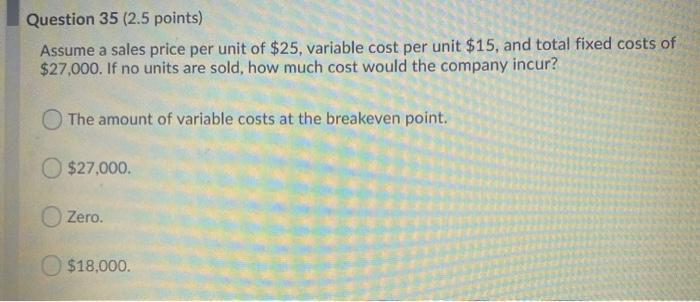

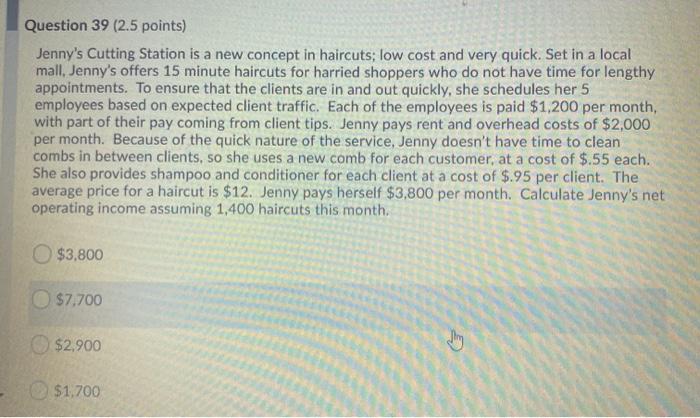

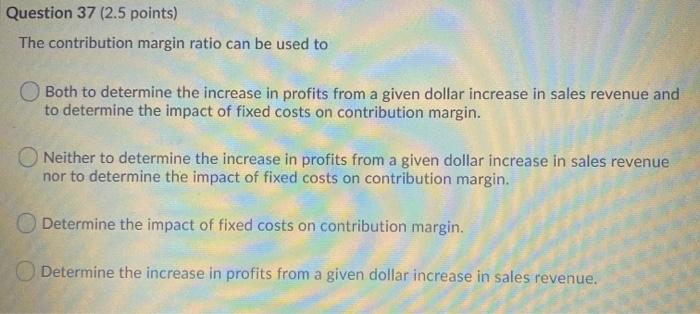

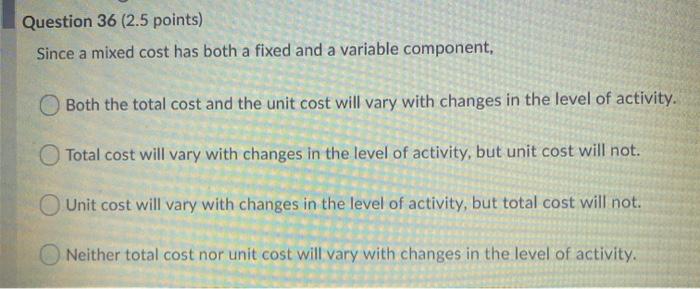

Question 35 (2.5 points) Assume a sales price per unit of $25, variable cost per unit $15, and total fixed costs of $27,000. If no units are sold, how much cost would the company incur? The amount of variable costs at the breakeven point. $27.000 Zero. $18,000. Question 39 (2.5 points) Jenny's Cutting Station is a new concept in haircuts; low cost and very quick. Set in a local mall, Jenny's offers 15 minute haircuts for harried shoppers who do not have time for lengthy appointments. To ensure that the clients are in and out quickly, she schedules her 5 employees based on expected client traffic. Each of the employees is paid $1,200 per month, with part of their pay coming from client tips. Jenny pays rent and overhead costs of $2,000 per month. Because of the quick nature of the service, Jenny doesn't have time to clean combs in between clients, so she uses a new comb for each customer, at a cost of $.55 each. She also provides shampoo and conditioner for each client at a cost of $.95 per client. The average price for a haircut is $12. Jenny pays herself $3,800 per month. Calculate Jenny's net operating income assuming 1,400 haircuts this month. $3,800 $7,700 $2,900 $1,700 Question 37 (2.5 points) The contribution margin ratio can be used to Both to determine the increase in profits from a given dollar increase in sales revenue and to determine the impact of fixed costs on contribution margin. Neither to determine the increase in profits from a given dollar increase in sales revenue nor to determine the impact of fixed costs on contribution margin. Determine the impact of fixed costs on contribution margin. Determine the increase in profits from a given dollar increase in sales revenue. Question 36 (2.5 points) Since a mixed cost has both a fixed and a variable component, Both the total cost and the unit cost will vary with changes in the level of activity. Total cost will vary with changes in the level of activity, but unit cost will not. Unit cost will vary with changes in the level of activity, but total cost will not. Neither total cost nor unit cost will vary with changes in the level of activity