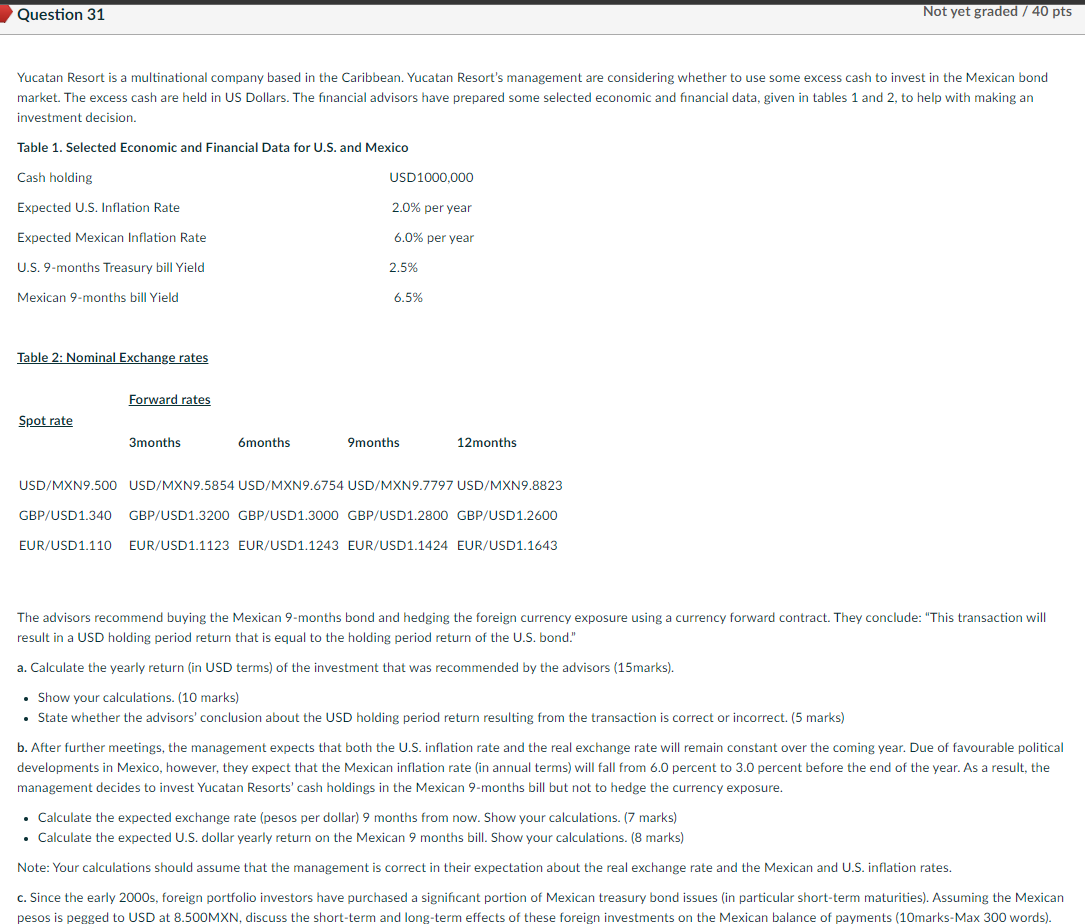

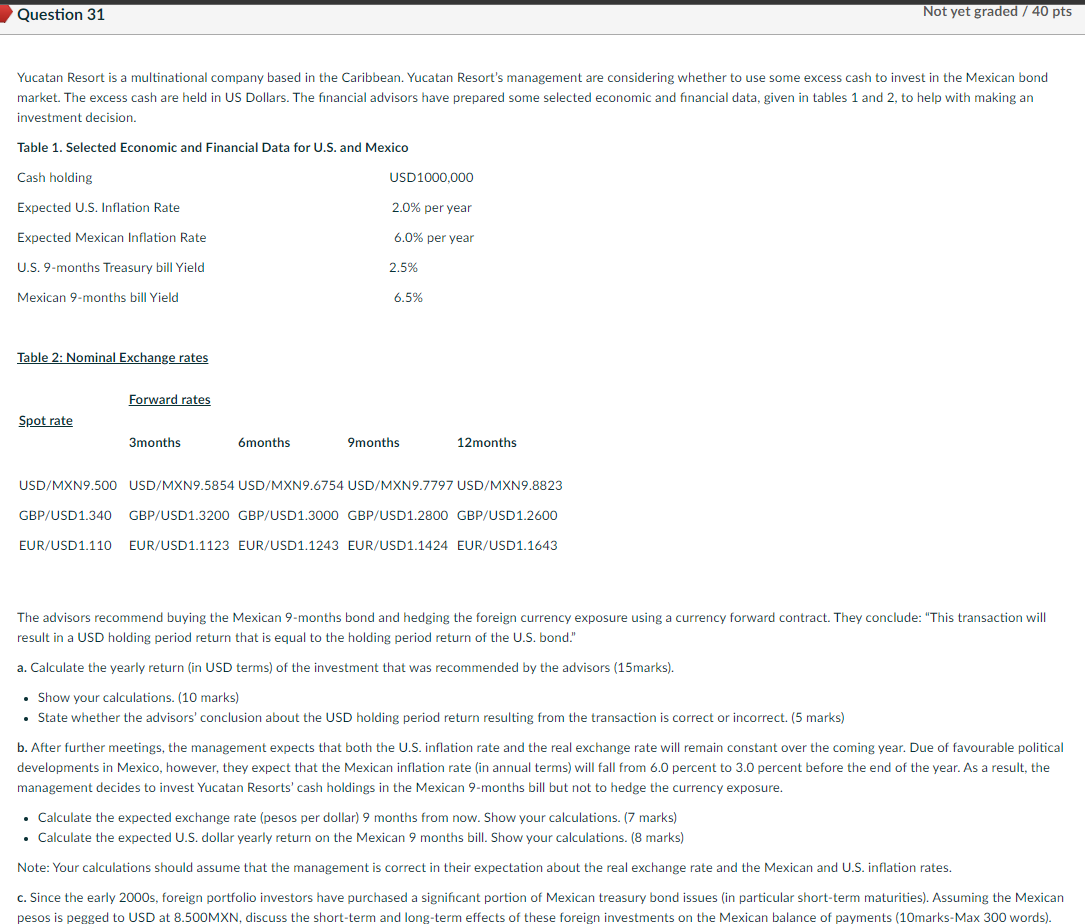

Question 31 Not yet graded / 40 pts Yucatan Resort is a multinational company based in the Caribbean. Yucatan Resort's management are considering whether to use some excess cash to invest in the Mexican bond market. The excess cash are held in US Dollars. The financial advisors have prepared some selected economic and financial data, given in tables 1 and 2, to help with making an investment decision. Table 1. Selected Economic and Financial Data for U.S. and Mexico Cash holding USD 1000.000 Expected U.S. Inflation Rate 2.0% per year Expected Mexican Inflation Rate 6.0% per year U.S. 9-months Treasury bill Yield 2.5% Mexican 9-months bill Yield 6.5% Table 2: Nominal Exchange rates Forward rates Spot rate 3months 6months 9months 12months USD/MXN9.500 USD/MXN9.5854 USD/MXN9.6754 USD/MXN9.7797 USD/MXN9.8823 GBP/USD 1.340 GBP/USD1.3200 GBP/USD 1.3000 GBP/USD 1.2800 GBP/USD 1.2600 EUR/USD 1.110 EUR/USD 1.1123 EUR/USD 1.1243 EUR/USD 1.1424 EUR/USD1.1643 The advisors recommend buying the Mexican 9-months bond and hedging the foreign currency exposure using a currency forward contract. They conclude: "This transaction will result in a USD holding period return that is equal to the holding period return of the U.S. bond." a. Calculate the yearly return (in USD terms) of the investment that was recommended by the advisors (15marks). Show your calculations. (10 marks) State whether the advisors' conclusion about the USD holding period return resulting from the transaction is correct or incorrect. (5 marks) b. After further meetings, the management expects that both the U.S. inflation rate and the real exchange rate will remain constant over the coming year. Due of favourable political developments in Mexico, however, they expect that the Mexican inflation rate (in annual terms) will fall from 6.0 percent to 3.0 percent before the end of the year. As a result, the management decides to invest Yucatan Resorts' cash holdings in the Mexican 9-months bill but not to hedge the currency exposure. Calculate the expected exchange rate (pesos per dollar) 9 months from now. Show your calculations. (7 marks) Calculate the expected U.S. dollar yearly return on the Mexican 9 months bill. Show your calculations. (8 marks) Note: Your calculations should assume that the management is correct in their expectation about the real exchange rate and the Mexican and U.S. inflation rates. c. Since the early 2000s, foreign portfolio investors have purchased a significant portion of Mexican treasury bond issues in particular short-term maturities). Assuming the Mexican pesos is pegged to USD at 8.500MXN, discuss the short-term and long-term effects of these foreign investments on the Mexican balance of payments (10marks-Max 300 words). Question 31 Not yet graded / 40 pts Yucatan Resort is a multinational company based in the Caribbean. Yucatan Resort's management are considering whether to use some excess cash to invest in the Mexican bond market. The excess cash are held in US Dollars. The financial advisors have prepared some selected economic and financial data, given in tables 1 and 2, to help with making an investment decision. Table 1. Selected Economic and Financial Data for U.S. and Mexico Cash holding USD 1000.000 Expected U.S. Inflation Rate 2.0% per year Expected Mexican Inflation Rate 6.0% per year U.S. 9-months Treasury bill Yield 2.5% Mexican 9-months bill Yield 6.5% Table 2: Nominal Exchange rates Forward rates Spot rate 3months 6months 9months 12months USD/MXN9.500 USD/MXN9.5854 USD/MXN9.6754 USD/MXN9.7797 USD/MXN9.8823 GBP/USD 1.340 GBP/USD1.3200 GBP/USD 1.3000 GBP/USD 1.2800 GBP/USD 1.2600 EUR/USD 1.110 EUR/USD 1.1123 EUR/USD 1.1243 EUR/USD 1.1424 EUR/USD1.1643 The advisors recommend buying the Mexican 9-months bond and hedging the foreign currency exposure using a currency forward contract. They conclude: "This transaction will result in a USD holding period return that is equal to the holding period return of the U.S. bond." a. Calculate the yearly return (in USD terms) of the investment that was recommended by the advisors (15marks). Show your calculations. (10 marks) State whether the advisors' conclusion about the USD holding period return resulting from the transaction is correct or incorrect. (5 marks) b. After further meetings, the management expects that both the U.S. inflation rate and the real exchange rate will remain constant over the coming year. Due of favourable political developments in Mexico, however, they expect that the Mexican inflation rate (in annual terms) will fall from 6.0 percent to 3.0 percent before the end of the year. As a result, the management decides to invest Yucatan Resorts' cash holdings in the Mexican 9-months bill but not to hedge the currency exposure. Calculate the expected exchange rate (pesos per dollar) 9 months from now. Show your calculations. (7 marks) Calculate the expected U.S. dollar yearly return on the Mexican 9 months bill. Show your calculations. (8 marks) Note: Your calculations should assume that the management is correct in their expectation about the real exchange rate and the Mexican and U.S. inflation rates. c. Since the early 2000s, foreign portfolio investors have purchased a significant portion of Mexican treasury bond issues in particular short-term maturities). Assuming the Mexican pesos is pegged to USD at 8.500MXN, discuss the short-term and long-term effects of these foreign investments on the Mexican balance of payments (10marks-Max 300 words)