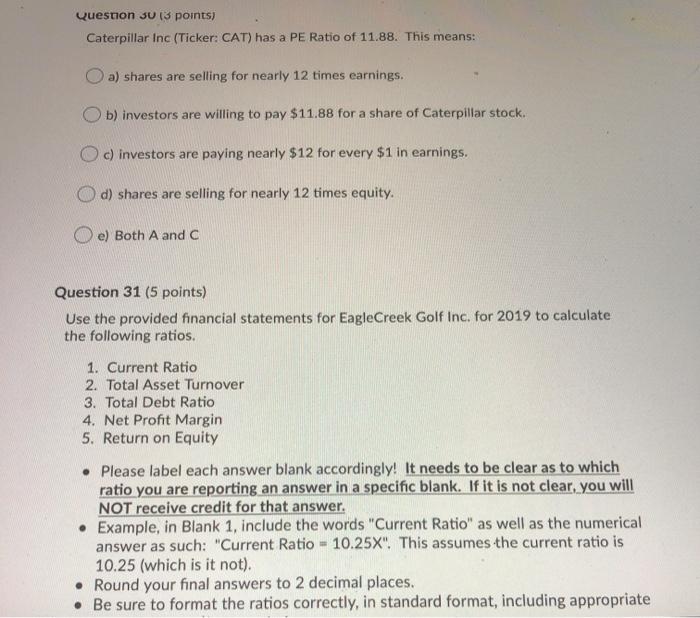

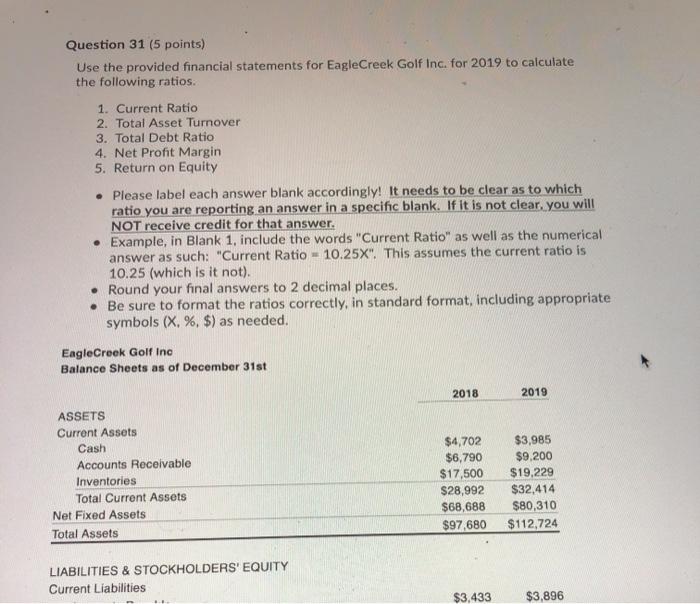

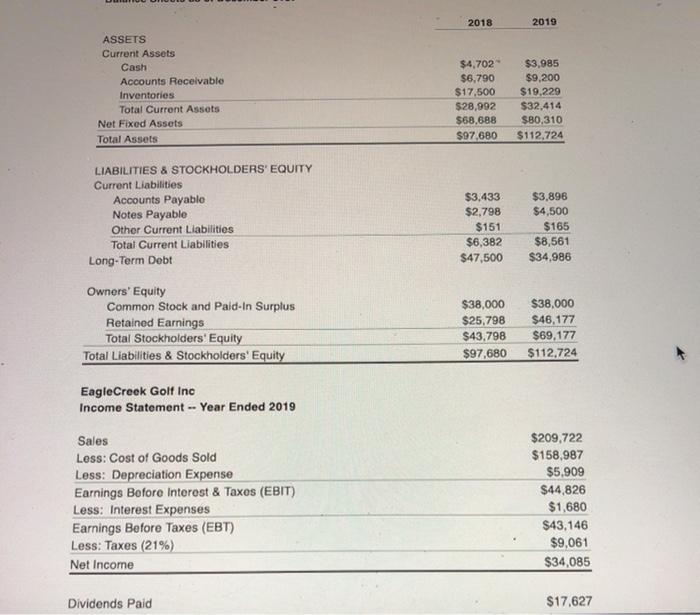

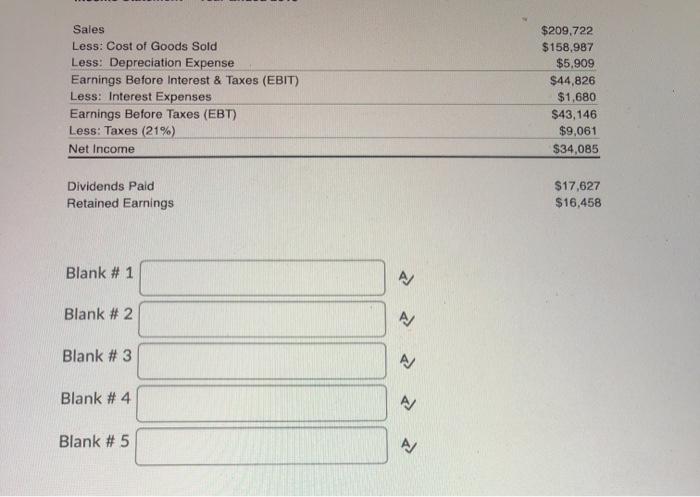

Question 30 13 points) Caterpillar Inc (Ticker: CAT) has a PE Ratio of 11.88. This means: a) shares are selling for nearly 12 times earnings. b) investors are willing to pay $11.88 for a share of Caterpillar stock. Oc) investors are paying nearly $12 for every $1 in earnings. d) shares are selling for nearly 12 times equity. e) Both A and C Question 31 (5 points) Use the provided financial statements for EagleCreek Golf Inc. for 2019 to calculate the following ratios. 1. Current Ratio 2. Total Asset Turnover 3. Total Debt Ratio 4. Net Profit Margin 5. Return on Equity Please label each answer blank accordingly! It needs to be clear as to which ratio you are reporting an answer in a specific blank. If it is not clear, you will NOT receive credit for that answer. Example, in Blank 1, include the words "Current Ratio" as well as the numerical answer as such: "Current Ratio - 10.25X". This assumes the current ratio is 10.25 (which is it not). Round your final answers to 2 decimal places. Be sure to format the ratios correctly, in standard format, including appropriate Question 31 (5 points) Use the provided financial statements for EagleCreek Golf Inc. for 2019 to calculate the following ratios. 1. Current Ratio 2. Total Asset Turnover 3. Total Debt Ratio 4. Net Profit Margin 5. Return on Equity . Please label each answer blank accordingly! It needs to be clear as to which ratio you are reporting an answer in a specific blank. If it is not clear, you will NOT receive credit for that answer. Example, in Blank include the words "Current Ratio" as well as the numerical answer as such: "Current Ratio - 10.25X". This assumes the current ratio is 10.25 (which is it not). Round your final answers to 2 decimal places. Be sure to format the ratios correctly, in standard format, including appropriate symbols (X, %, $) as needed. EagleCreek Golf Inc Balance Sheets as of December 31st 2018 2019 ASSETS Current Assets Cash Accounts Receivable Inventories Total Current Assets Net Fixed Assets Total Assets $4,702 $6,790 $17,500 $28,992 $68,688 $97,680 $3,985 $9,200 $19,229 $32,414 $80,310 $112,724 LIABILITIES & STOCKHOLDERS' EQUITY Current Liabilities $3,433 $3,896 2018 2019 ASSETS Current Assets Cash Accounts Receivable Inventories Total Current Assets Net Fixed Assets Total Assets $4,702 $6.790 $17.500 $28.992 $68.688 $97.680 $3,985 $9,200 $19.229 $32,414 $80.310 $112,724 LIABILITIES & STOCKHOLDERS' EQUITY Current Liabilities Accounts Payablo Notes Payable Other Current Liabilities Total Current Liabilities Long-Term Debt $3,433 $2,798 $151 $6,382 $47,500 $3,896 $4,500 $165 $8,561 $34.986 Owners' Equity Common Stock and Paid-In Surplus Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity $38,000 $25,798 $43,798 $97,680 $38,000 $46,177 $69, 177 $112,724 Eagle Creek Golf Inc Income Statement -- Year Ended 2019 Sales Less: Cost of Goods Sold Less: Depreciation Expense Earnings Before Interest & Taxos (EBIT) Less: Interest Expenses Earnings Before Taxes (EBT) Less: Taxes (21%) Net Income $209,722 $158,987 $5.909 $44,826 $1,680 $43,146 $9,061 $34,085 Dividends Paid $17.627 Sales Less: Cost of Goods Sold Less: Depreciation Expense Earnings Before Interest & Taxes (EBIT) Less: Interest Expenses Earnings Before Taxes (EBT) Less: Taxes (21%) Net Income $209,722 $158,987 $5,909 $44,826 $1,680 $43,146 $9,061 $34,085 Dividends Paid Retained Earnings $17,627 $16,458 Blank # 1 AM Blank # 2 Blank # 3 Blank #4 Blank # 5 A