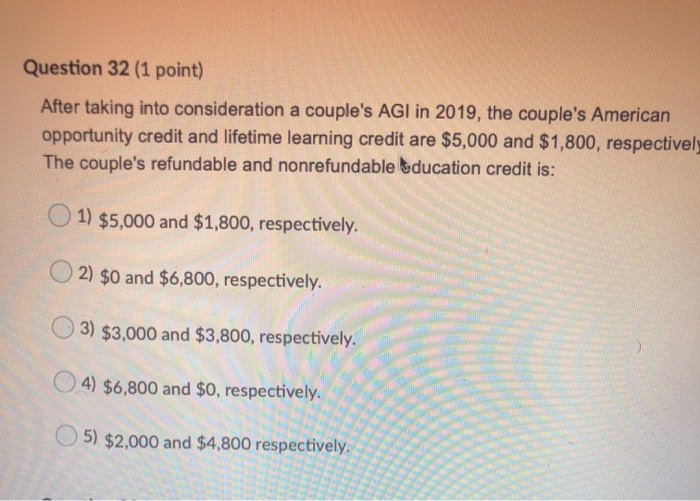

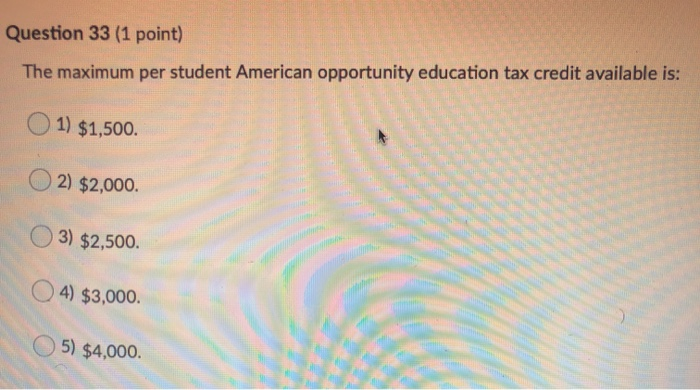

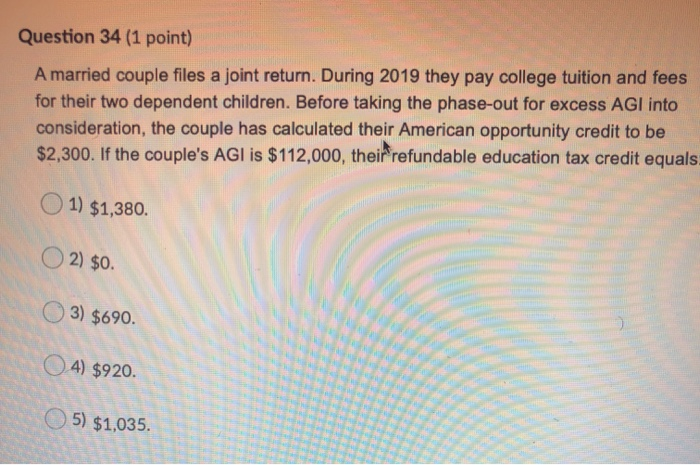

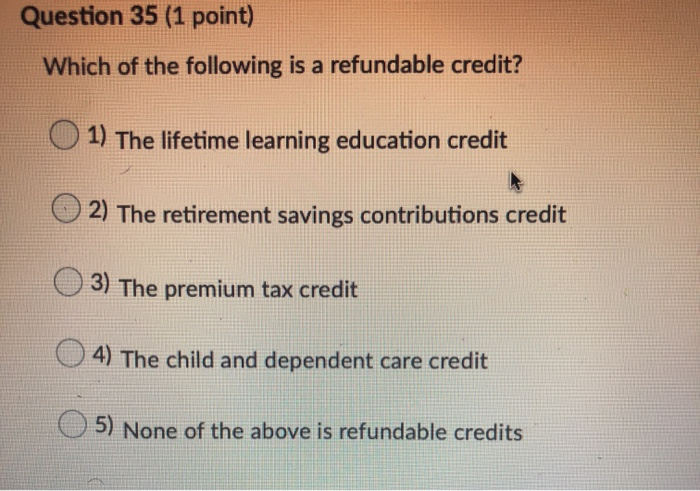

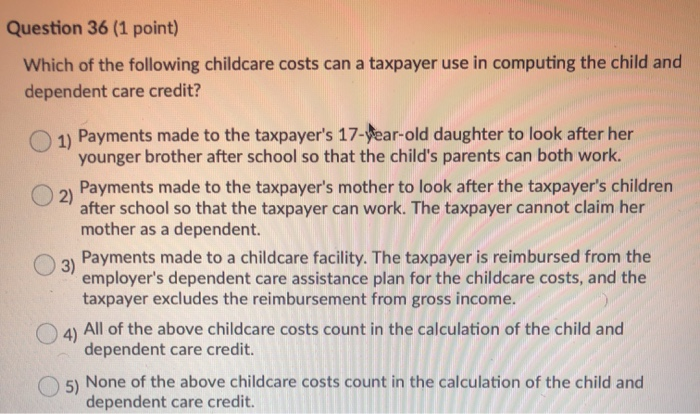

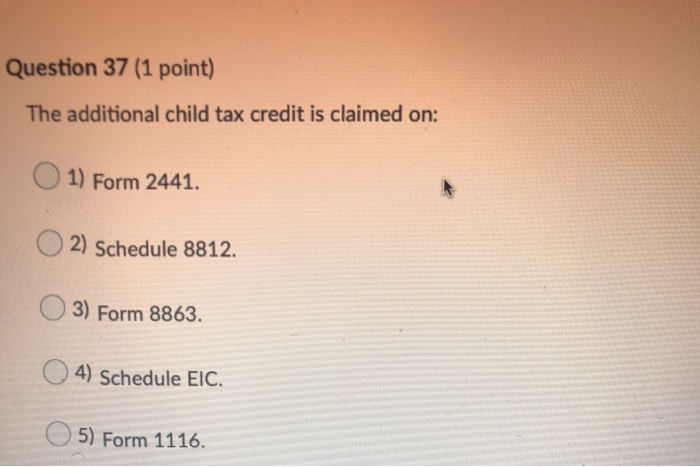

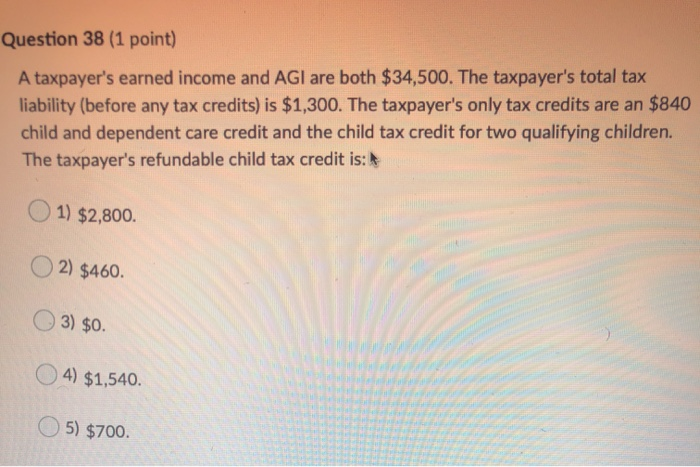

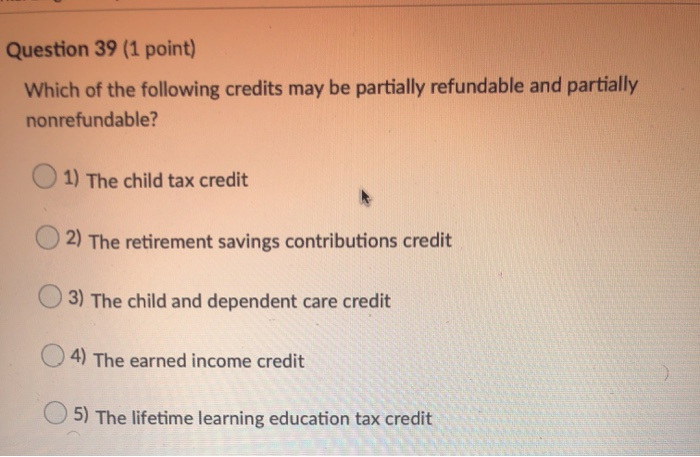

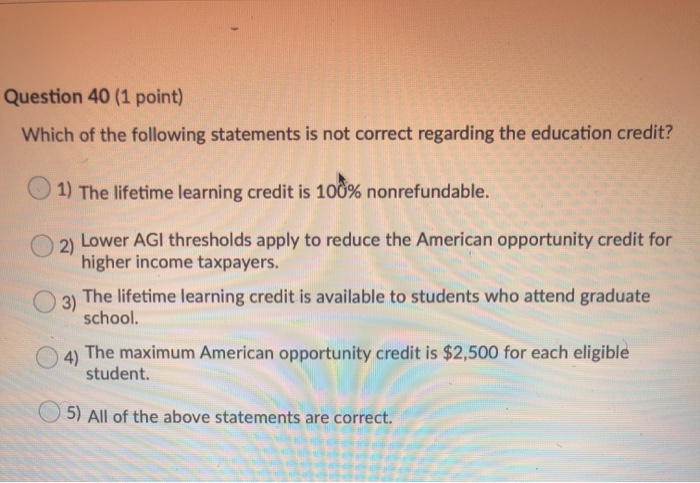

Question 32 (1 point) After taking into consideration a couple's AGI in 2019, the couple's American opportunity credit and lifetime learning credit are $5,000 and $1,800, respectively The couple's refundable and nonrefundable education credit is: 1) $5,000 and $1,800, respectively. 2) $0 and $6,800, respectively. 3) $3,000 and $3,800, respectively. 4) $6,800 and $0, respectively. 5) $2,000 and $4,800 respectively, Question 33 (1 point) The maximum per student American opportunity education tax credit available is: 01) $1,500. 2) $2,000. 3) $2,500. 4) $3,000. 5) $4,000. Question 34 (1 point) A married couple files a joint return. During 2019 they pay college tuition and fees for their two dependent children. Before taking the phase-out for excess AGI into consideration, the couple has calculated their American opportunity credit to be $2,300. If the couple's AGI is $112,000, their refundable education tax credit equals 1) $1,380. 2) $0. 3) $690. 4) $920. 5) $1,035. Question 35 (1 point) Which of the following is a refundable credit? 1) The lifetime learning education credit 2) The retirement savings contributions credit 3) The premium tax credit 4) The child and dependent care credit 5) None of the above is refundable credits Question 36 (1 point) Which of the following childcare costs can a taxpayer use in computing the child and dependent care credit? 1) Payments made to the taxpayer's 17-year-old daughter to look after her younger brother after school so that the child's parents can both work. 2) Payments made to the taxpayer's mother to look after the taxpayer's children after school so that the taxpayer can work. The taxpayer cannot claim her mother as a dependent. 3) Payments made to a childcare facility. The taxpayer is reimbursed from the employer's dependent care assistance plan for the childcare costs, and the taxpayer excludes the reimbursement from gross income. All of the above childcare costs count in the calculation of the child and dependent care credit. 5) None of the above childcare costs count in the calculation of the child and dependent care credit. O4) Question 37 (1 point) The additional child tax credit is claimed on: 1) Form 2441. 2) Schedule 8812. 3) Form 8863. 4) Schedule EIC. 5) Form 1116. Question 38 (1 point) A taxpayer's earned income and AGI are both $34,500. The taxpayer's total tax liability (before any tax credits) is $1,300. The taxpayer's only tax credits are an $840 child and dependent care credit and the child tax credit for two qualifying children. The taxpayer's refundable child tax credit is: 1) $2,800. 2) $460. O3) $0. 4) $1,540. 5) $700. Question 39 (1 point) Which of the following credits may be partially refundable and partially nonrefundable? 1) The child tax credit 2) The retirement savings contributions credit 3) The child and dependent care credit 4) The earned income credit 5) The lifetime learning education tax credit Question 40 (1 point) Which of the following statements is not correct regarding the education credit? 1) The lifetime learning credit is 100% nonrefundable. 2) Lower AGI thresholds apply to reduce the American opportunity credit for higher income taxpayers. O3) The lifetime learning credit is available to students who attend graduate school. 4) The maximum American opportunity credit is $2,500 for each eligible student. 5) All of the above statements are correct