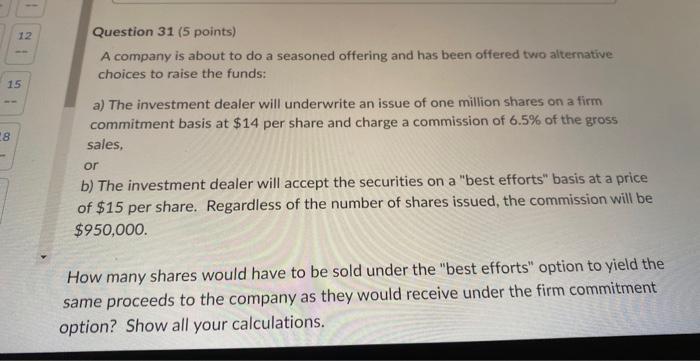

Question: Question 31 (5 points) A company is about to do a seasoned offering and has been offered two alternative choices to raise the funds: a)

Question 31 (5 points) A company is about to do a seasoned offering and has been offered two alternative choices to raise the funds: a) The investment dealer will underwrite an issue of one million shares on a firm commitment basis at $14 per share and charge a commission of 6.5% of the gross sales, or b) The investment dealer will accept the securities on a "best efforts" basis at a price of $15 per share. Regardless of the number of shares issued, the commission will be $950,000. low many shares would have to be sold under the "best efforts" option to yield the me proceeds to the company as they would receive under the firm commitment tion? Show all your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts