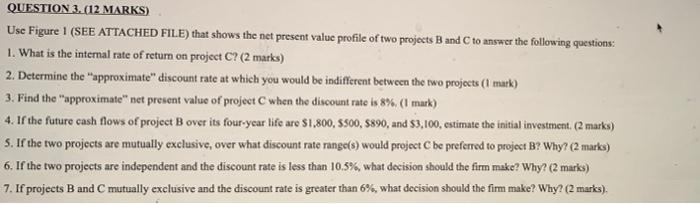

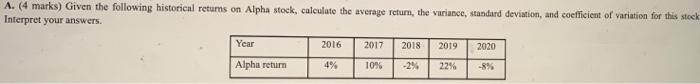

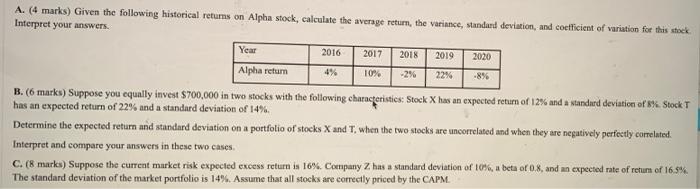

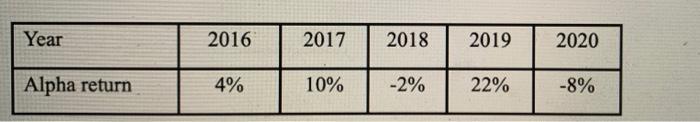

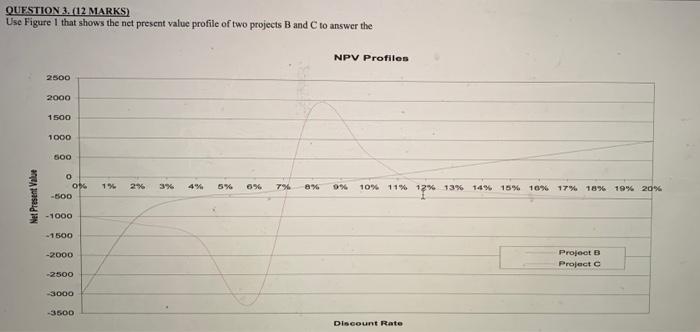

QUESTION 3.(12 MARKS) Use Figure 1 (SEE ATTACHED FILE) that shows the net present value profile of two projects B and C to answer the following questions: 1. What is the internal rate of return on project C? (2 marks) 2. Determine the approximate" discount rate at which you would be indifferent between the two projects (1 mark) 3. Find the "approximate" net present value of project C when the discount rate is 8% (1 mark) 4. If the future cash flows of project Bover its four-year life are $1,800, 8500, 8890, and $3,100, estimate the initial investment. (2 marks) S. If the two projects are mutually exclusive, over what discount rate range(s) would project Che preferred to project B? Why? (2 marks) 6. If the two projects are independent and the discount rate is less than 10.5%, what decision should the firm make? Why? (2 marks) 7. If projects B and C mutually exclusive and the discount rate is greater than 6%, what decision should the firm make? Why? (2 marks). A. (4 marks) Given the following historical retums on Alpha stock, calculate the average return, the variance, standard deviation, and coefficient of variation for this stock Interpret your answers. Year 2016 2017 2018 2019 2020 Alpha return 4% 10% -2% 22% -8% A. (4 marks) Given the following historical returns on Alpha stock, calculate the average return, the variance, standard deviation, and coefficient of variation for this stock Interpret your answers Year 2016 2017 2018 2019 2020 Alpha return 4% 10% -2% 22% -8% B. (6 marks) Suppose you equally invest $700,000 in two stocks with the following characteristics: Stock X has an expected return of 12% and a standard deviation of % Stock T has an expected return of 22% and a standard deviation of 14%. Determine the expected return and standard deviation on a portfolio of stocks X and T, when the two stocks are uncorrelated and when they are negatively perfectly correlated. Interpret and compare your answers in these two cases C. (8 marks) Suppose the current market risk expected excess return is 16%. Company has a standard deviation of 10%, a beta of 0.8, and an expected rate of return of 16.5% The standard deviation of the market portfolio is 14%. Assume that all stocks are correctly priced by the CAPM. Year 2016 2017 2018 2019 2020 Alpha return 4% 10% -2% 22% -8% QUESTION 3. (12 MARKS) Use Figure that shows the net present value profile of two projects B and C to answer the NPV Profiles 2500 2000 1500 1000 600 O 1% 2% 3% 4% 5% 0% 7% 8% 0% 10% 11% 12% 13% 14% 15% 10% 17% 18% 19% 20% Net Present Value 12% -BOD -1000 -1500 -2000 Project B Project -2500 3000 -350D Discount Rate QUESTION 3.(12 MARKS) Use Figure 1 (SEE ATTACHED FILE) that shows the net present value profile of two projects B and C to answer the following questions: 1. What is the internal rate of return on project C? (2 marks) 2. Determine the approximate" discount rate at which you would be indifferent between the two projects (1 mark) 3. Find the "approximate" net present value of project C when the discount rate is 8% (1 mark) 4. If the future cash flows of project Bover its four-year life are $1,800, 8500, 8890, and $3,100, estimate the initial investment. (2 marks) S. If the two projects are mutually exclusive, over what discount rate range(s) would project Che preferred to project B? Why? (2 marks) 6. If the two projects are independent and the discount rate is less than 10.5%, what decision should the firm make? Why? (2 marks) 7. If projects B and C mutually exclusive and the discount rate is greater than 6%, what decision should the firm make? Why? (2 marks). A. (4 marks) Given the following historical retums on Alpha stock, calculate the average return, the variance, standard deviation, and coefficient of variation for this stock Interpret your answers. Year 2016 2017 2018 2019 2020 Alpha return 4% 10% -2% 22% -8% A. (4 marks) Given the following historical returns on Alpha stock, calculate the average return, the variance, standard deviation, and coefficient of variation for this stock Interpret your answers Year 2016 2017 2018 2019 2020 Alpha return 4% 10% -2% 22% -8% B. (6 marks) Suppose you equally invest $700,000 in two stocks with the following characteristics: Stock X has an expected return of 12% and a standard deviation of % Stock T has an expected return of 22% and a standard deviation of 14%. Determine the expected return and standard deviation on a portfolio of stocks X and T, when the two stocks are uncorrelated and when they are negatively perfectly correlated. Interpret and compare your answers in these two cases C. (8 marks) Suppose the current market risk expected excess return is 16%. Company has a standard deviation of 10%, a beta of 0.8, and an expected rate of return of 16.5% The standard deviation of the market portfolio is 14%. Assume that all stocks are correctly priced by the CAPM. Year 2016 2017 2018 2019 2020 Alpha return 4% 10% -2% 22% -8% QUESTION 3. (12 MARKS) Use Figure that shows the net present value profile of two projects B and C to answer the NPV Profiles 2500 2000 1500 1000 600 O 1% 2% 3% 4% 5% 0% 7% 8% 0% 10% 11% 12% 13% 14% 15% 10% 17% 18% 19% 20% Net Present Value 12% -BOD -1000 -1500 -2000 Project B Project -2500 3000 -350D Discount Rate