Question

Question 30, E3-22 (similar to) HW Score: 66.82%,23.39 of 35 points Part 1 of 5 Points: 0 of 1 Consider the following independent situations at

Question 30, E3-22 (similar to)\ HW Score:

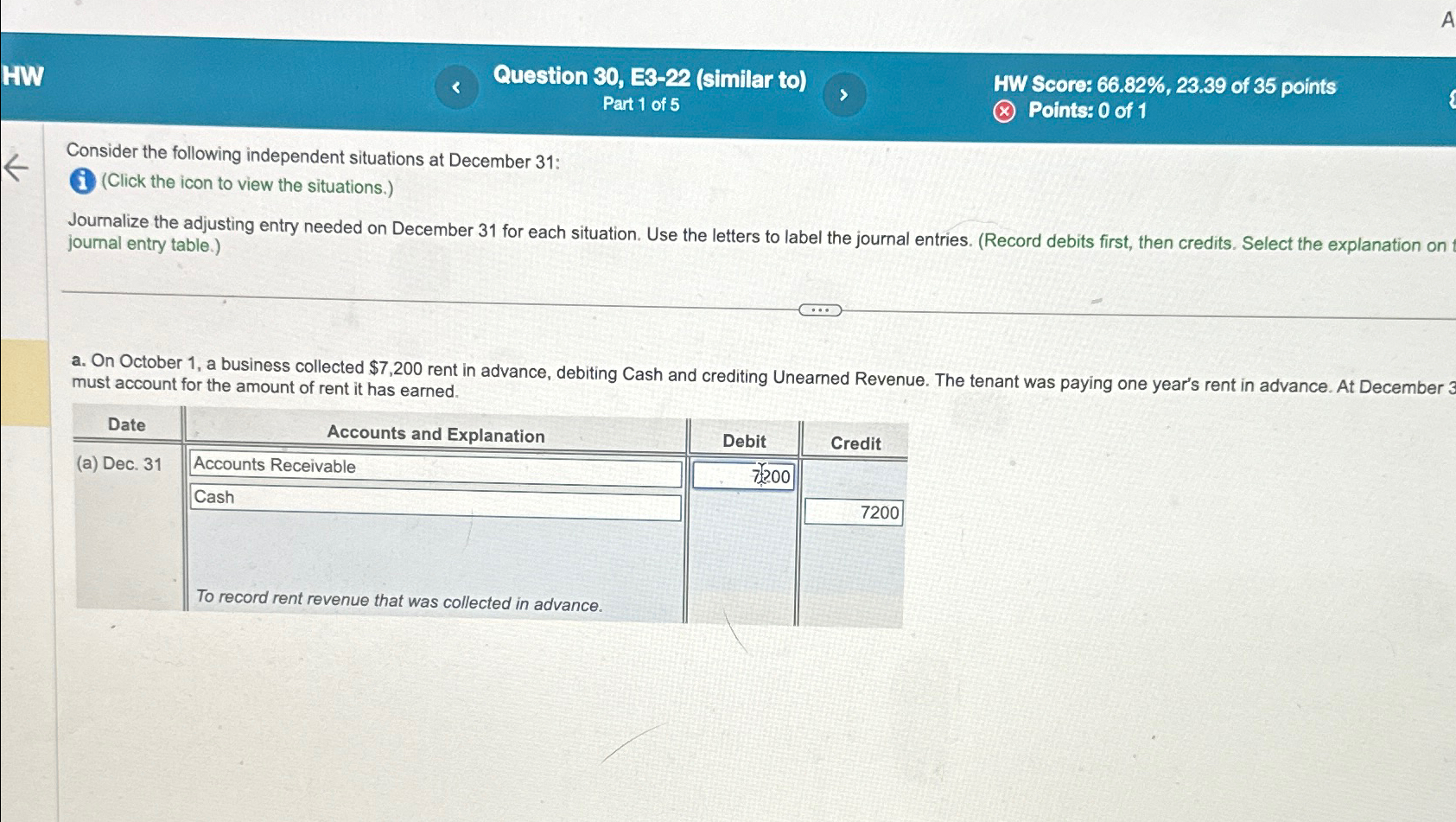

66.82%,23.39of 35 points\ Part 1 of 5\ Points: 0 of 1\ Consider the following independent situations at December 31:\ (Click the icon to view the situations.)\ Journalize the adjusting entry needed on December 31 for each situation. Use the letters to label the journal entries. (Record debits first, then credits. Select the explanation on journal entry table.)\ a. On October 1, a business collected

$7,200rent in advance, debiting Cash and crediting Unearned Revenue. The tenant was paying one year's rent in advance. At December 3 must account for the amount of rent it has earned.\ \\\\table[[Date,Accounts and Explanation,Debit,Credit],[(a) Dec. 31,Accounts Receivable,72000,],[Cash,,7200],[To record rent revenue that was collected in advance.,,]]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started