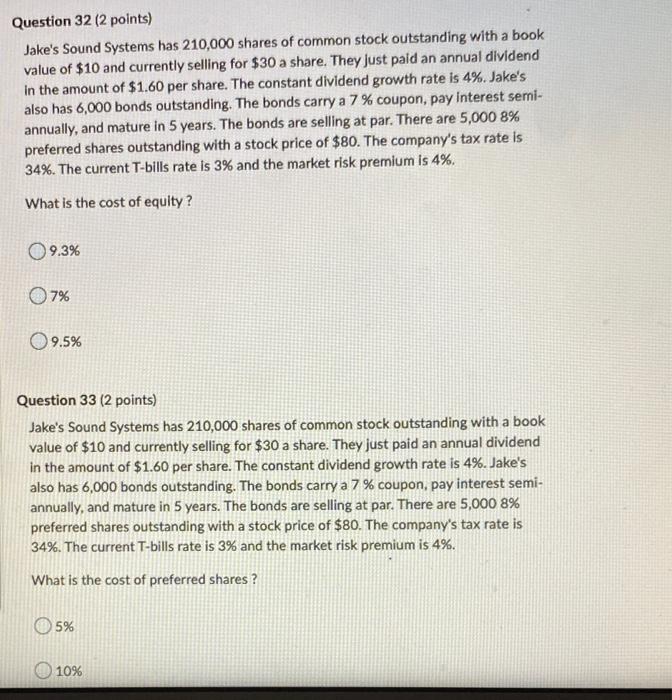

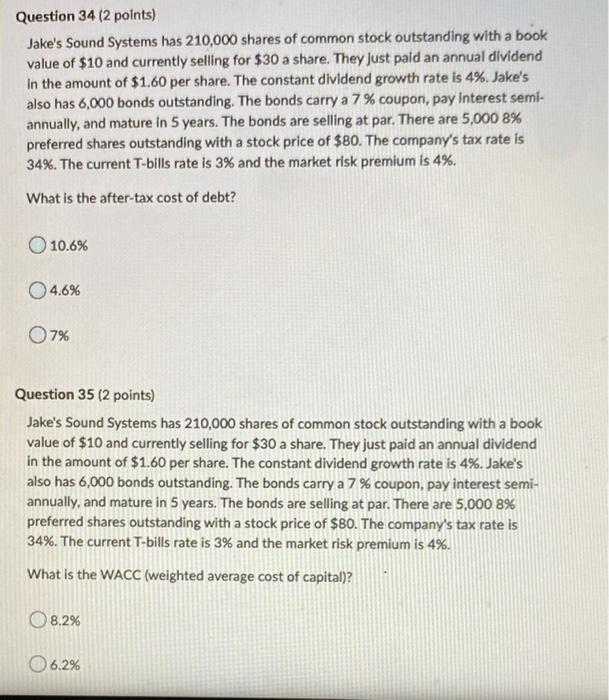

Question 32 (2 points) Jake's Sound Systems has 210,000 shares of common stock outstanding with a book value of $10 and currently selling for $30 a share. They just paid an annual dividend in the amount of $1.60 per share. The constant dividend growth rate is 4%. Jake's also has 6,000 bonds outstanding. The bonds carry a 7% coupon, pay interest semiannually, and mature in 5 years. The bonds are selling at par. There are 5,000 8% preferred shares outstanding with a stock price of $80. The company's tax rate is 34%. The current T-bills rate is 3% and the market risk premium is 4%. What is the cost of equity? 9.3% 7% 9.5% Question 33 (2 points) Jake's Sound Systems has 210,000 shares of common stock outstanding with a book value of $10 and currently selling for $30 a share. They just paid an annual dividend in the amount of $1.60 per share. The constant dividend growth rate is 4%. Jake's also has 6,000 bonds outstanding. The bonds carry a 7% coupon, pay interest semiannually, and mature in 5 years. The bonds are selling at par. There are 5,000 8\% preferred shares outstanding with a stock price of $80. The company's tax rate is 34%. The current T-bills rate is 3% and the market risk premium is 4%. What is the cost of preferred shares? 5% 10% Jake's Sound Systems has 210,000 shares of common stock outstanding with a book value of $10 and currently selling for $30 a share. They just paid an annual dividend In the amount of $1.60 per share. The constant dividend growth rate is 4%. Jake's also has 6,000 bonds outstanding. The bonds carry a 7% coupon, pay interest semiannually, and mature in 5 years. The bonds are selling at par. There are 5,0008% preferred shares outstanding with a stock price of $80. The company's tax rate is 34%. The current T-bills rate is 3% and the market risk premium is 4%. What is the after-tax cost of debt? 10.6% 4.6% 7% Question 35 ( 2 points) Jake's Sound Systems has 210,000 shares of common stock outstanding with a book value of $10 and currently selling for $30 a share. They just paid an annual dividend in the amount of $1.60 per share. The constant dividend growth rate is 4%. Jake's also has 6,000 bonds outstanding. The bonds carry a 7% coupon, pay interest semiannually, and mature in 5 years. The bonds are selling at par. There are 5,000 8\% preferred shares outstanding with a stock price of $80. The company's tax rate is 34%. The current T-bills rate is 3% and the market risk premium is 4%. What is the WACC (weighted average cost of capital)? 8.2% 6.2%