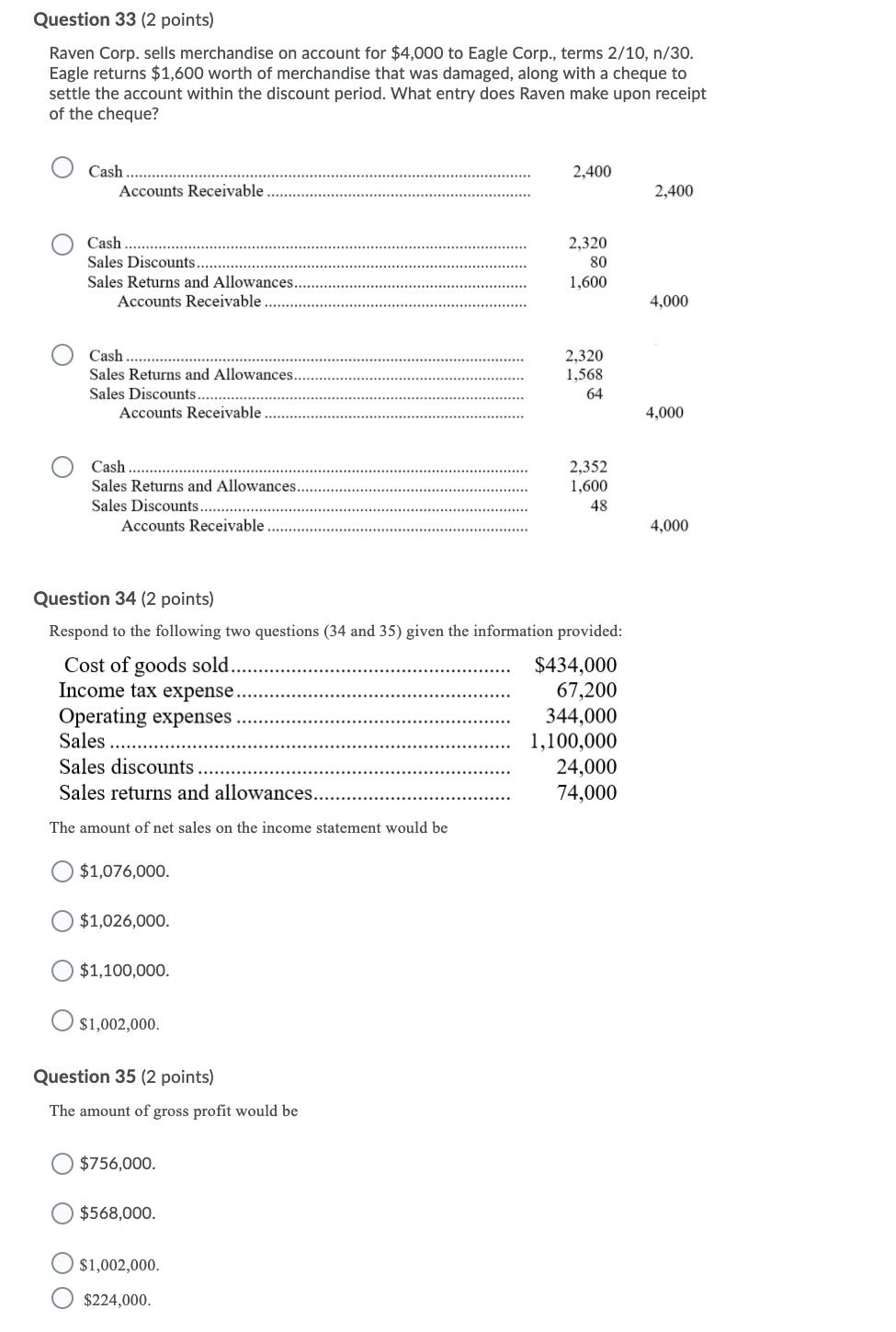

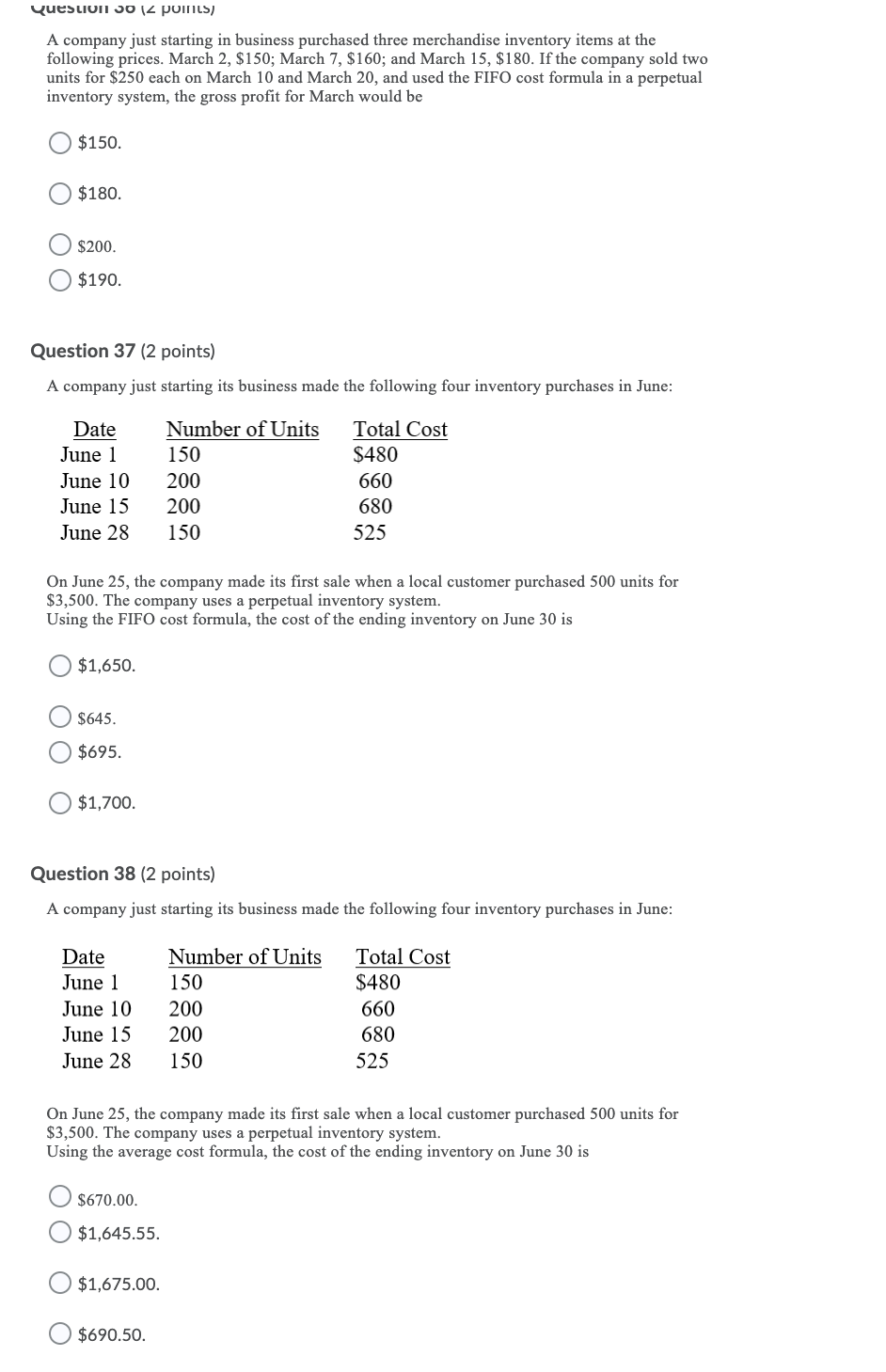

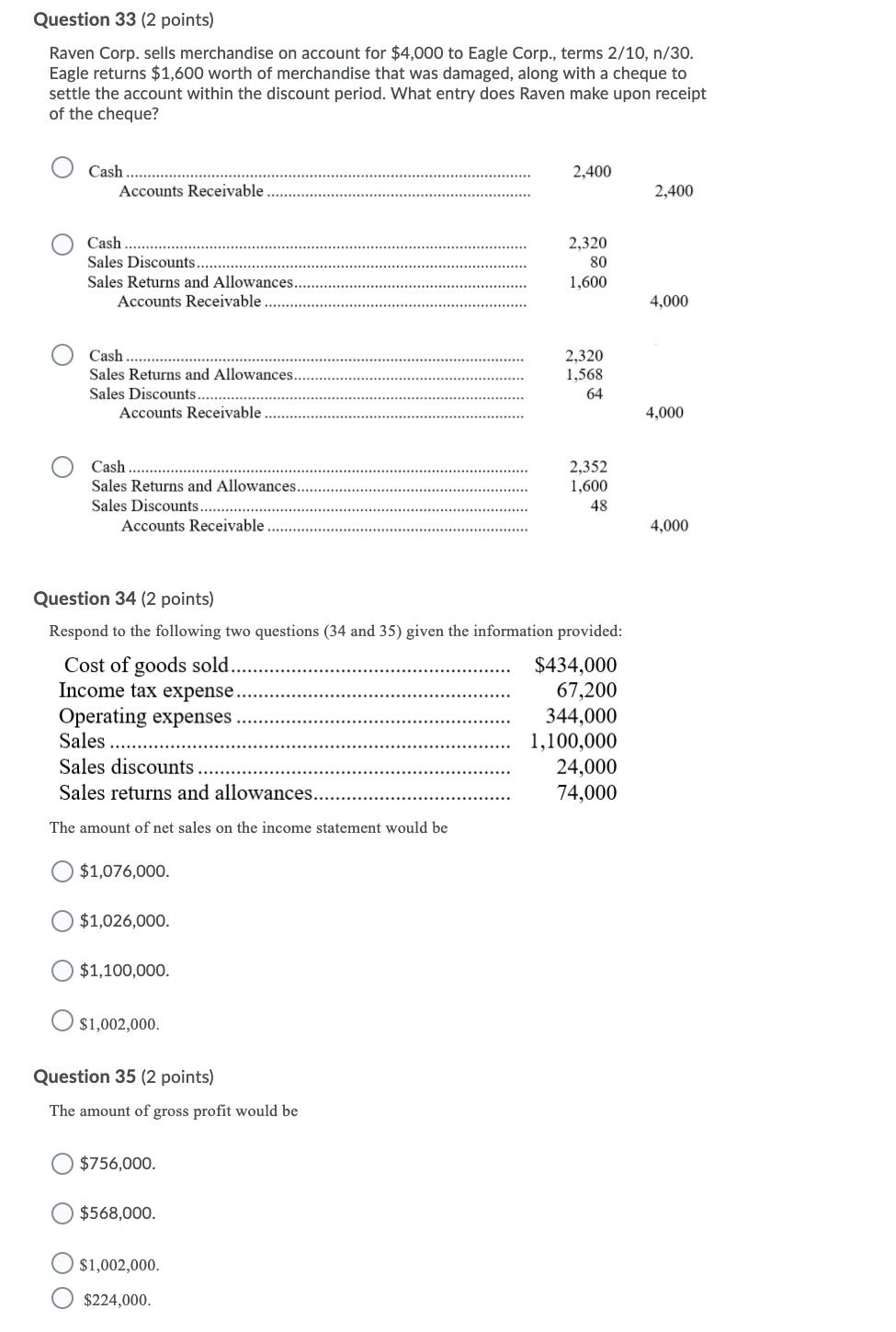

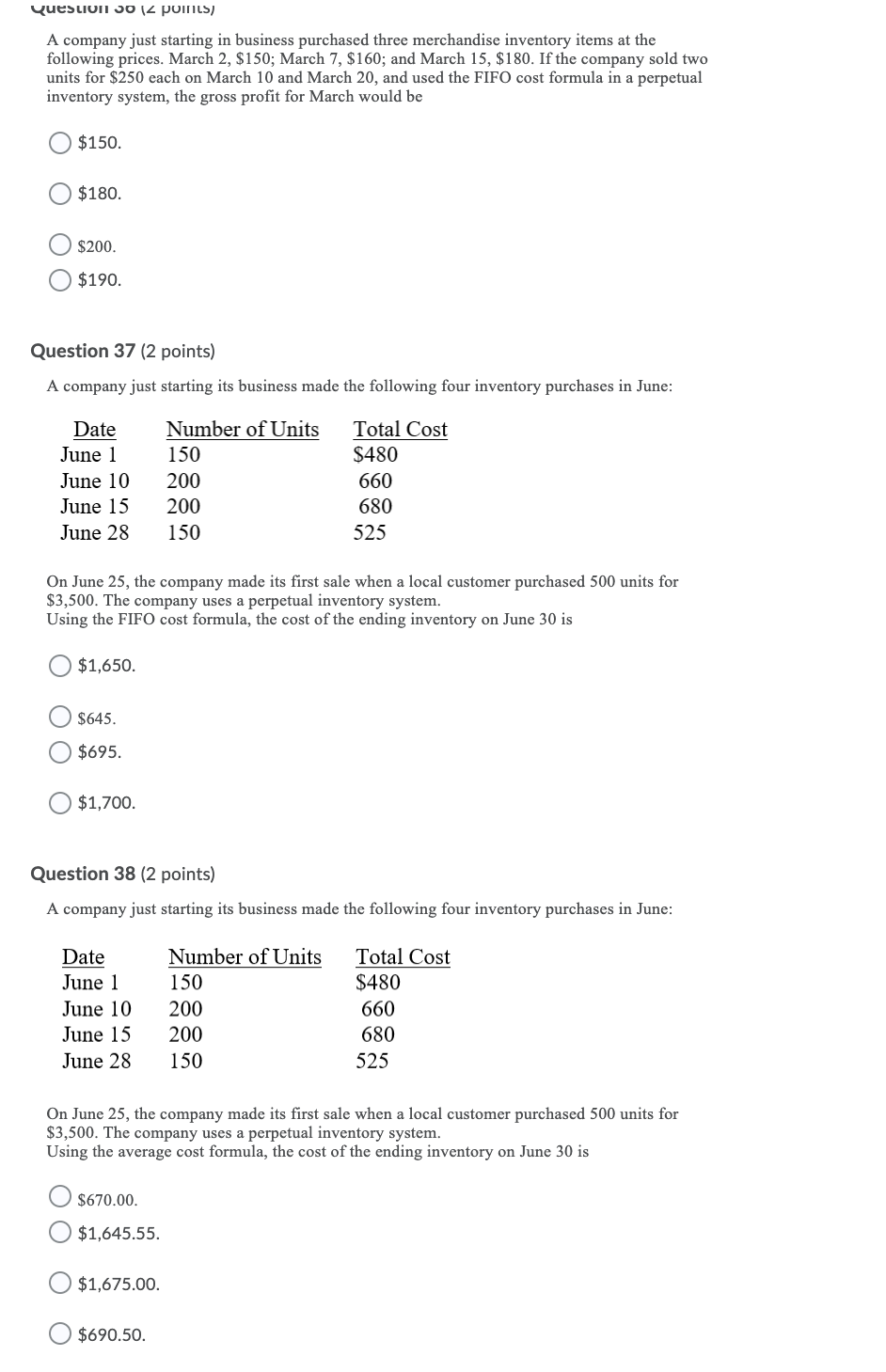

Question 33 (2 points) Raven Corp. sells merchandise on account for $4,000 to Eagle Corp., terms 2/10, n/30. Eagle returns $1,600 worth of merchandise that was damaged, along with a cheque to settle the account within the discount period. What entry does Raven make upon receipt of the cheque? 2,400 Cash Accounts Receivable 2,400 Cash Sales Discounts Sales Returns and Allowances.. Accounts Receivable 2,320 80 1,600 4,000 Cash Sales Returns and Allowances. Sales Discounts..... Accounts Receivable 2,320 1,568 64 4,000 Cash Sales Returns and Allowances.... Sales Discounts..... Accounts Receivable 2,352 1,600 48 4,000 Question 34 (2 points) Respond to the following two questions (34 and 35) given the information provided: Cost of goods sold. $434,000 Income tax expense 67,200 Operating expenses 344,000 Sales 1,100,000 Sales discounts 24,000 Sales returns and allowances. 74,000 The amount of net sales on the income statement would be $1,076,000. $1,026,000. $1,100,000. $1,002,000. Question 35 (2 points) The amount of gross profit would be $756,000. $568,000 $1,002,000. $224,000. Question 30 14 points) A company just starting in business purchased three merchandise inventory items at the following prices. March 2, $150; March 7, $160; and March 15, $180. If the company sold two units for $250 each on March 10 and March 20, and used the FIFO cost formula in a perpetual inventory system, the gross profit for March would be $150. $180. $200. $190. Question 37 (2 points) A company just starting its business made the following four inventory purchases in June: Date June 1 June 10 June 15 June 28 Number of Units 150 200 200 150 Total Cost $480 660 680 525 On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system. Using the FIFO cost formula, the cost of the ending inventory on June 30 is $1,650. $645. $695. $1,700. Question 38 (2 points) A company just starting its business made the following four inventory purchases in June: Date June 1 June 10 June 15 June 28 Number of Units 150 200 200 150 Total Cost $480 660 680 525 On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system. Using the average cost formula, the cost of the ending inventory on June 30 is $670.00. $1,645.55. $1,675.00. $690.50