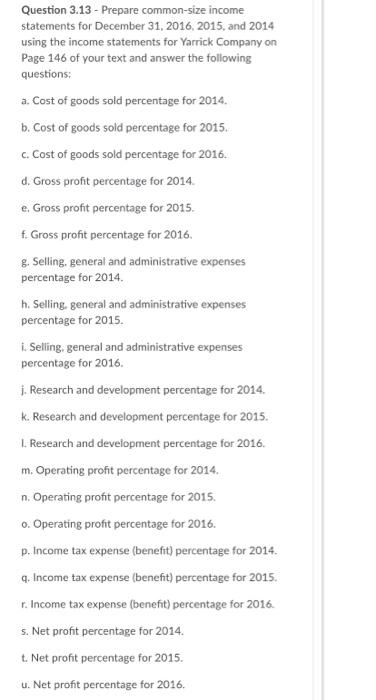

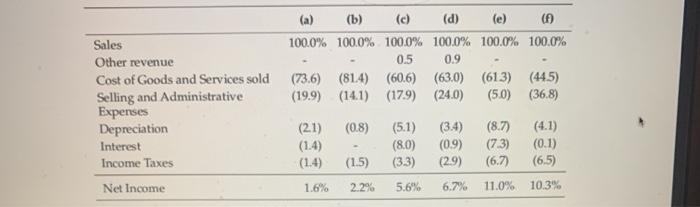

Question 3.13 - Prepare common-size income statements for December 31, 2016, 2015, and 2014 using the income statements for Yarrick Company on Page 146 of your text and answer the following questions: a. Cost of goods sold percentage for 2014. b. Cost of goods sold percentage for 2015. c. Cost of goods sold percentage for 2016. d. Gross profit percentage for 2014. e. Gross profit percentage for 2015. f. Gross profit percentage for 2016, 8. Selling, general and administrative expenses percentage for 2014 h. Selling, general and administrative expenses percentage for 2015 i. Selling, general and administrative expenses percentage for 2016. 1. Research and development percentage for 2014. k. Research and development percentage for 2015. 1. Research and development percentage for 2016. m. Operating profit percentage for 2014. n. Operating profit percentage for 2015 o. Operating profit percentage for 2016. p. Income tax expense (benefit) percentage for 2014. q. Income tax expense (benefit) percentage for 2015. r. Income tax expense (benefit) percentage for 2016 s. Net profit percentage for 2014. t. Net profit percentage for 2015. u. Net profit percentage for 2016, Sales Other revenue Cost of Goods and Services sold Selling and Administrative Expenses Depreciation Interest Income Taxes (a) (b) (d) (e) 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 0.5 0.9 (73.6) (814) (60.6) (63.0) (613) (445) (19.9) (14.1) (179) (24.0) (5.0) (36.8) (0.8) (5.1) (2.1) (1.4) (1.4) (3.4) (0.9) (29) (8.0) (3.3) (8.7) (7.3) (6.7) (4.1) (0.1) (1.5) (6.5) Net Income 1.6% 2.2% 5.6% 6.7% 11.0% 10.3% Question 3.13 - Prepare common-size income statements for December 31, 2016, 2015, and 2014 using the income statements for Yarrick Company on Page 146 of your text and answer the following questions: a. Cost of goods sold percentage for 2014. b. Cost of goods sold percentage for 2015. c. Cost of goods sold percentage for 2016. d. Gross profit percentage for 2014. e. Gross profit percentage for 2015. f. Gross profit percentage for 2016, 8. Selling, general and administrative expenses percentage for 2014 h. Selling, general and administrative expenses percentage for 2015 i. Selling, general and administrative expenses percentage for 2016. 1. Research and development percentage for 2014. k. Research and development percentage for 2015. 1. Research and development percentage for 2016. m. Operating profit percentage for 2014. n. Operating profit percentage for 2015 o. Operating profit percentage for 2016. p. Income tax expense (benefit) percentage for 2014. q. Income tax expense (benefit) percentage for 2015. r. Income tax expense (benefit) percentage for 2016 s. Net profit percentage for 2014. t. Net profit percentage for 2015. u. Net profit percentage for 2016, Sales Other revenue Cost of Goods and Services sold Selling and Administrative Expenses Depreciation Interest Income Taxes (a) (b) (d) (e) 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 0.5 0.9 (73.6) (814) (60.6) (63.0) (613) (445) (19.9) (14.1) (179) (24.0) (5.0) (36.8) (0.8) (5.1) (2.1) (1.4) (1.4) (3.4) (0.9) (29) (8.0) (3.3) (8.7) (7.3) (6.7) (4.1) (0.1) (1.5) (6.5) Net Income 1.6% 2.2% 5.6% 6.7% 11.0% 10.3%