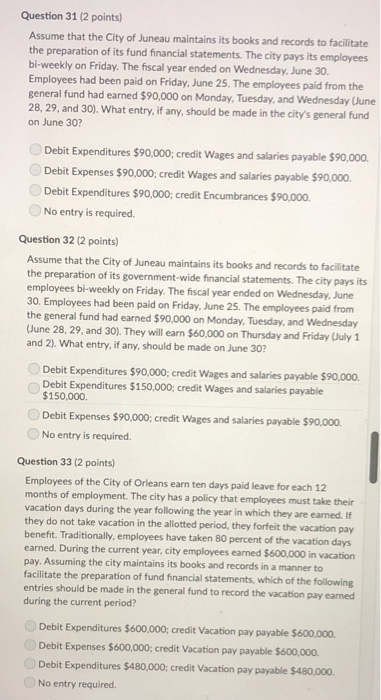

Question 31 (2 points) Assume that the City of Juneau maintains its books and records to facilitate the preparation of its fund financial statements. The city pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30 Employees had been paid on Friday, June 25. The employees paid from the general fund had earned $90,000 on Monday, Tuesday, and Wednesday Uune 28, 29, and 30). What entry, if any, should be made in the city's general fund on June 30? Debit Expenditures $90,000; credit Wages and salaries payable $90,000 Debit Expenses $90,000; credit Wages and salaries payable $90,000 Debit Expenditures $90,000; credit Encumbrances $90,000. No entry is required. Question 32 (2 points) Assume that the City of Juneau maintains its books and records to facilitate the preparation of its government-wide financial statements. The city pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30. Employees had been paid on Friday, June 25. The employees paid from the general fund had earned $90,000 on Monday. Tuesday, and Wednesday Uune 28, 29, and 30). They will earn $60,000 on Thursday and Friday Uuly 1 and 2). What entry, if any, should be made on June 30? Debit Expenditures $90,.000, credit Wages and salaries payable $90,00o. Debit Expenditures $150,000, credit Wages and salaries payable $150,000. Debit Expenses $90,000; credit Wages and salaries payable $90,000 No entry is required. Question 33 (2 points) Employees of the City of Orleans earn ten days paid leave for each 12 months of employment. The city has a policy that employees must take their vacation days during the year following the year in which they are earned. If they do not take vacation in the allotted period, they forfeit the vacation pay benefit. Traditionally, employees have taken 80 percent of the vacation days earned. During the current year, city employees earned $ pay. Assuming the city maintains its books and records in a manner to facilitate the preparation of fund financial statements, which of the following entries should be made in the general fund to record the vacation pay earned during the current period? 600,000 in vacation Debit Expenditures $600,000, credit Vacation pay payable $600,000. Debit Expenses $600,000; credit Vacation pay payable $600,000 Debit Expenditures $480,000; credit Vacation pay payable $480,000. No entry required