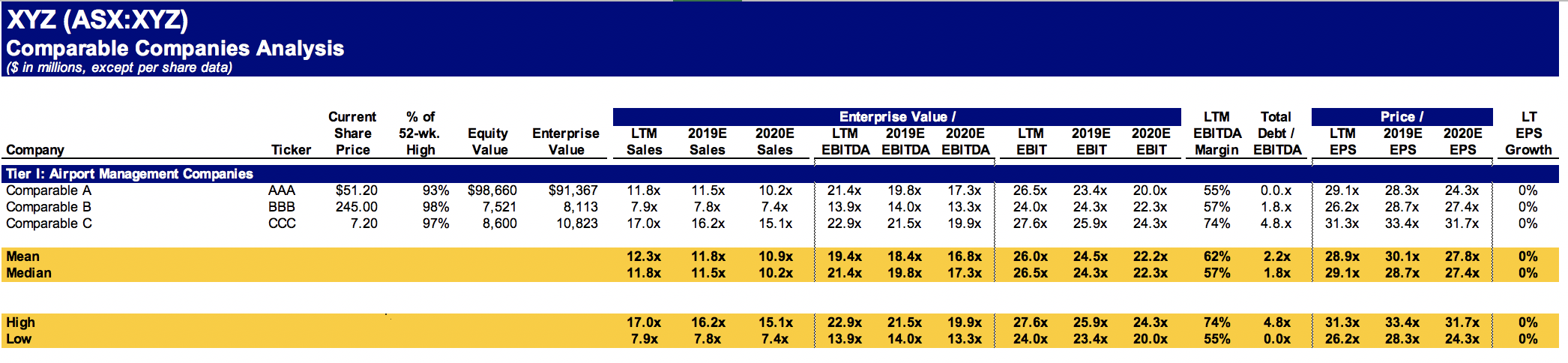

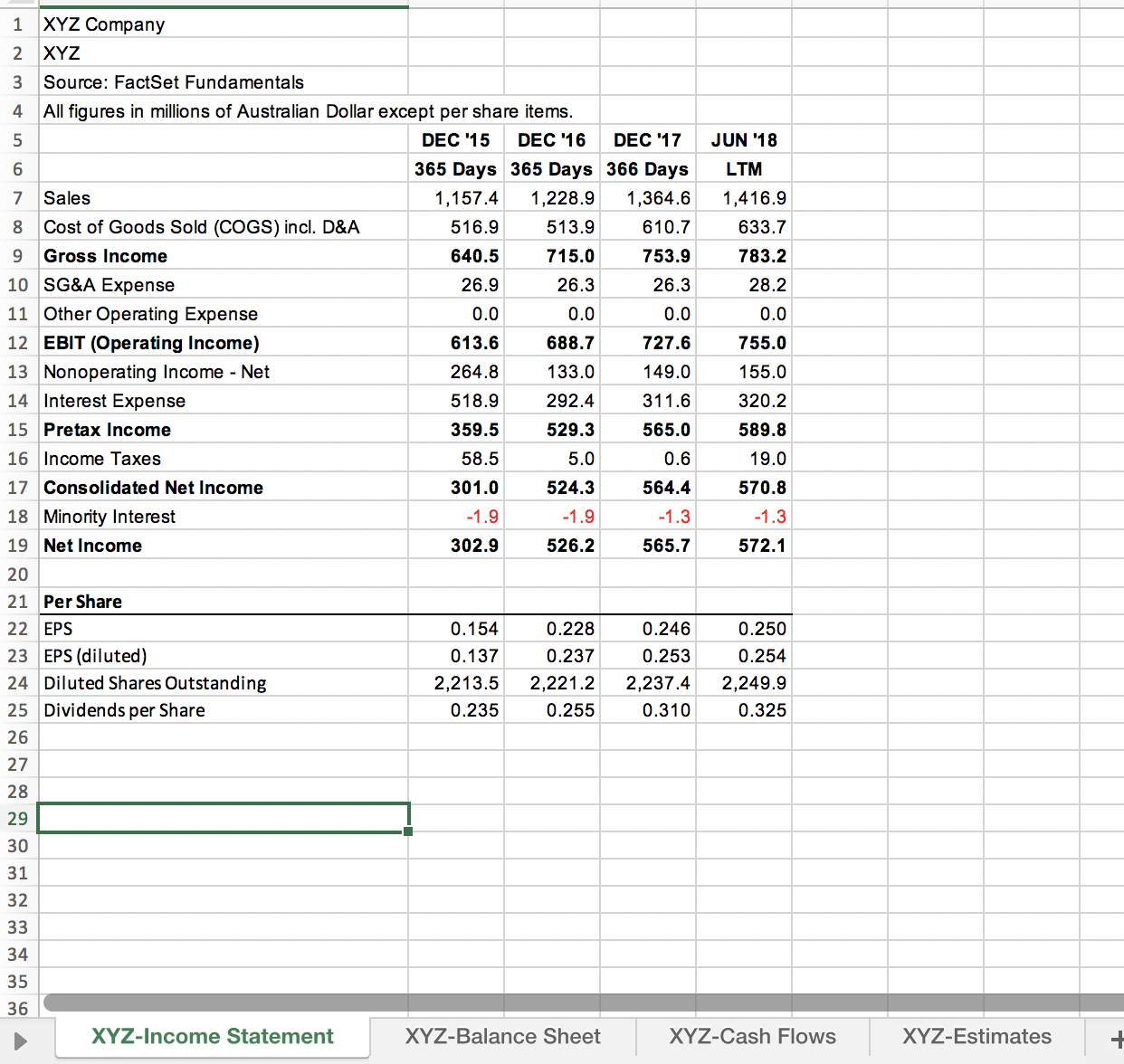

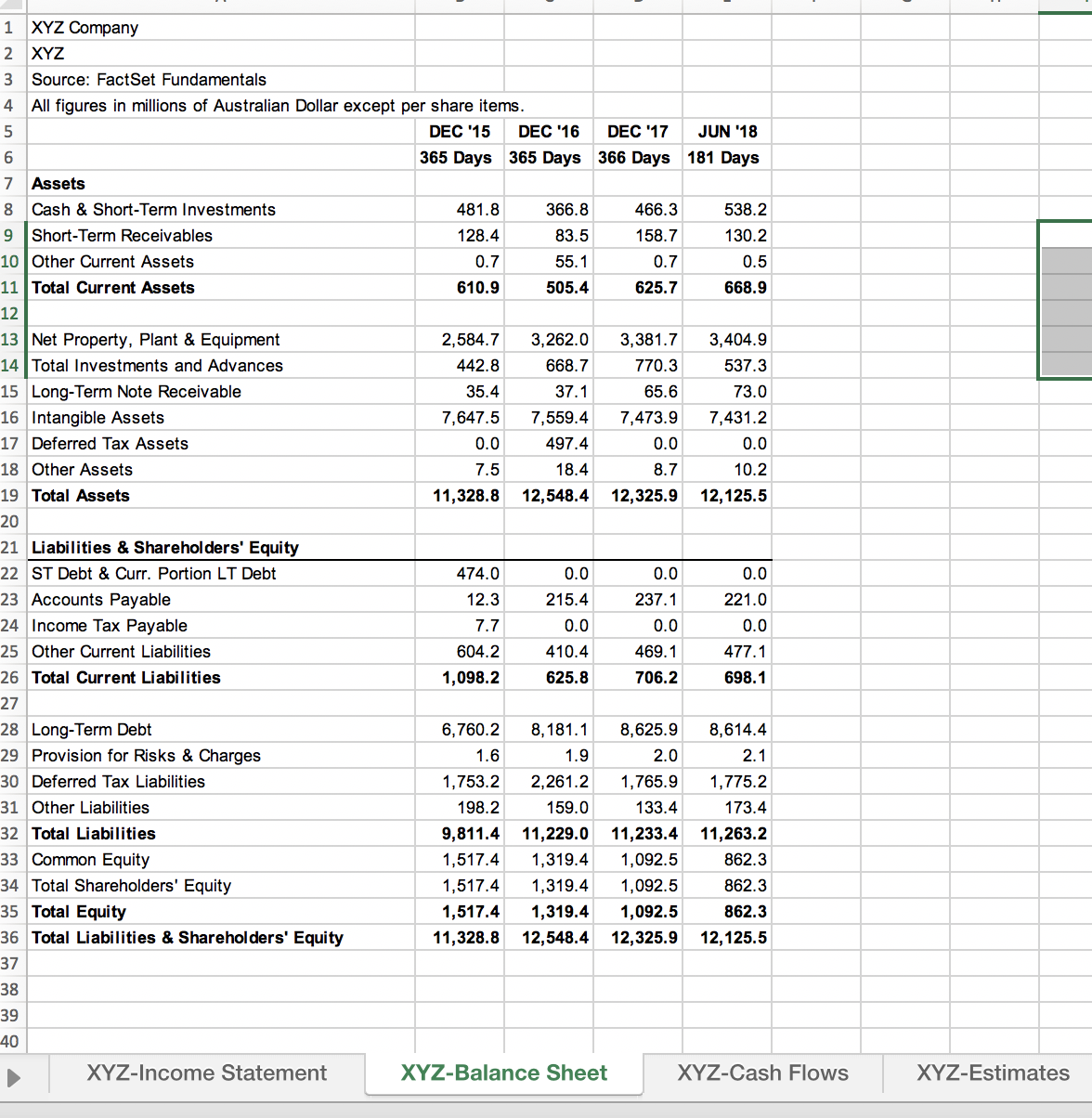

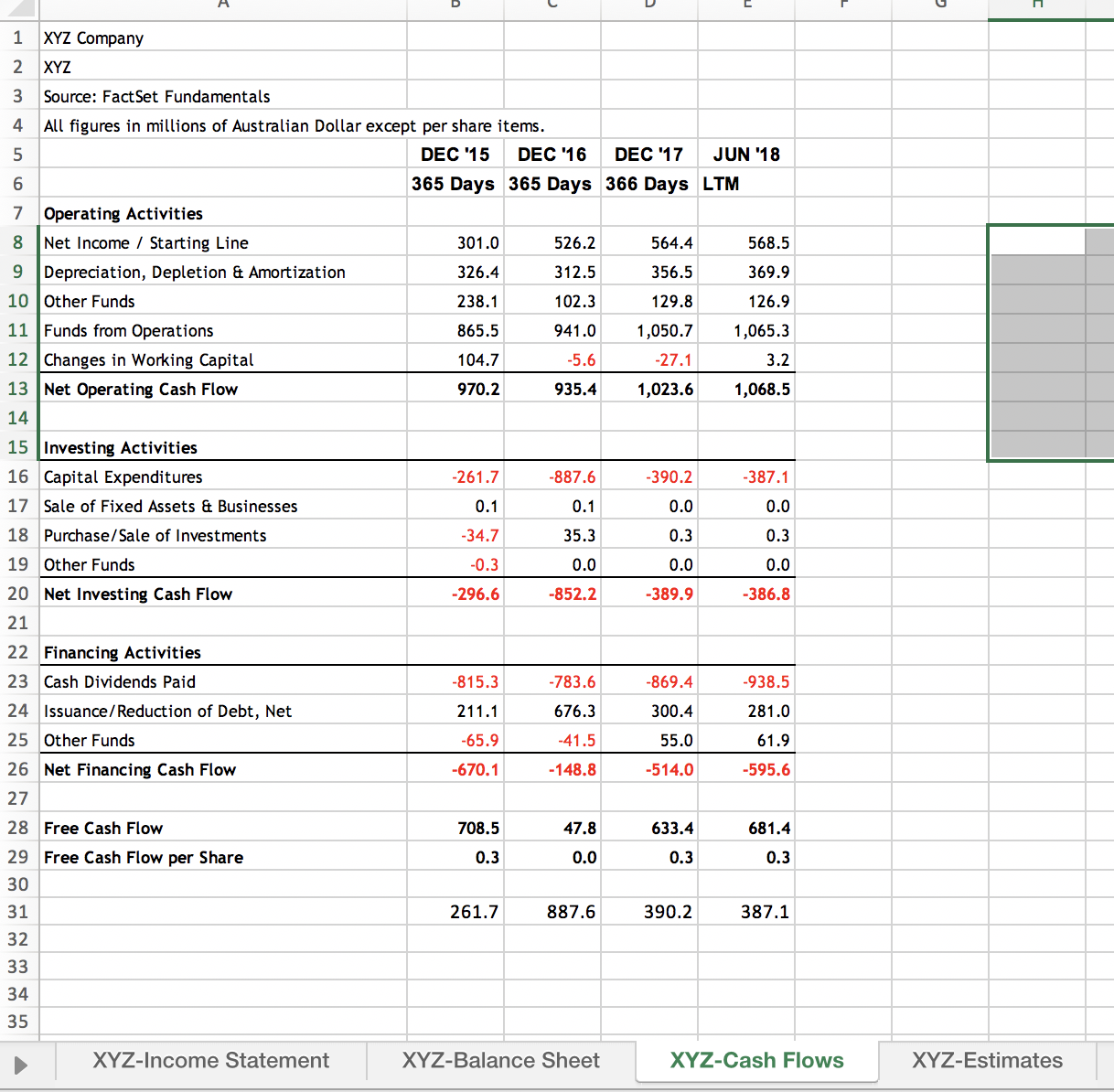

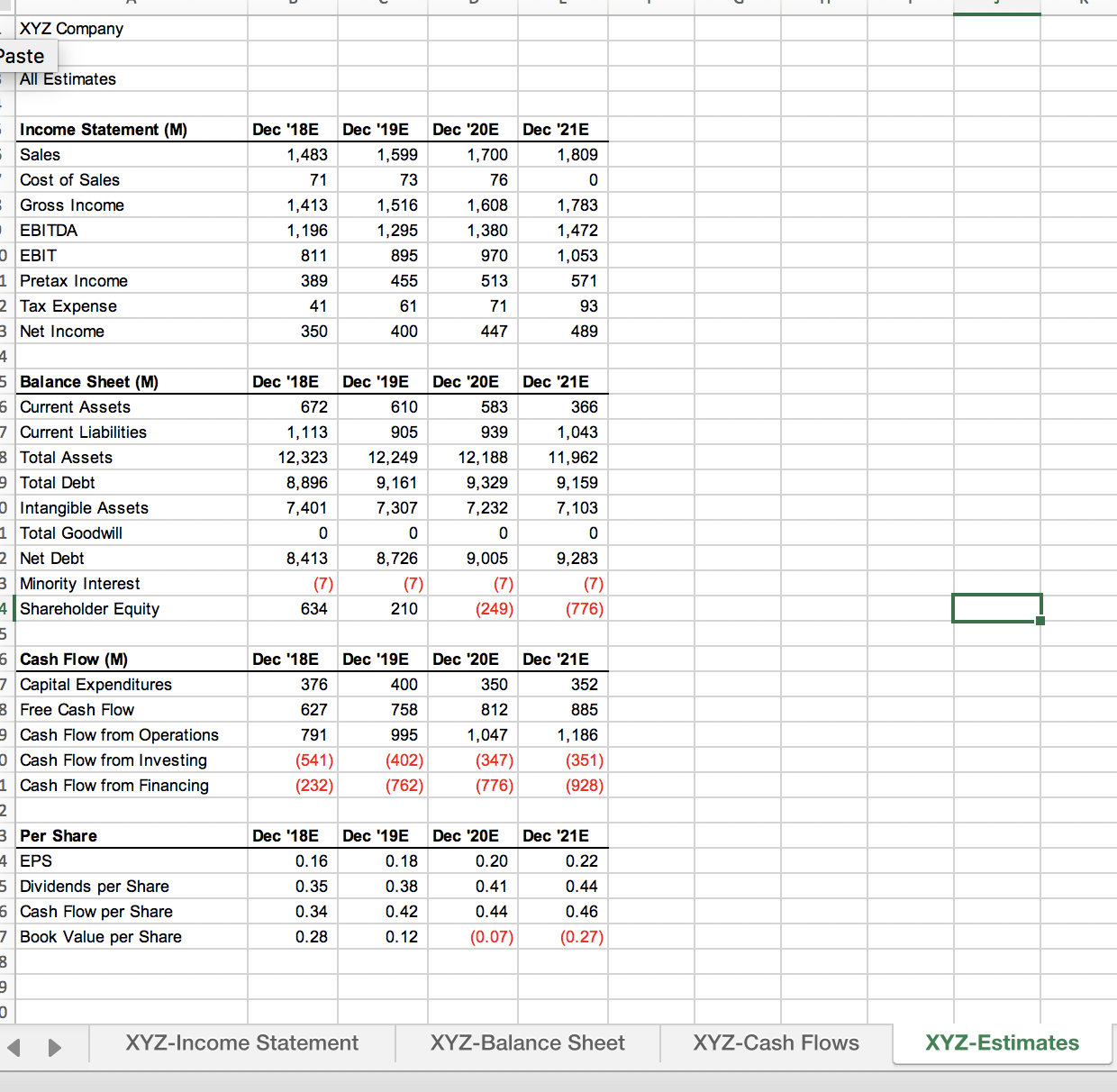

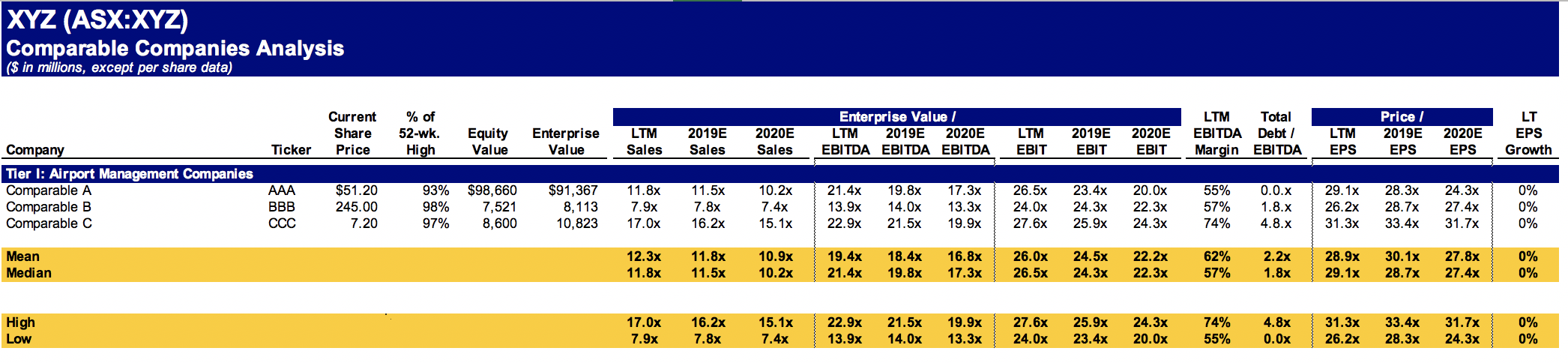

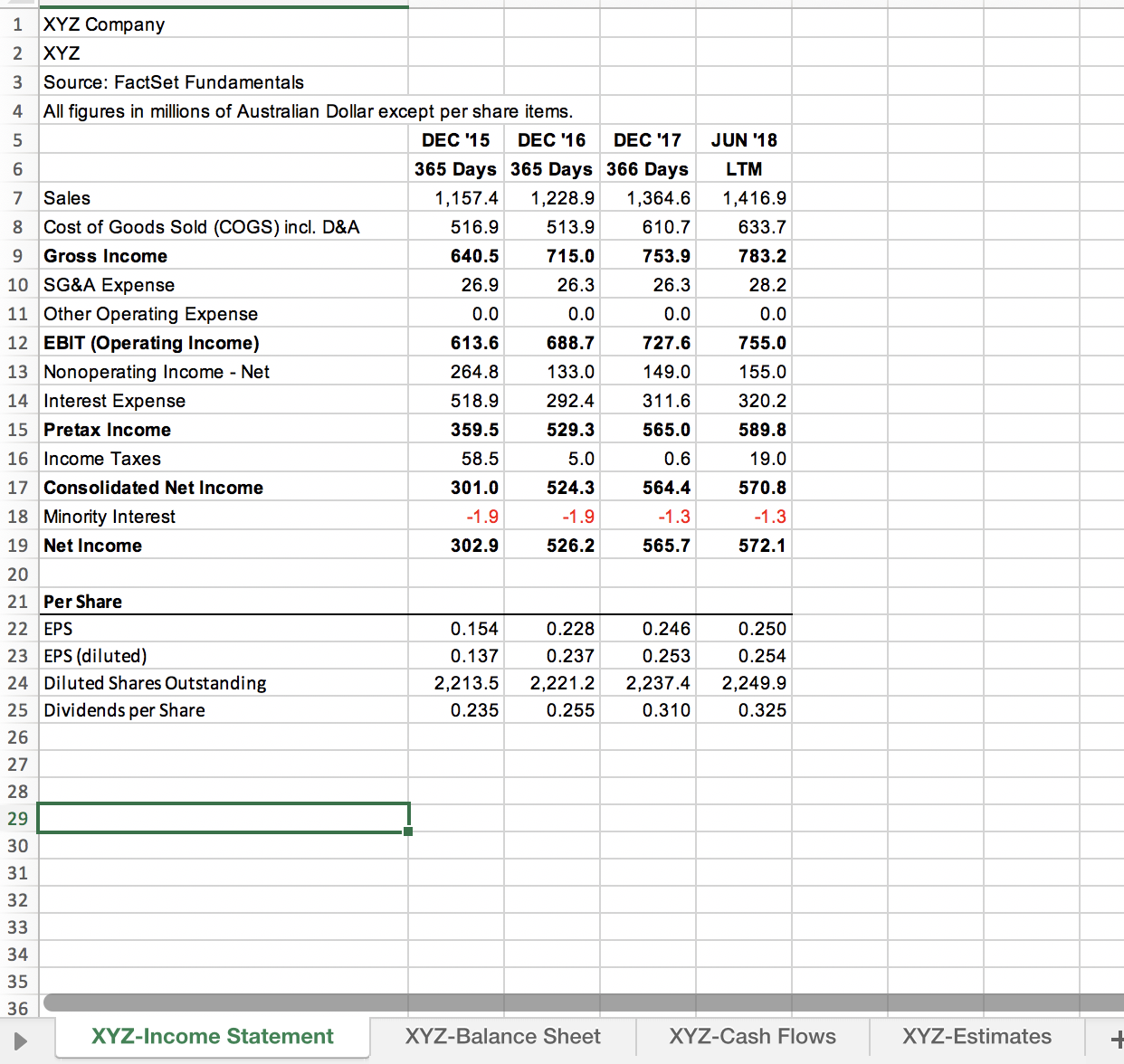

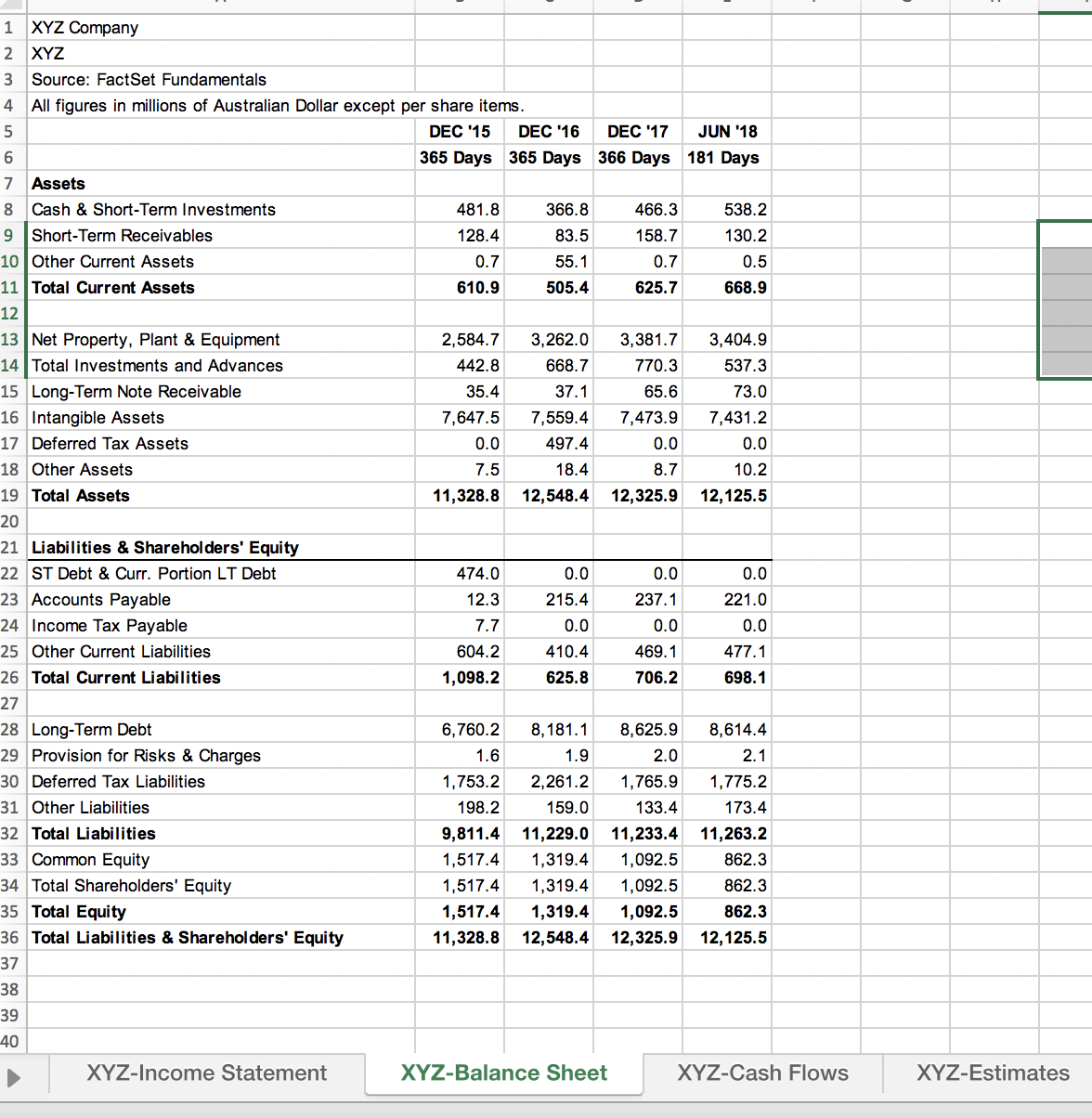

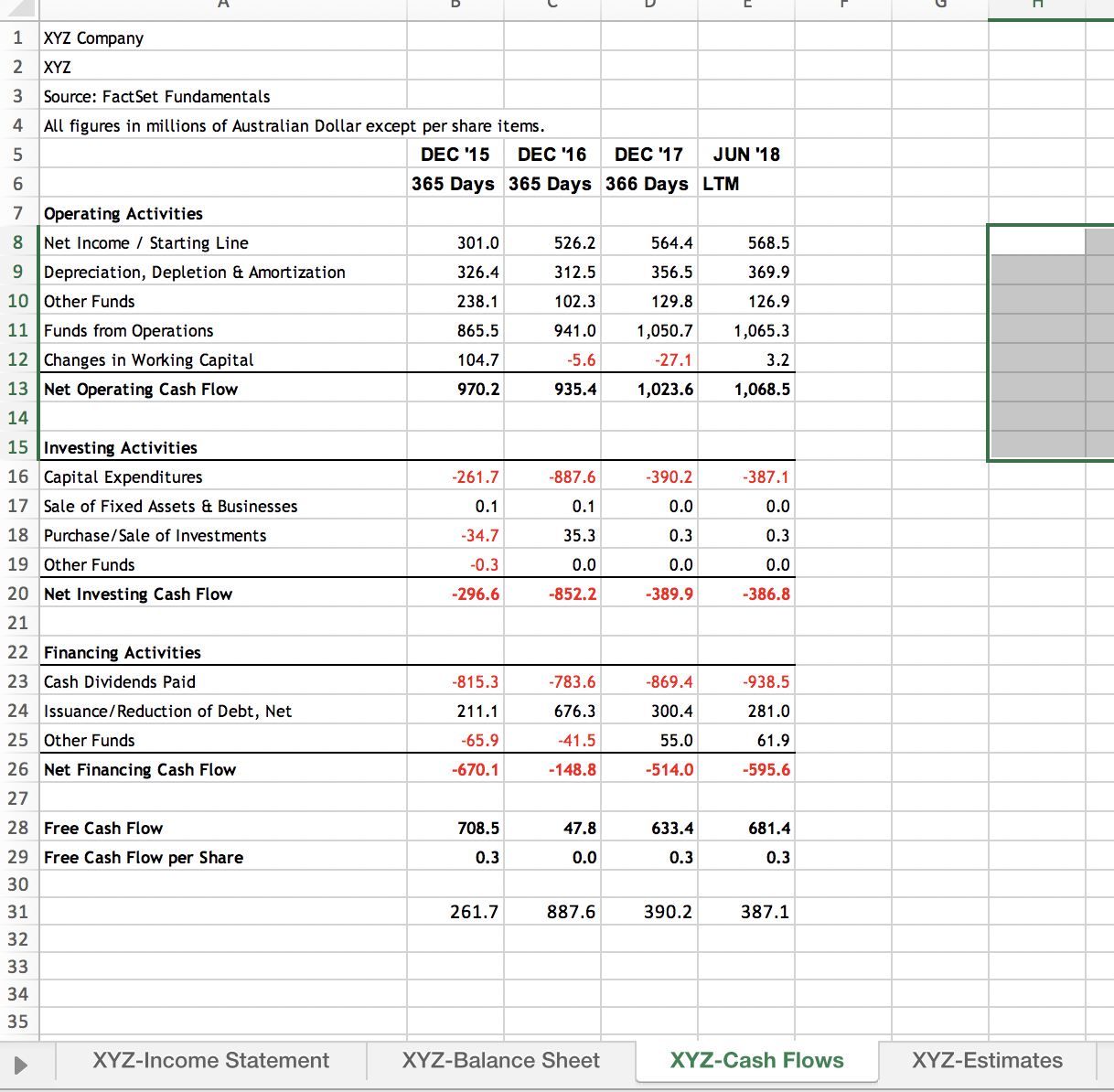

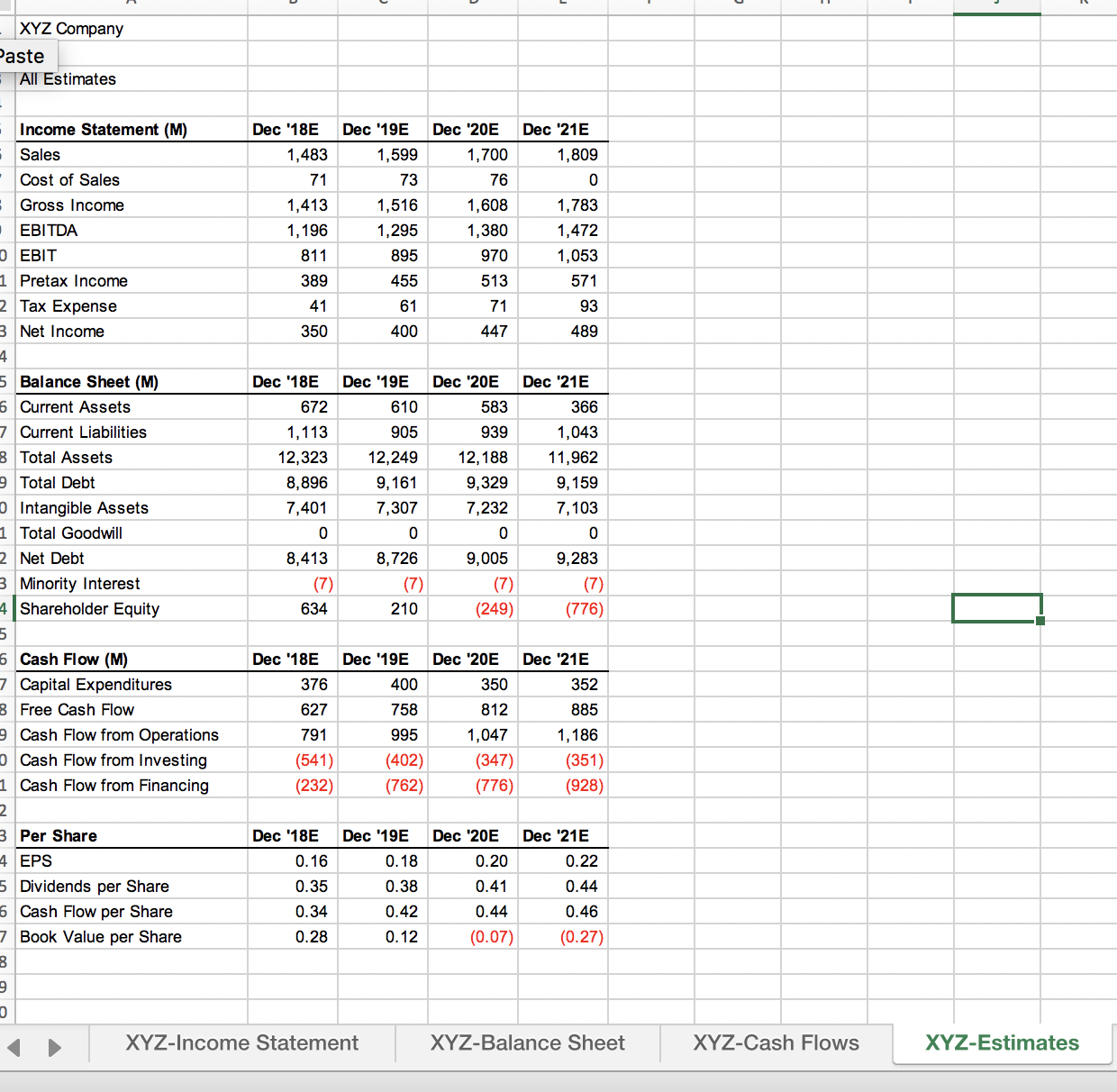

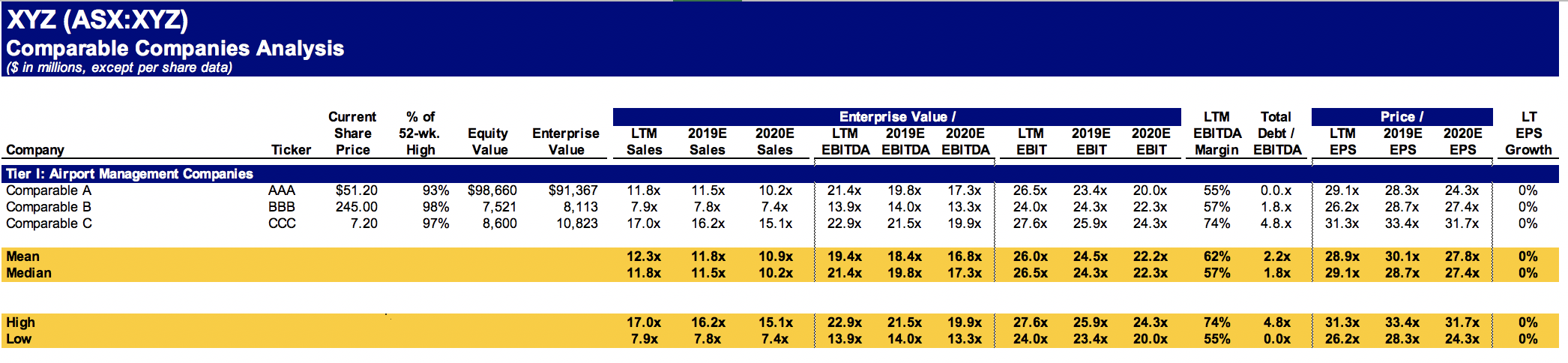

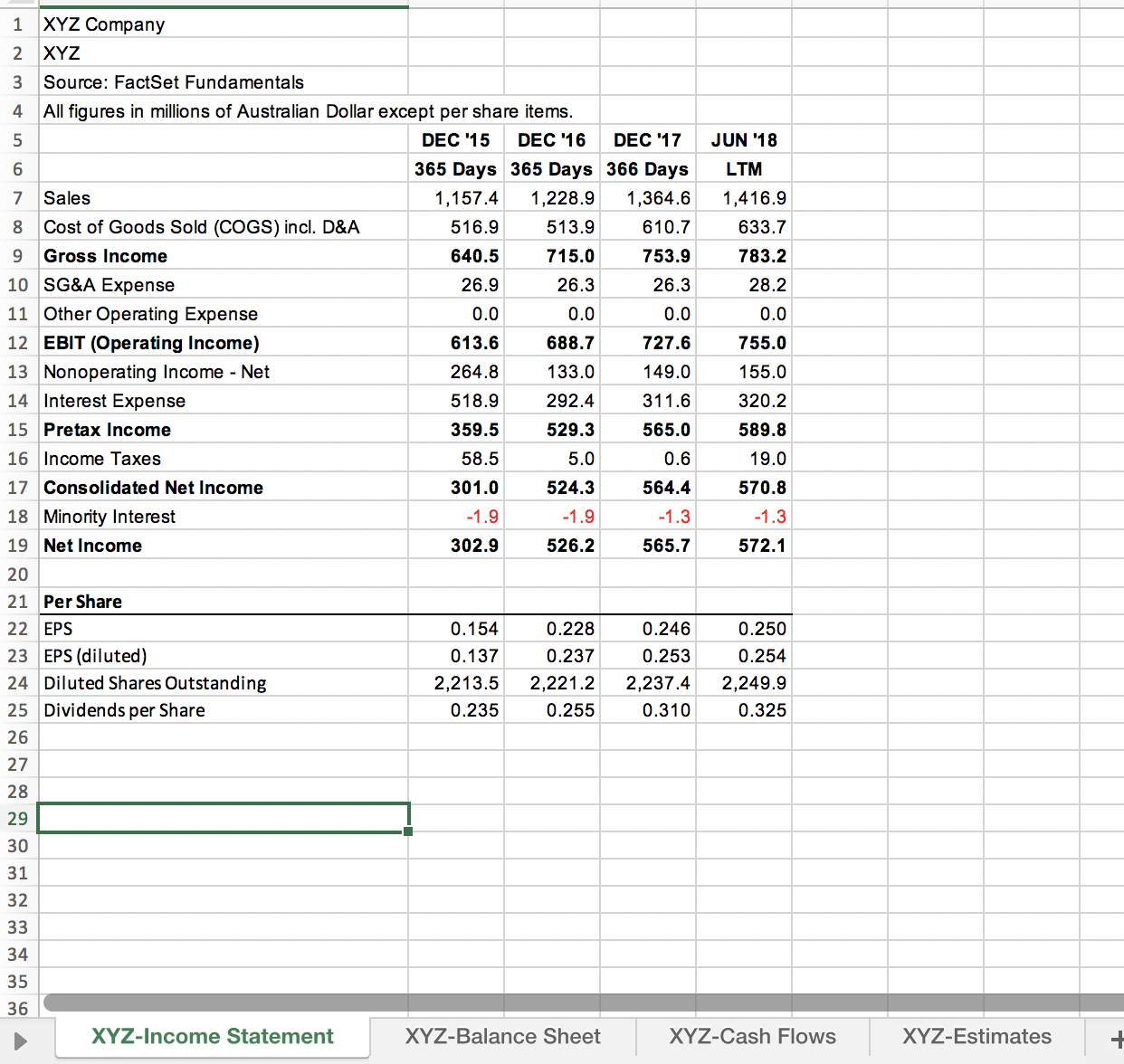

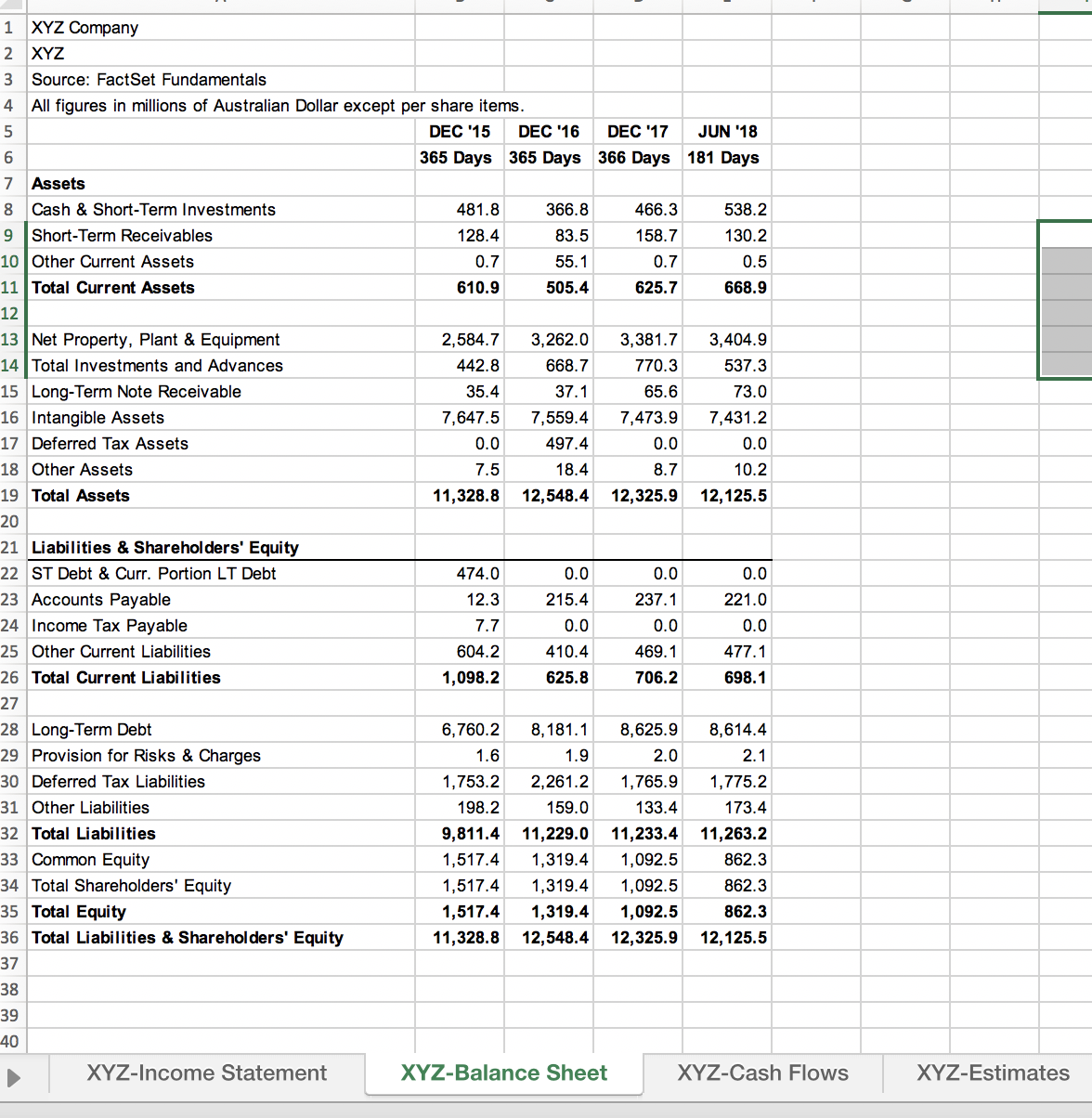

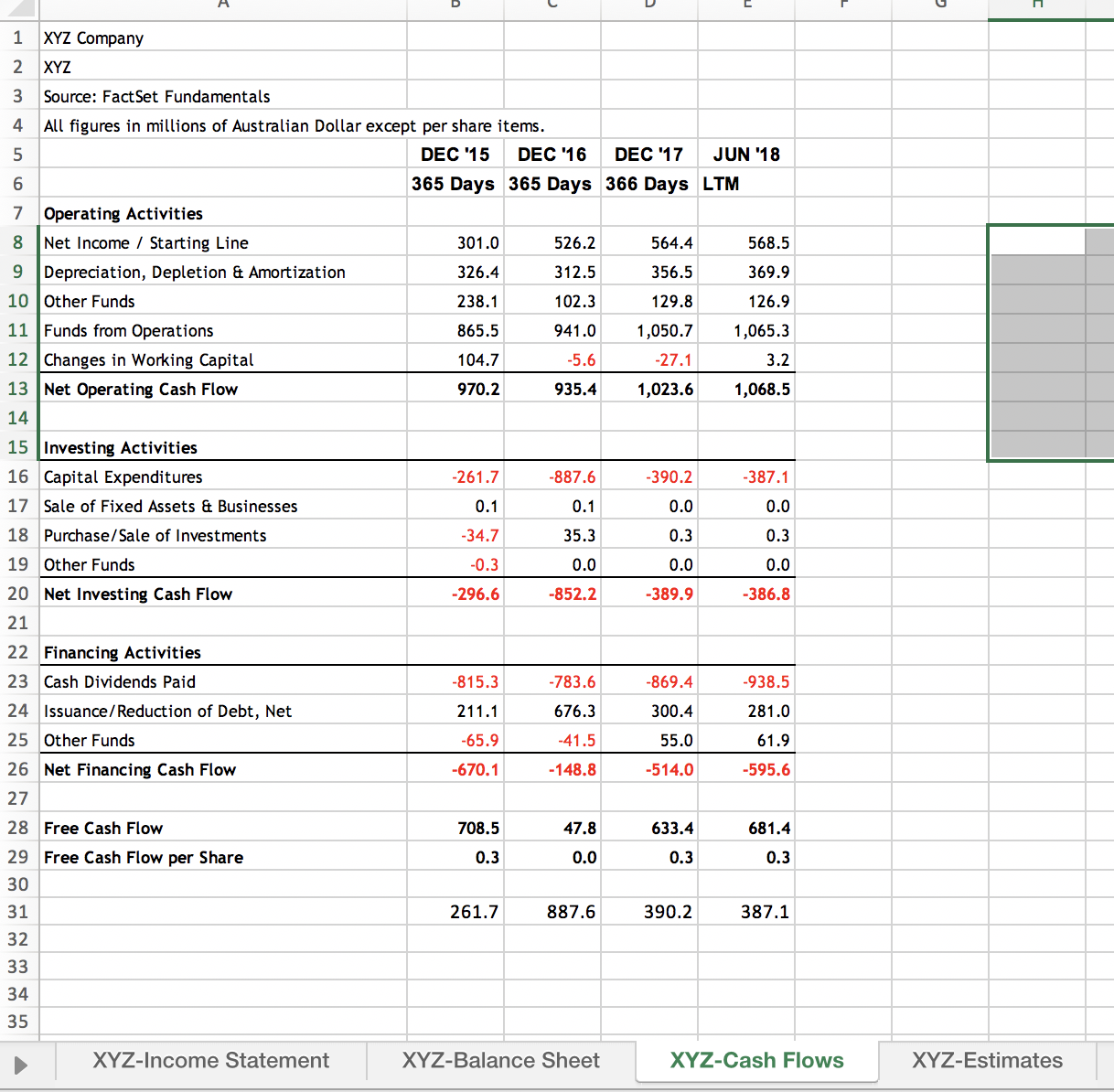

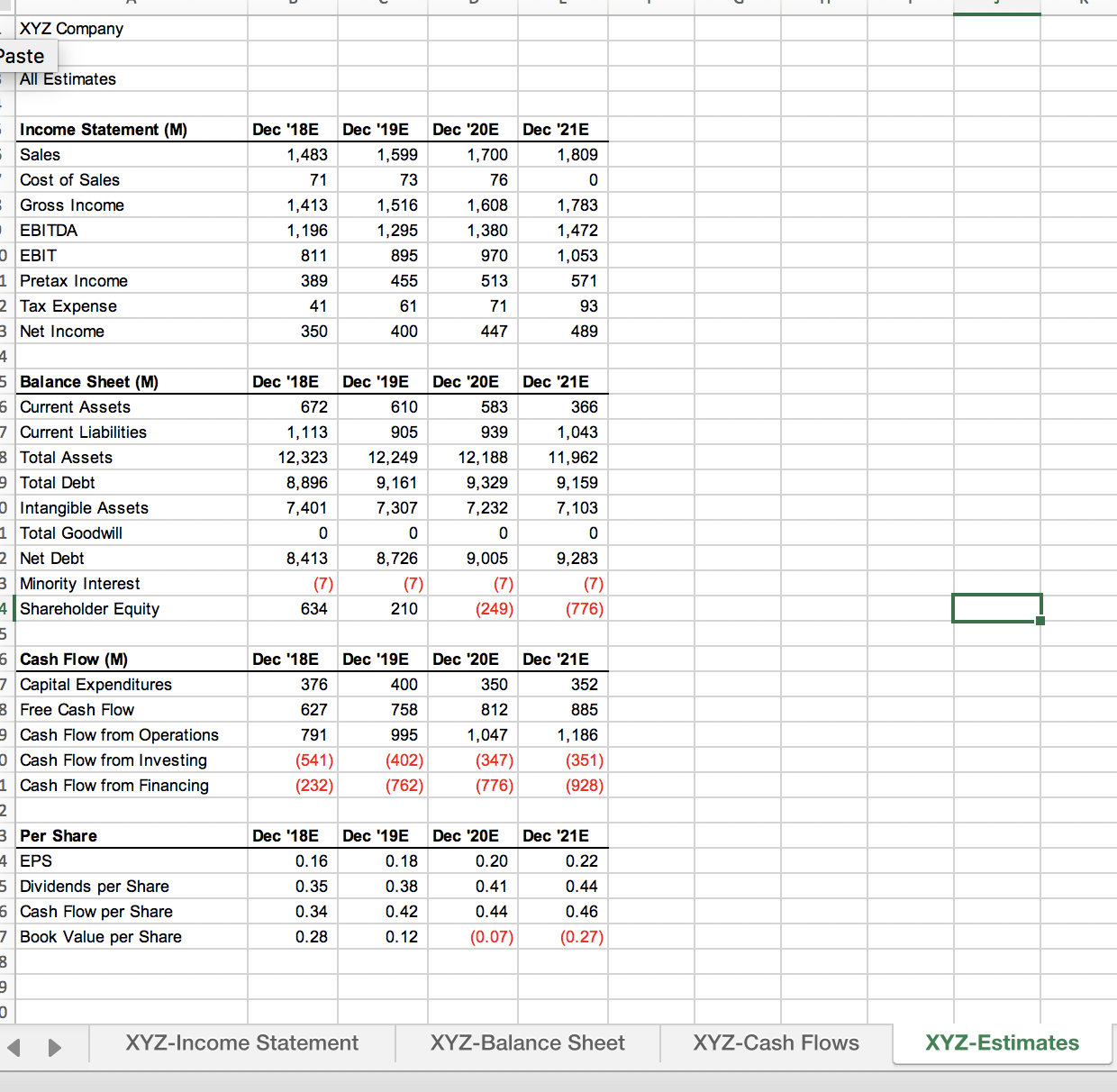

You need to complete a Comparable Companies Analysis for company XYZ. The file Question_3.xlsx has the results (output) of your valuation model. The file Question_3DATA.xlsx has all the relevant data for XYZ downloaded from Factset and presented in the same format used for the CCA tutorial. Assuming that your preferred valuation method is to base your valuation on the 2020 median EV/SALES of your comparables, what would be your valuation (in terms of Enterprise Value) of company XYZ? Please notice that the last accounting information available is at June 2018. Also notice that XYZ closes the fiscal year in December. You do not have to provide a range, but simply a number expressed in millions of dollars with one decimal point and without the dollar sign. For example 10.5 billions of dollars would be 10500.0

3.xlsx

XYZ (ASX:XYZ) Comparable Companies Analysis ($ in millions, except per share data) LT Current % of Enterprise Value / LTM Total Price 2019E 2020E LTM 2019E 2020E LTM 2019E 2020E EBITDA Debt / LTM 2019E 2020E EPS Share 52-wk. Equity Enterprise LTM EBIT EBIT EBIT Margin EBITDA EPS EPS PS Growth Value Sales Sales Sales EBITDA EBITDA EBITDA Company Ticker Price High Value 0.0.X 29.1x 28.3x 24.3X 0% Tier I: Airport Management Companies AAA $51.20 93% $98, 660 $91,367 11.8x 11.5x 10.2x 21.4x 19.8x 17.3x 26.5x 23.4x 20.0x 55% 14.0x 13.3x 24.0x 24.3x 22.3x 57% 1.8.x 26.2x 28.7x 27.4x 0% Comparable A Comparable B BBB 245.00 98% 7.521 8,113 7.9x 7.8x 7.4x 13.9x 33.4x 31.7x 0% 97% 8,600 10,823 17.0x 16.2x 15.1x 22.9x 21.5x 19.9x 27.6x 25.9x 24.3x 74% 4.8.X 31.3x Comparable C CCC 7.20 12.3x 11.8x 10.9x 19.4x 18.4x 16.8x 26.0x 24.5x 22.2x 62% 2.2x 28.9x 30.1x 27.8x 0% 27.4X 0% Mean 11.8x 11.5x 10.2x 21.4x 19.8x 17.3x 26.5x 24.3x 22.3x 57% 1.8x 29.1x 28.7x Median 0% 17.0x 16.2x 15.1x 22.9x 21.5x 19.9x 27.6x 25.9x 24.3x 74% 4.8x 31.3x 33.4x 31.7x 14.0x 13.3x 24.0x 23.4x 20.0x 55% 0.0x 26.2x 28.3x 24.3x 0% High 7.9x 7.8x 7.4x 13.9x Low1 XYZ Company 2 XYZ W Source: FactSet Fundamentals All figures in millions of Australian Dollar except per share items. DEC 15 DEC 16 DEC '17 JUN '18 365 Days 365 Days 366 Days LTM 00 Sales 1, 157.4 1,228.9 1,364.6 1,416.9 Cost of Goods Sold (COGS) incl. D&A 516.9 513.9 610.7 633.7 9 Gross Income 640.5 715.0 753.9 783.2 10 SG&A Expense 26.9 26.3 26.3 28.2 11 Other Operating Expense 0.0 0.0 0.0 0.0 EBIT (Operating Income) 613.6 688.7 727.6 755.0 13 Nonoperating Income - Net 264.8 133.0 149.0 155.0 14 Interest Expense 518.9 292.4 311.6 320.2 15 Pretax Income 359.5 529.3 565.0 589.8 16 Income Taxes 58.5 5.0 0.6 19.0 17 Consolidated Net Income 301.0 524.3 564.4 570.8 18 Minority Interest -1.9 -1.9 -1.3 1.3 19 Net Income 302.9 526.2 565.7 572.1 20 21 Per Share 22 EPS 0.154 0.228 0.246 0.250 23 EPS (diluted) 0.137 0.237 0.253 0.254 24 Diluted Shares Outstanding 2,213.5 2,221.2 2,237.4 2,249.9 25 Dividends per Share 0.235 0.255 0.310 0.325 26 27 28 29 30 31 32 33 34 35 36 XYZ-Income Statement XYZ-Balance Sheet XYZ-Cash Flows XYZ-EstimatesXYZ Company XYZ Source: FactSet Fundamentals All figures in millions of Australian Dollar except per share items DEC 15 DEC '16 6 DEC '17 JUN '18 365 Days 365 Days 366 Days 181 Days Assets Cash & Short-Term Investments 481.8 366.8 466.3 538.2 Short-Term Receivables 128.4 83.5 158.7 130.2 Other Current Assets 0.7 55.1 0.7 0.5 Total Current Assets 610.9 505.4 625.7 668.9 12 13 Net Property, Plant & Equipment 2,584.7 3,262.0 3,381.7 3,404.9 14 Total Investments and Advances 442.8 668.7 770.3 537.3 15 Long-Term Note Receivable 35.4 37.1 65.6 73.0 16 Intangible Assets 7,647.5 7,559.4 7,473.9 7,431.2 17 Deferred Tax Assets 0.0 497.4 0.0 18 Other Assets 7.5 18.4 8.7 10.2 Total Assets 11,328.8 12,548.4 12,325.9 12, 125.5 20 21 Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt 474.0 0.0 0.0 0.0 23 Accounts Payable 12.3 215.4 237.1 221.0 24 Income Tax Payable 7.7 0.0 0.0 0.0 Other Current Liabilities 604.2 410.4 469.1 477.1 26 Total Current Liabilities 1,098.2 625.8 706.2 698.1 27 28 Long-Term Debt 6,760.2 8, 181. 1 8,625.9 8,614.4 29 Provision for Risks & Charges 1.6 1.9 2.0 2.1 30 Deferred Tax Liabilities 1,753.2 2,261.2 1,765.9 1,775.2 Other Liabilities 198.2 159.0 133.4 173.4 32 Total Liabilities 9,811.4 11,229.0 11,233.4 11,263.2 Common Equity 1,517.4 1,319.4 1,092.5 862.3 4 Total Shareholders' Equity 1,517.4 1,319.4 1,092.5 862.3 35 Total Equity 1,517.4 1,319.4 1,092.5 862.3 36 Total Liabilities & Shareholders' Equity 11,328.8 12,548.4 12,325.9 12, 125.5 37 38 39 40 XYZ-Income Statement XYZ-Balance Sheet XYZ-Cash Flows XYZ-Estimates1 XYZ Company W N XYZ Source: FactSet Fundamentals All figures in millions of Australian Dollar except per share items. DEC 15 DEC 16 DEC '17 JUN '18 365 Days 365 Days 366 Days LTM Operating Activities 4 00 Net Income / Starting Line 301.0 526.2 564.4 568.5 Depreciation, Depletion & Amortization 326.4 312.5 356.5 369.9 10 Other Funds 238.1 102.3 129.8 126.9 11 Funds from Operations 865.5 941.0 1,050.7 1,065.3 12 Changes in Working Capital 104.7 5.6 .27.1 3.2 13 Net Operating Cash Flow 970.2 935.4 1,023.6 1,068.5 14 15 Investing Activities 16 Capital Expenditures 261.7 887.6 -390.2 -387.1 17 Sale of Fixed Assets & Businesses 0.1 0.1 0.0 0.0 18 Purchase/Sale of Investments -34.7 35.3 0.3 0.3 19 Other Funds 0.3 0.0 0.0 0.0 20 Net Investing Cash Flow -296.6 -852.2 -389.9 -386.8 21 22 Financing Activities 23 Cash Dividends Paid 815.3 783.6 869.4 938.5 24 Issuance/ Reduction of Debt, Net 211.1 676.3 300.4 281.0 25 Other Funds -65.9 41.5 55.0 61.9 26 Net Financing Cash Flow 670.1 -148.8 -514.0 -595.6 27 28 Free Cash Flow 708.5 47.8 633.4 681.4 29 Free Cash Flow per Share 0.3 0.0 0.3 0.3 30 31 261.7 887.6 390.2 387.1 32 33 34 35 XYZ-Income Statement XYZ-Balance Sheet XYZ-Cash Flows XYZ-EstimatesXYZ Company Paste All Estimates Income Statement (M) Dec '18E Dec 19E Dec '20E Dec '21E Sales 1,483 1,599 1,700 1,809 Cost of Sales 71 73 76 Gross Income 1,413 1,516 1,608 1,783 EBITDA 1, 196 1,295 1,380 1,472 EBIT 811 895 970 1,053 Pretax Income 389 455 513 571 Tax Expense 41 61 71 93 Net Income 350 400 447 489 Balance Sheet (M) Dec '18E Dec '19E Dec '20E Dec '21E Current Assets 672 610 583 366 Current Liabilities 1, 113 905 939 1,043 Total Assets 12,323 12,249 12, 188 11,962 Total Debt 8,896 9, 161 9,329 9, 159 Intangible Assets 7,401 7,307 7,232 7, 103 Total Goodwill Net Debt 8,413 8,726 9,005 9,283 Minority Interest (7) Shareholder Equity 634 210 249 (776 Cash Flow (M Dec '18E Dec '19E Dec '20E Dec '21E Capital Expenditures 376 400 350 352 Free Cash Flow 627 758 812 885 Cash Flow from Operations 791 995 1,047 1, 186 Cash Flow from Investing (541) (402 (347 (351) Cash Flow from Financing 232) (762) 776) (928) Per Share Dec '18E Dec '19E Dec '20E Dec '21E EPS 0. 16 0. 18 0.20 0.22 Dividends per Share 0.35 0.38 0.41 0.44 Cash Flow per Share 0.34 0.42 0.44 .46 Book Value per Share 0.28 0.12 (0.07) (0.27) XYZ-Income Statement XYZ-Balance Sheet XYZ-Cash Flows XYZ-Estimates