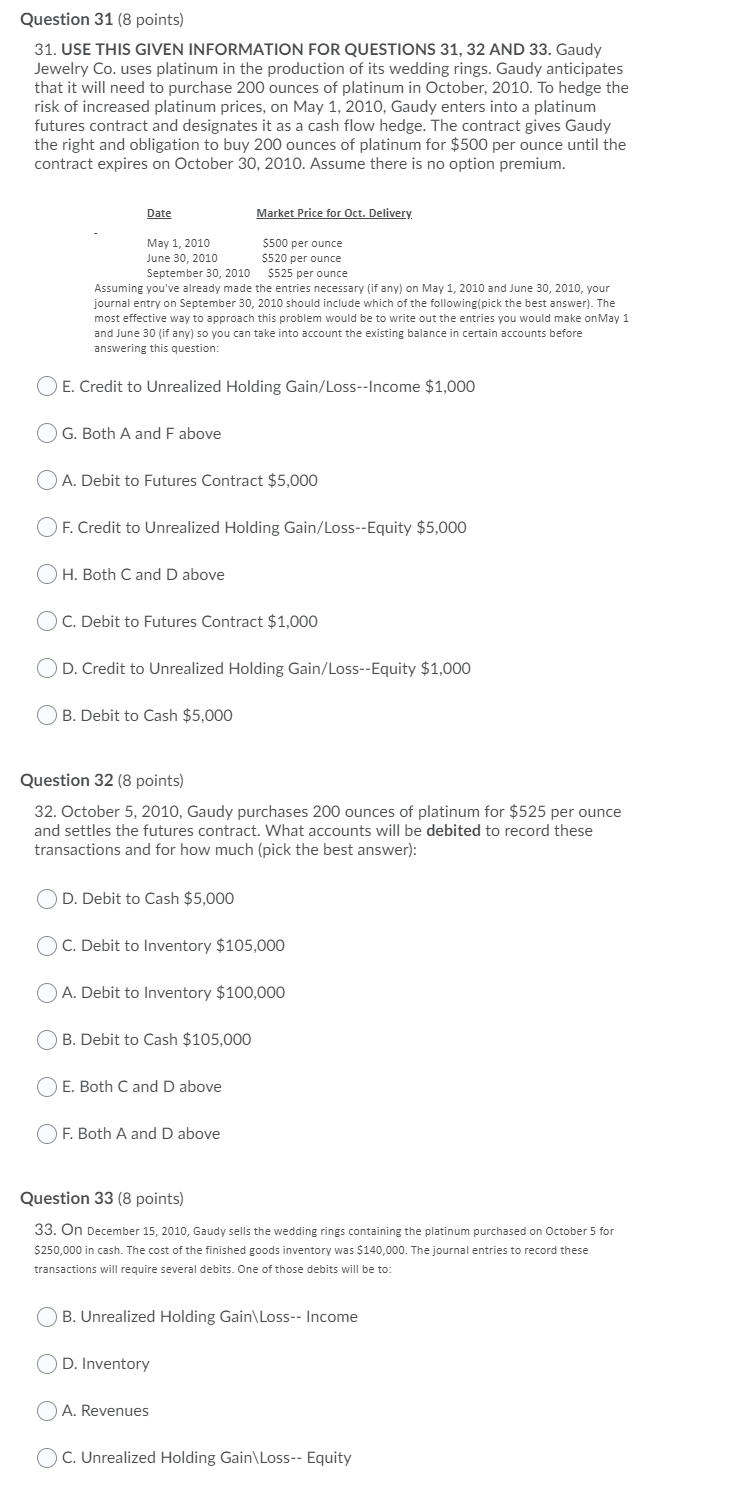

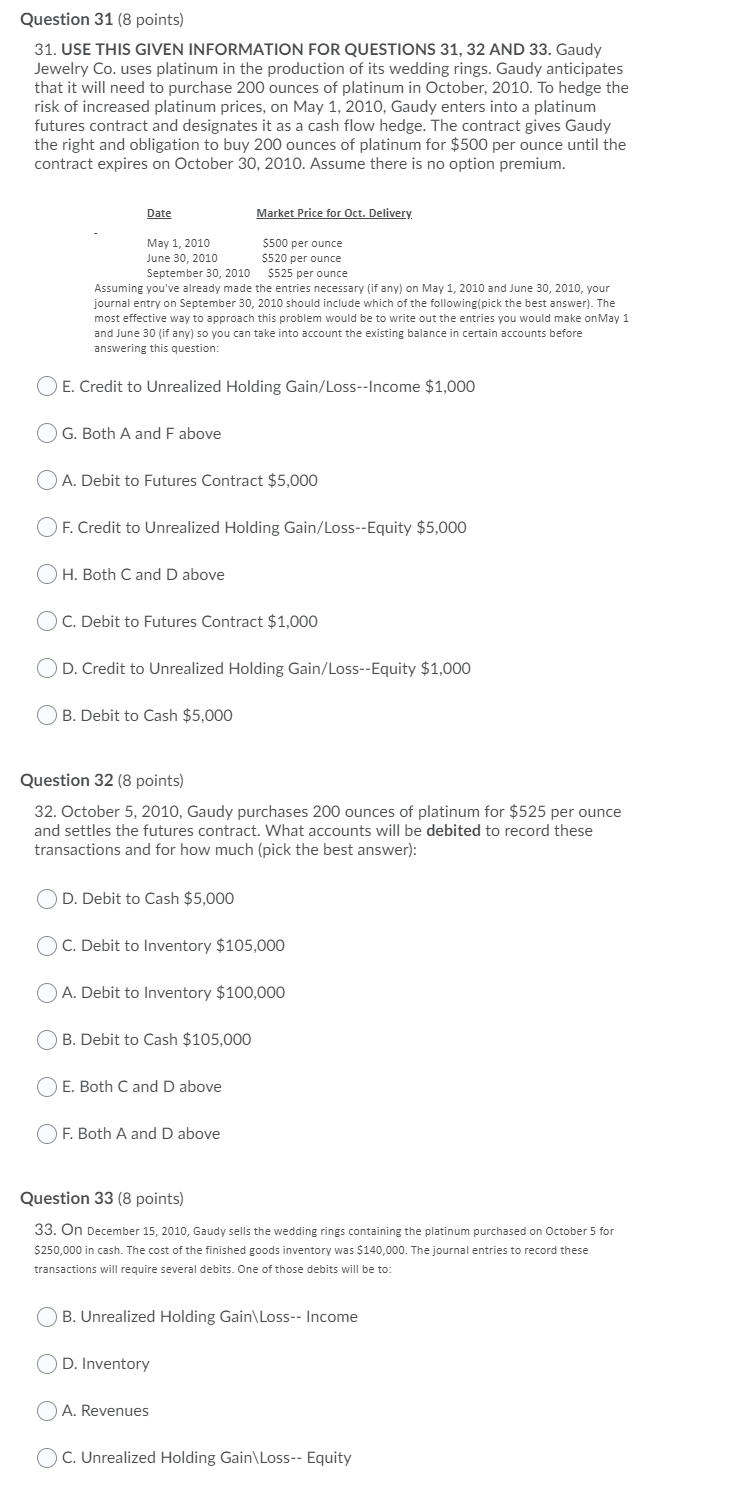

Question 31 (8 points) 31. USE THIS GIVEN INFORMATION FOR QUESTIONS 31, 32 AND 33. Gaudy Jewelry Co. uses platinum in the production of its wedding rings. Gaudy anticipates that it will need to purchase 200 ounces of platinum in October, 2010. To hedge the risk of increased platinum prices, on May 1, 2010, Gaudy enters into a platinum futures contract and designates it as a cash flow hedge. The contract gives Gaudy the right and obligation to buy 200 ounces of platinum for $500 per ounce until the contract expires on October 30, 2010. Assume there is no option premium. Date Market Price for Oct. Delivery May 1, 2010 $500 per ounce June 30, 2010 S520 per ounce September 30, 2010 $525 per ounce Assuming you've already made the entries necessary (if any) on May 1, 2010 and June 30, 2010, your journal entry on September 30, 2010 should include which of the following pick the best answer). The most effective way to approach this problem would be to write out the entries you would make on May 1 and June 30 (if any) so you can take into account the existing balance in certain accounts before answering this question: E. Credit to Unrealized Holding Gain/Loss--Income $1,000 G. Both A and F above O A. Debit to Futures Contract $5,000 OF. Credit to Unrealized Holding Gain/Loss--Equity $5,000 OH. Both C and D above C. Debit to Futures Contract $1,000 O O D. Credit to Unrealized Holding Gain/Loss--Equity $1,000 B. Debit to Cash $5,000 Question 32 (8 points) 32. October 5, 2010, Gaudy purchases 200 ounces of platinum for $525 per ounce and settles the futures contract. What accounts will be debited to record these transactions and for how much (pick the best answer): OD. Debit to Cash $5,000 C. Debit to Inventory $105,000 A. Debit to Inventory $100,000 B. Debit to Cash $105,000 E. Both C and D above OF. Both A and D above Question 33 (8 points) 33. On December 15, 2010, Gaudy sells the wedding rings containing the platinum purchased on October 5 for $250,000 in cash. The cost of the finished goods inventory was $140,000. The journal entries to record these transactions will require several debits. One of those debits will be to: B. Unrealized Holding Gain Loss-- Income D. Inventory A. Revenues OC. Unrealized Holding Gain Loss-- Equity